Beijing Hanbang Technology Shares Surge, But Is the Price Realistic?

Shares of Beijing Hanbang Technology Corp. (SZSE:300449) have experienced a significant increase in value over the past month, climbing by an impressive 29%. This recent performance adds to a substantial 131% gain over the last year. However, a closer look at the company’s valuation raises some questions.

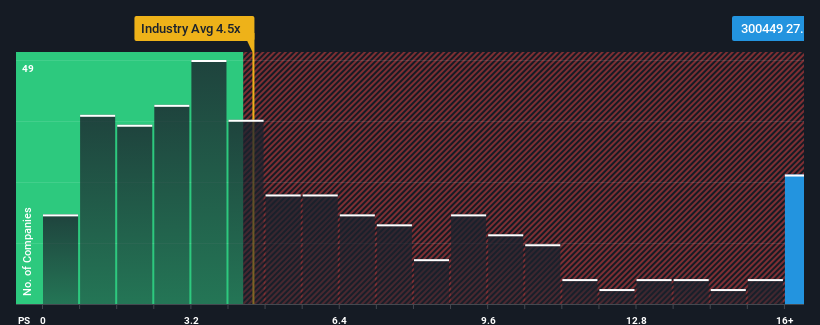

Following the recent price surge, Beijing Hanbang Technology’s price-to-sales (P/S) ratio stands at 27.9x. This figure may seem high compared to other companies in the Electronic industry within China, where approximately half of the companies have P/S ratios below 4.5x, and ratios under 2x are common. The high P/S ratio warrants further investigation to determine if it’s justified.

The primary concern is whether the company’s revenue growth justifies the premium. While Beijing Hanbang Technology has demonstrated solid revenue growth recently, investor expectations may be overly optimistic.

To understand the bigger picture of the company’s financial performance, including revenue and cash flow, a free report on Beijing Hanbang Technology is available.

Revenue Forecasts and P/S Ratio

A high P/S ratio, like the one seen in Beijing Hanbang Technology, is typically considered acceptable when a company’s growth is poised to significantly outperform the industry. Over the last year, the company’s top line grew by 15%. However, the latest three-year period shows a 74% decrease in overall revenue. This trend paints a worrying picture for shareholders as the industry predicts a 26% growth in the next 12 months.

Given this information, the fact that Beijing Hanbang Technology is trading at a P/S higher than the industry average is a cause for concern. Investors appear to be overlooking the recent negative growth rates and are betting on a future turnaround in the company’s business prospects.

If the company is unable to improve, existing shareholders may face disappointment if the P/S falls more in line with its recent performance. Investors should be aware that the share price might not be fairly valued.

The Bottom Line

The recent increase in the price of Beijing Hanbang Technology’s shares has pushed its P/S ratio higher. While a rising P/S ratio can indicate positive market sentiment, in this instance, the company’s medium-term revenue decline doesn’t align with the high valuation. With declining revenues, the sentiment may eventually sour, pulling the P/S ratio down. Unless the medium-term financial performance improves significantly, it will become exceedingly difficult for investors to justify the current share price.

It’s essential to assess the potential risks. One warning sign for Beijing Hanbang Technology should be acknowledged.

This article is based on historical data and analyst forecasts. It is not intended to be financial advice.