Autel Intelligent Technology’s Insider Ownership: A Deep Dive

Autel Intelligent Technology Corp., Ltd. (SHSE:688208) recently saw its stock experience a 10% gain, a development that likely pleased CEO Hongjing Li, the company’s most bullish insider.

Key Insights

- Significant insider ownership suggests strong alignment with company expansion.

- The top 7 shareholders control 51% of the company.

- Institutions hold 21% of Autel Intelligent Technology.

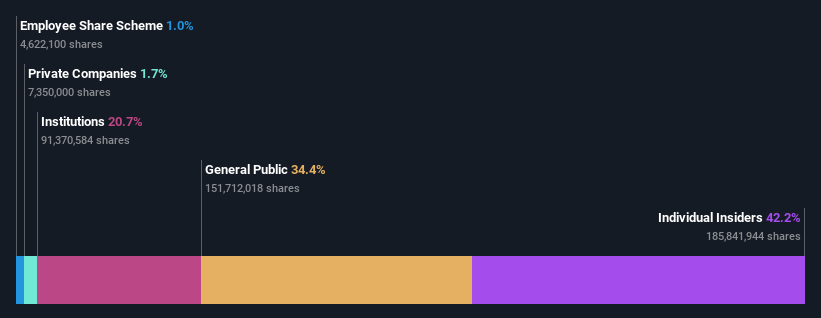

Understanding a company’s ownership structure is crucial for investors. In the case of Autel Intelligent Technology, individual insiders hold the largest stake, possessing 42% of the shares. This means that insiders stand to benefit the most from the company’s success. With the stock’s recent gains, reaching a market cap of CN¥20 billion, insiders saw a significant boost.

Let’s break down the ownership groups of Autel Intelligent Technology.

Institutional Ownership

Institutions often use benchmarks for their investments, and inclusion in a major index can increase their enthusiasm for a stock. Autel Intelligent Technology has a respectable level of institutional ownership, indicating credibility among professional investors. However, it’s essential to remember that even institutions can make poor investment choices. Large institutional investors selling simultaneously can lead to a sharp drop in share price.

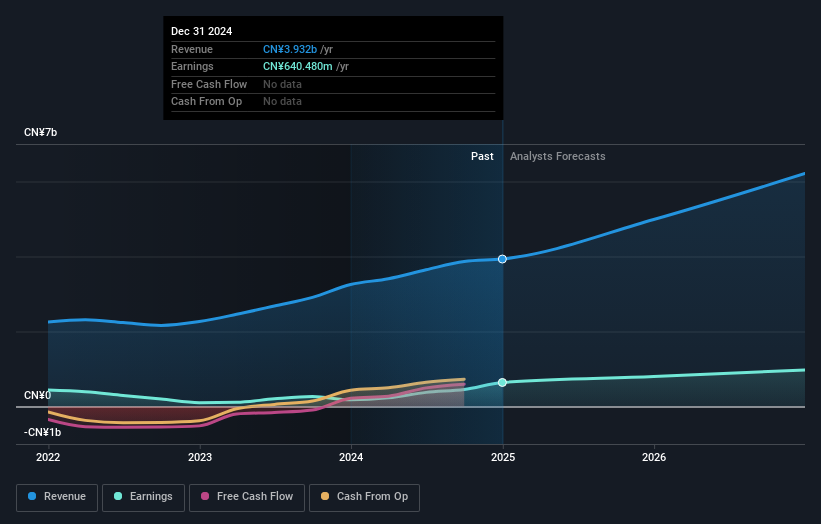

It’s also wise to consider the company’s past earnings trajectory.

Shareholder Breakdown

CEO Hongjing Li is the largest shareholder, with a 38% stake. Following him are Hong Li and Shenzhen Hongtai Fund Investment Management Co., Ltd., holding 3.6% and 3.2% respectively. The top seven shareholders collectively account for over half the shares, with smaller shareholders balancing the interests to a certain extent.

Researching institutional ownership provides insight into a stock’s expected performance, as does studying analyst sentiments. Several analysts cover the stock, allowing easy access to growth forecasts.

Insider Ownership

Insiders typically include board members and company management. High insider ownership often suggests alignment of interests between the board and other shareholders. In the case of Autel Intelligent Technology, insiders hold a substantial CN¥8.6 billion worth of shares in the CN¥20 billion company. This demonstrates a significant level of investment and confidence.

General Public Ownership

The general public, including retail investors, owns a 34% stake in the company. While this group may not dictate company decisions, they wield influence over its operation.

By examining the ownership structure, investors gain valuable insights. For a comprehensive analysis, risks should also be taken into account. Autel Intelligent Technology has two warning signs.

Disclaimer: This article provides commentary based on historical data and analyst forecasts and is not financial advice. It does not constitute a recommendation to buy or sell any stock and does not consider your individual financial situation or objectives. Simply Wall St has no position in any stocks mentioned.