When a company relies heavily on one or two major clients for revenue, it can create vulnerabilities. Strong relationships are crucial, and sometimes concessions are necessary to retain those large customers. This scenario played out recently for Arista Networks (ANET), as Meta Platforms (META), formerly Arista’s largest customer, scaled back its spending in 2024. The news triggered a significant sell-off, with the stock dropping approximately 25% from its all-time highs. While the market reacted strongly, was the response justified?

Arista Networks provides data center networking solutions. Essentially, any business needing to transfer information between data centers is a potential client. While many companies operate data centers globally, few rival the scale of the major tech giants. Consequently, it’s unsurprising that a significant portion of Arista’s revenue comes from a concentrated client base. This isn’t unlike the situation with GPU manufacturer Nvidia (NVDA), where several clients each contribute over 10% of total revenue.

The core issue for Arista lies in Meta’s decreased spending. In 2024, Meta accounted for 14.6% of Arista’s total revenue, translating to approximately $1.02 billion. Although this is a significant amount, in 2023, Meta represented 21% of Arista’s revenue, or $1.23 billion. The question is: should investors be concerned?

I don’t believe so. The company’s management highlighted a key trend: Meta’s “Year of Efficiency” strategy implemented throughout 2024.

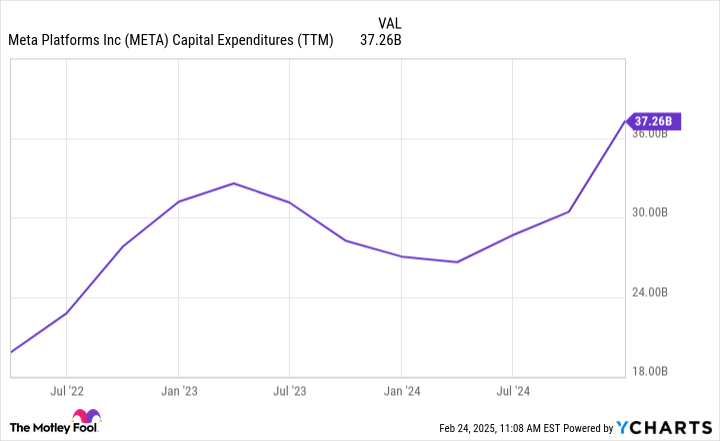

Arista’s management stated that it was affected by Meta’s efficiency measures, yet anticipates a rebound in sales to Meta this year. Meta announced that they expect capital expenditures between $60 billion and $65 billion in 2025, primarily directed toward AI infrastructure. Arista is poised to benefit directly from this investment.

Furthermore, Arista forecasts 17% revenue growth for 2025, a figure that is not too far off the 19.5% growth achieved in 2024. These factors suggest that the market’s initial reaction might have been an overreaction. This situation, therefore, could present a potential buying opportunity for investors.

Even after the recent sell-off, Arista’s stock isn’t cheap. Arista Networks isn’t a bargain stock. It currently trades at roughly 37 times forward earnings, reaching a level not seen since September 2024.

This multiple is quite high when compared to other tech stocks with comparable growth rates. Nvidia, which operates in a similar market, is projected to report a Q4 revenue growth of 73%, yet its stock is trading at 30 times forward earnings.

Nevertheless, Arista’s products are top-tier, and its clients are committed to their ongoing use. Therefore, considering a small initial position to capitalize on the recent drop does not seem like a detrimental decision. It may, however, be prudent to gradually increase the position in increments, as the price could experience continued volatility until positive news from Arista emerges.