Autel Intelligent Technology’s Stock: Are Strong Financials the Key?

Autel Intelligent Technology Corp., Ltd.’s (SHSE:688208) stock has seen a notable increase of 12% over the past three months. Considering the general link between stock prices and a company’s financial health over time, it’s a good time to examine the financial metrics and see if they played a part in this upward movement. This analysis will focus on the company’s Return on Equity (ROE), which is a crucial indicator for investors.

Understanding Return on Equity

ROE, or Return on Equity, is important because it demonstrates how effectively a company uses shareholder capital. In essence, ROE shows the profit generated by each dollar invested by shareholders. To calculate ROE, the following formula is used:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Based on the trailing twelve months to September 2024, Autel Intelligent Technology’s calculation looked like this:

12% = CN¥402m ÷ CN¥3.2b

This indicates that the company generates a profit of CN¥0.12 for every CN¥1 of shareholder investment.

ROE and Earnings Growth

ROE gives us a gauge of a company’s ability to generate profits. We can also assess how much profit the company reinvests for future growth. Companies with both a high ROE and high profit retention usually show higher growth rates compared to those without these features.

Autel Intelligent Technology: ROE and Income

Autel Intelligent Technology displays a respectable ROE. Compared to the industry average of 8.3%, the company’s ROE of 12% looks solid. However, the 11% decrease in net income is a surprise, suggesting there may be other influencing factors. These could include a high payout ratio or inefficient capital allocation.

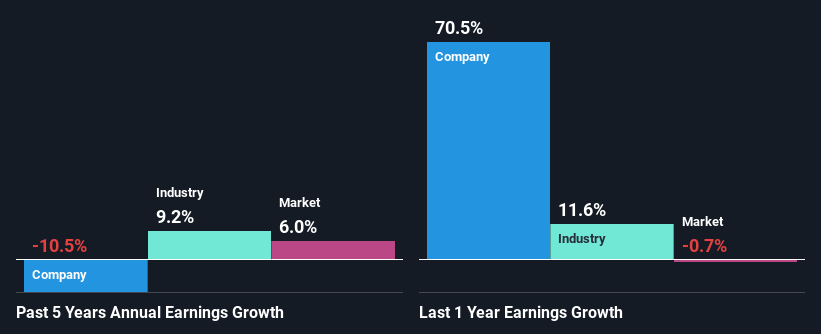

When comparing Autel Intelligent Technology’s performance with the industry, while the company’s earnings have shrunk, the industry has grown by 9.2% during the same time. This disparity is concerning.

Further Considerations

Despite a typical three-year median payout ratio of 50%, the shrinking earnings are puzzling. Autel Intelligent Technology has been distributing dividends for five years, showing a focus on maintaining those payments regardless of the declining earnings. The predicted future payout ratio is approximately 44%, it is predicted the company’s ROE to rise to 18%.

Summary

Overall, Autel Intelligent Technology presents some positive attributes, but the low earnings growth is a concern, especially given the high rate of return and the company’s reinvestment strategy. Further factors beyond the business’s control might be preventing growth. Despite this, analyst estimates suggest a significant improvement in the company’s earnings growth rate in the future.