Arcadyan Technology Corporation: Assessing the P/E Ratio

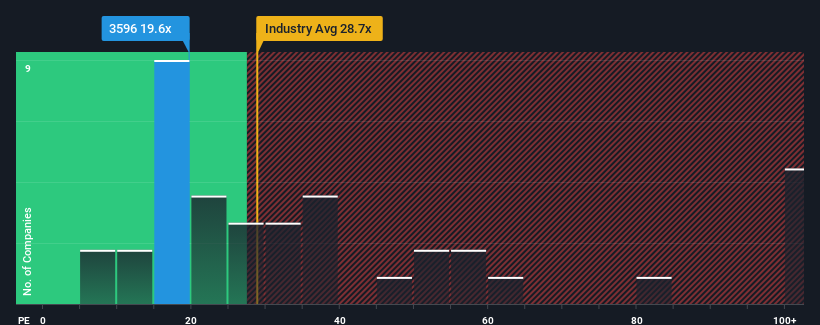

With a median price-to-earnings (P/E) ratio hovering around 20x in Taiwan, investors might be forgiven for giving a cursory glance at Arcadyan Technology Corporation’s (TWSE:3596) P/E of 19.6x. However, a deeper dive is warranted to understand if the market valuation is rational.

Arcadyan Technology’s recent earnings growth has been relatively modest compared to many other companies. This situation raises the question of whether the moderate P/E suggests investors anticipate an improvement in performance. Conversely, current shareholders might be concerned about the stock’s valuation if earnings continue at a similar pace.

To gain further insight, a review of recent earnings growth provides context. Over the past year, the company demonstrated a 2.7% increase in earnings. Looking at the broader picture, the last three years show an impressive 31% rise in earnings per share (EPS), slightly boosted by short-term performance. Therefore, earnings growth has been solid recently.

Looking to the future, analysts project a 20% increase in EPS during the coming year. This forecast is similar to the 19% growth anticipated for the overall market. Given this information, it’s understandable why Arcadyan Technology trades at a P/E comparable to the market average. Most investors seem to believe average future growth is likely and are pricing the stock accordingly.

Conclusion

Generally, a price-to-earnings ratio helps gauge how the market views the overall health of a company. As expected, our review of Arcadyan Technology’s analyst forecasts suggests that its market-matching earnings outlook contributes to its current P/E. At this stage, investors don’t seem to feel the potential for significant improvement in earnings, or a decline, is great enough to warrant an extremely high or low P/E ratio. Consequently, the share price is unlikely to experience substantial movement in the near future under these conditions.

Investors should always consider the inherent risks. For instance, Arcadyan Technology has one warning signal that investors should be aware of.

Disclaimer: This analysis is based on historical data and analyst forecasts and is not financial advice. It does not constitute a recommendation to buy or sell any stock and does not consider your personal objectives or financial situation.