Applied Materials: A Dividend Growth Stock for Today and Tomorrow

For those decades away from retirement, the focus tends to be on maximizing growth. As retirement nears, the emphasis gradually shifts towards generating income. This makes the years leading up to retirement the ideal time to invest in dividend growth stocks. A company’s ability to increase its dividend over time, provided it’s profitable and has a solid growth trajectory, can result in significant returns when you finally reach retirement. The challenge with dividend growth stocks often lies in their initial yields, which may not impress at first glance.

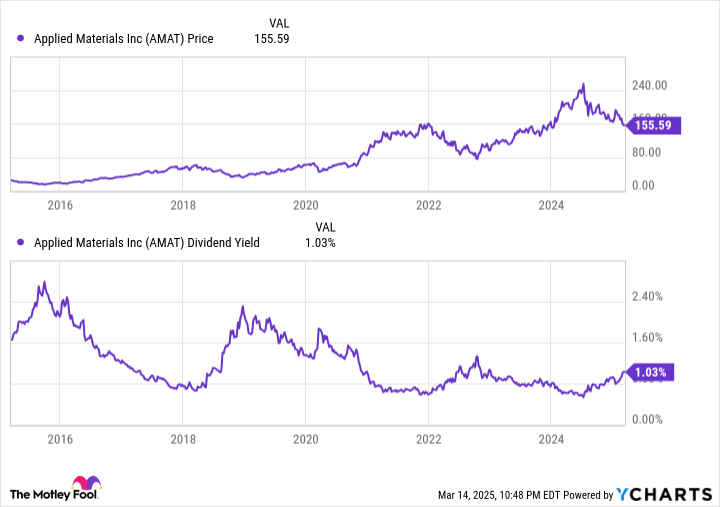

However, recent market volatility has created opportunities. Applied Materials (AMAT), a key player in the semiconductor equipment sector, is one such opportunity. The recent market downturn has significantly boosted its dividend yield, potentially making it an attractive option for Gen X and millennial investors.

Applied Materials: The Semiconductor Equipment Leader

Semiconductor stocks have historically delivered strong returns, but it’s essential to be selective when choosing companies. While chip designers face potential risks from shifting technology and competition, and chip manufacturers require substantial capital, “Semicap” equipment companies like Applied Materials offer a more stable investment. These firms, which create the machinery used in the chip manufacturing process, typically grow alongside the overall semiconductor industry, which is expected to outpace GDP growth over the long term. This sub-sector is also highly concentrated, with a few major players boasting high margins and robust cash flows.

Applied Materials, known for its diverse portfolio, recently announced a sizable dividend increase and a share repurchase program. Despite this, the stock price has dipped significantly, creating a potentially favorable entry point for dividend growth investors.

A Dividend Hike and Share Buyback

Last Monday, Applied Materials announced a 15% increase in its quarterly dividend, raising it from $0.40 to $0.46 per share. This increase, effective June 12th, will benefit shareholders of record on May 22nd. In addition, the board of directors approved a new $10 billion share repurchase program, supplementing the remaining $7.6 billion from an existing program. This is a substantial increase in shareholder payouts, even as current market sentiment is cautious. To demonstrate, Applied’s stock has lost about 40% from its highs in July 2024. Even with this decline, the company continues to report solid financials; In the most recent quarter, revenue grew by 7%, and adjusted earnings per share increased by 12%. Analysts are projecting nearly 10% earnings growth for the next two years.

Attractive Yield and Strong Earnings Coverage

The dividend increase, coupled with the stock price decline, has pushed Applied Materials’ forward dividend yield to approximately 1.25%, which is the highest it’s been in a while. Historically, these yield spikes have been a signal of opportunity to buy the stock.

Furthermore, the dividend is well-supported by earnings. In fiscal year 2024, Applied Materials earned $8.65 per share, providing 4.7 times the coverage for the new $1.84 annual dividend. Wall Street forecasts continued earnings growth over the next two years, with an average earnings per share (EPS) estimate of $9.37 for this year and $10.11 in fiscal 2026.

Applied Materials: Positioned for Long-Term Success

Applied Materials holds a strong position in etch and deposition equipment, essential for producing leading-edge logic chips and high-performance DRAM. The AI revolution is driving demand for both, which should boost Applied’s growth and dividends. In addition to this, the company creates testing metrology equipment and ion implant equipment used in mature power chips for automotive and industrial markets. With a diversified business portfolio and a robust services business, Applied Materials is poised to grow along with the chip industry, while also reducing its share count through repurchases. That’s the recipe for above-inflation dividend growth for years to come. Looking over a decade or two, Applied Material’s dividend payouts could become quite substantial.