Beijing Shenzhou Aerospace Software: Is the Price Right?

Shares of Beijing Shenzhou Aerospace Software Technology Co., Ltd. (SHSE:688562) might be trading at a price that doesn’t fully reflect the company’s recent performance, according to a recent analysis.

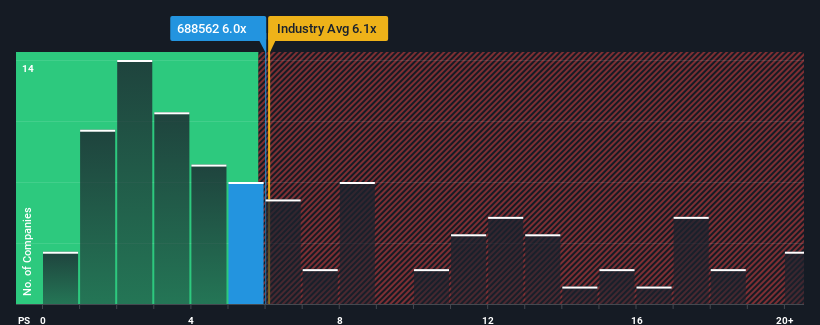

With the IT industry in China sporting a median price-to-sales (P/S) ratio of around 6.1x, Beijing Shenzhou Aerospace Software’s P/S of 6x might seem unremarkable at first glance. However, a deeper look reveals potential discrepancies between the company’s valuation and its financial results.

Recent Performance Concerns

One key factor to consider is the company’s declining revenue. The analysis highlights a recent drop in revenue, which could be a cause for concern. While some investors may be betting on a turnaround, the current P/S ratio appears to be holding steady despite this negative trend.

Revenue Growth Disappoints

The company’s revenue fell by 30% over the last year. This decline extends to the longer term, with a 28% decrease over the past three years. This trajectory contrasts sharply with the industry’s projected growth of 17% in the next 12 months.

This divergence raises questions about the sustainability of the current valuation. The analysis suggests that investors may be overly optimistic, given the company’s recent performance.

Key Takeaway

The P/S ratio, while sometimes criticized, can be a useful indicator of market sentiment. In this case, the analysis suggests that the company’s shrinking revenues haven’t been reflected in its P/S ratio to the extent one might expect, given the industry’s growth prospects. Unless the company’s financial performance improves, shareholders could face challenges.

Disclaimer: This article provides commentary based on historical data and analyst forecasts and is not intended as financial advice.