Beijing CTJ Information Technology: Is Recent Stock Performance Driven by Fundamentals?

Beijing CTJ Information Technology (SZSE:301153) has experienced a significant surge in its stock price, increasing by 17% over the past month. Given that stock prices typically align with a company’s long-term financial performance, it’s worth examining the company’s financial indicators to understand the drivers behind this recent movement.

Understanding Return on Equity (ROE)

This analysis focuses on Beijing CTJ Information Technology’s Return on Equity (ROE), a key metric for assessing how efficiently a company’s management utilizes shareholders’ capital. ROE provides insight into a company’s profitability, measuring the return generated on the capital provided by shareholders.

To calculate ROE, the following formula is used:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Based on the trailing twelve months up to September 2024, Beijing CTJ Information Technology’s ROE is calculated as:

7.1% = CN¥122m ÷ CN¥1.7b

This indicates that for every CN¥1 of shareholders’ capital, the company generated CN¥0.07 in profit.

ROE and Earnings Growth

ROE helps measure a company’s profitability. A company’s ability to generate future profits depends on how much of its profits it chooses to reinvest or retain. Higher return on equity, coupled with profit retention, often leads to higher growth rates.

Beijing CTJ Information Technology’s ROE and Earnings Growth

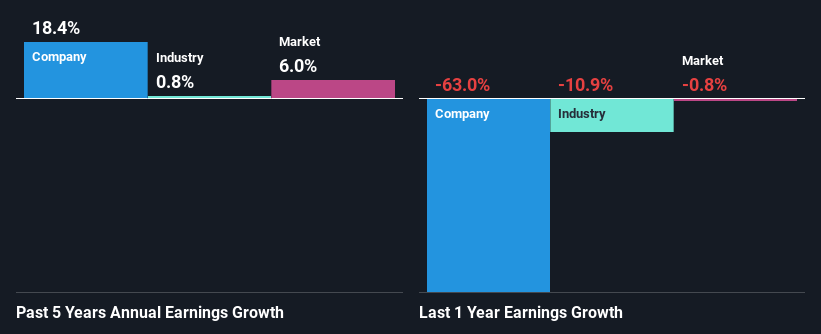

While a 7.1% ROE might not seem exceptionally high, it’s noteworthy that it surpasses the industry average ROE of 4.3%. This may have contributed to the company’s decent earnings growth of 18% over the past five years. However, the company could still be experiencing growth due to other factors, such as high earnings retention or belonging to a rapidly growing industry.

To further assess its performance, Beijing CTJ Information Technology’s net income growth was compared to the industry average. The company’s growth outperformed the industry, suggesting that its positive performance is not solely due to its above-average ROE.

Earnings growth is key when assessing a stock’s value. It’s important for investors to consider whether the market has factored in the company’s expected earnings growth (or decline) to determine if the stock is undervalued or overvalued.

Profit Reinvestment

Beijing CTJ Information Technology has a three-year median payout ratio of 68%, retaining 32% of its profits. Despite this relatively high payout ratio, the company has still experienced solid earnings growth, indicating that the high payout has not hindered its growth trajectory. The company recently started paying dividends, which may be an effort to impress new and existing shareholders.

Conclusion

In summary, Beijing CTJ Information Technology presents several positive aspects. Its respectable ROE likely contributed to its considerable earnings growth. While the company retains only a small portion of its profits, it still has managed to increase earnings, which is a favorable sign. Furthermore, analysts anticipate continued momentum in the company’s earnings. For more details, click here.

Disclaimer: This article is for general informational purposes only and does not constitute financial advice. Always conduct your own research and consider consulting with a financial professional before making any investment decisions.