Beijing Asiacom Information Technology: A Closer Look at Recent Performance

Beijing Asiacom Information Technology Co.Ltd (SZSE:301085) has seen a significant surge in its stock price, climbing 27% over the past three months. However, a closer examination of the company’s financial performance raises questions about the sustainability of this momentum. This analysis delves into the company’s Return on Equity (ROE) to assess whether the current stock performance is justified.

ROE is a crucial metric for investors, as it reveals how effectively a company utilizes shareholder capital to generate profits. In essence, ROE highlights a company’s ability to convert investments into earnings.

Calculating Return on Equity

The formula for calculating ROE is straightforward:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

For Beijing Asiacom, using the trailing twelve months ending September 2024, the ROE is calculated as follows:

4.7% = CN¥52m (Net Profit) ÷ CN¥1.1b (Shareholders’ Equity)

This means that for every CN¥1 of equity invested, the company generated CN¥0.05 in profit during the period.

ROE and Earnings Growth: What’s the Connection?

ROE serves as a measure of a company’s profitability. It is an indicator of a company’s future ability to generate profits based on how much of its profits it reinvests or retains. Generally speaking, firms with a high return on equity and a high profit retention rate tend to have a higher growth rate than firms that do not.

Analyzing Beijing Asiacom’s ROE

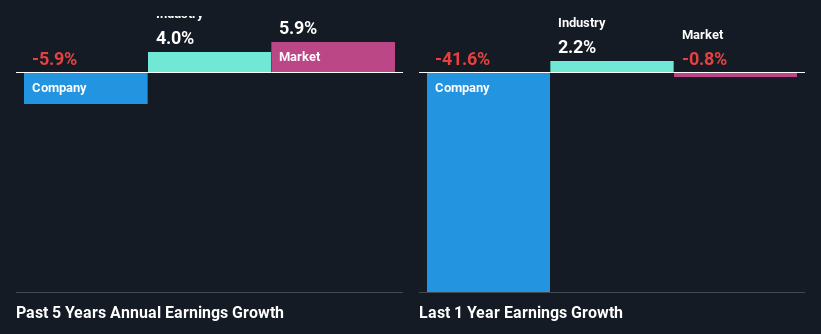

In Beijing Asiacom’s case, the 4.7% ROE appears relatively weak, and is well below the industry average of 6.1%. This may have contributed to the company’s 5.9% decline in net income growth over the past five years.

Several factors might be impacting the company’s earnings. This may include inefficient capital allocation or a high payout ratio. When compared to the industry, which has experienced a 4.0% earnings growth over the last few years, Beijing Asiacom’s performance appears less impressive.

Looking Ahead

The foundation for a company’s valuation is largely tied to its earnings growth, making it crucial for investors to determine if that growth, or the lack of it, is already reflected in the stock price. The price-to-earnings (P/E) ratio is a good indicator of expected earnings growth, helping investors decide whether the stock is positioned for a bright or bleak future. Investors should assess whether Beijing Asiacom is trading at a high or low P/E relative to its industry peers.

Effective Use of Retained Earnings?

Despite a median payout ratio of 31% over three years, Beijing Asiacom has seen a decline in earnings. Other factors, such as potential headwinds or management’s preference for maintaining dividend payments even during earnings declines, could be at play.

Conclusion

Overall, the company presents a mixed picture. Although it reinvests at a high rate, its low ROE may hinder its ability to generate value for investors. Investors should proceed with caution, and a thorough assessment of the company’s risk profile is recommended before making any investment decisions.

Disclaimer: This analysis is based on historical data and analyst forecasts and should not be considered financial advice. It is not a recommendation to buy or sell any stock.