Crypto Fraud Declines Sharply in Asia-Pacific, Report Finds

Cryptocurrency fraud is experiencing a notable decline in the Asia-Pacific (APAC) region, according to a new report by Sumsub. This encouraging trend is largely attributed to advancements in fraud prevention technologies and more robust regulatory oversight. The report indicates that between 2023 and 2024, APAC saw a significant 23% reduction in crypto fraud rates, positioning the region as a leader in this critical area.

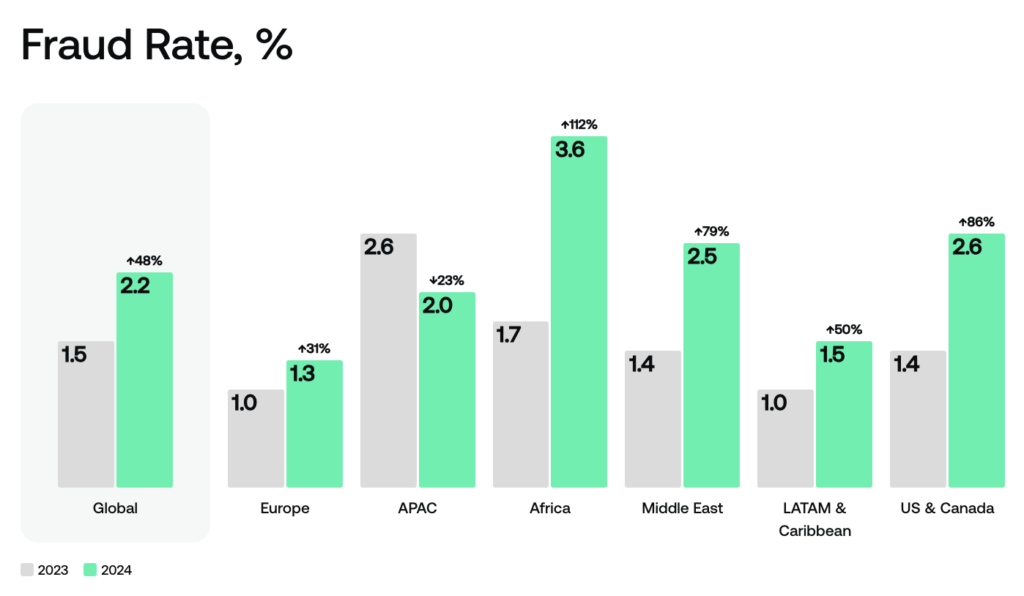

The findings, based on Sumsub’s internal identity verification and user activity data from 2023 and 2024, along with a survey of over 300 companies across the crypto, banking, payments, and e-commerce sectors, provides a detailed analysis of the current state of the industry. APAC stands out as the only region globally to show a decrease in crypto fraud during this period, with rates dropping from 2.6% in 2023 to 2% in 2024.

According to the report, this positive shift is a direct result of advancements in fraud prevention technologies. Innovations such as biometric checks and the use of artificial intelligence (AI)-backed automation have substantially improved security and fraud detection capabilities.

Technological Advancements and Adoption

To leverage these cutting-edge technologies, crypto firms in APAC are increasingly relying on specialized providers. Sumsub’s 2024 industry survey revealed a strong preference for automated third-party solutions (40%) and combined methods (45%) to meet their identity verification needs. This is a clear indication that manual or in-house verification processes are struggling to keep pace with the rapidly evolving demands of the crypto industry.

In addition to enhancing fraud detection, technology is also streamlining processes and improving efficiency. Between 2023 and 2024, APAC experienced the most significant improvement in verification speed, decreasing average onboarding times by 52%. Hong Kong, ranked sixth among the region’s top 10 markets, achieved an impressive average verification time of just 18 seconds.

The Rise of Document-Free Verification

The Sumsub report also highlights the growing adoption of document-free (non-doc) identity verification methods. These methods allow for the verification of customer identities without requiring the submission of identification documents. Instead, users provide key details such as an identification number, which are then cross-checked against government databases.

Sumsub, for example, provides Non-Doc identity and address verification solutions that enable businesses to verify users in an average of 4.5 seconds without the need for photos or document uploads. The 2024 Sumsub crypto survey shows that countries utilizing this technology are seeing a 3.6% improvement in verification times.

While document-free verification remains a relatively new approach, its adoption in APAC is among the highest in the world, with 25% of crypto companies in the region using it, compared to 19% in Europe and 18% in North America. The global average stands at 19%.

Regulatory Scrutiny and Fintech Innovation

The decrease in crypto fraud also aligns with the proactive regulatory measures implemented by major financial hubs within APAC to enhance transparency, security, and overall stability in the sector.

In Hong Kong, the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO) provides clear regulatory guidelines for Virtual Asset Service Providers (VASPs), including requirements for customer due diligence, ongoing monitoring, and record-keeping to combat money laundering and terrorist financing.

Singapore has strengthened the Payment Services Act (PSA) in 2024, introducing more rigorous requirements for crypto service providers related to Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT), user protection, and financial stability.

Sumsub highlights Hong Kong and Singapore as two of the world’s top 10 crypto-friendly jurisdictions, recognizing their robust regulatory frameworks, advanced infrastructure, and commitment to fintech innovation. Singapore supports innovation through government-backed accelerators and initiatives like the MAS Fintech Sandbox, which provides grants and a controlled environment for fintech startups. Leading universities, including the National University of Singapore (NUS) and the Singapore Management University (SMU), also play a crucial role by offering specialized blockchain programs.

Similarly, Hong Kong supports crypto innovation with its advanced digital infrastructure and robust cybersecurity measures. Regulatory sandboxes help facilitate collaboration between fintech associations and international partners, and government-backed projects, like the Project Ensemble Sandbox, are exploring tokenization in the financial sector to further enhance blockchain adoption in the industry.

Asia’s Dominance in Crypto Adoption

Asia continues to be a global leader in the adoption of cryptocurrencies. In 2024, Central and Southern Asia and Oceania (CSAO) led Chainalysis’ Global Crypto Adoption Index, with seven of the top 20 countries located within the region. These countries included India (#1), Indonesia (#3), Vietnam (#5), the Philippines (#8), Pakistan (#9), Thailand (#16) and Cambodia (#17).

Further emphasizing Asia’s leadership role in the crypto space, data from Triple-A, a digital currency payment company headquartered in Singapore, reveals that more than half of the world’s crypto holders are located in Asia, with 326.8 million out of 560 million crypto owners globally.