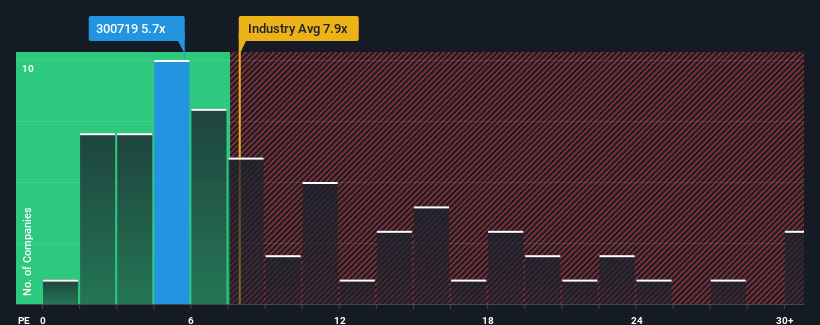

Are investors undervaluing Beijing Andawell Science & Technology Co., Ltd. (SZSE:300719)? With a price-to-sales (P/S) ratio of 5.7x, the company appears undervalued when compared to the Chinese Aerospace & Defense industry, where nearly half of the companies have P/S ratios exceeding 7.9x, and some even reach above 17x.

Recent Performance and Market Expectations

Beijing Andawell has demonstrated significant revenue growth recently. However, the market may be anticipating a slowdown, which has kept the P/S ratio suppressed. Those optimistic about the company hope this isn’t the case, viewing this as an opportunity to acquire the stock at a potentially lower valuation.

Revenue Growth Compared to Industry

Beijing Andawell’s P/S ratio reflects expectations of limited growth, especially when compared to the industry. While the company’s revenue grew by an impressive 42% last year and 50% over the past three years, the industry is projected to grow by 53% in the next 12 months. This slower growth aligns with the company’s P/S ratio falling short of its industry peers.

Generally, assessing a company’s revenue trends can give insights into how the market perceives its overall health. Beijing Andawell’s low P/S ratio is closely tied to its revenue trends over the past three years, which, as suspected, have been weaker than current industry expectations. Investors currently believe the potential for revenue improvement is insufficient to justify a higher P/S ratio.

Unless the recent conditions change, the share price may be limited around current levels.

Disclaimer: This analysis is based on historical data and analyst forecasts.