Beijing Yuanliu Hongyuan Electronic Technology Co. (SHSE:603267) Sees Stock Price Jump, But Is the P/E Ratio Realistic?

Shares of Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd. (SHSE:603267) have experienced a significant upswing, climbing 35% over the past month, following a period of volatility.

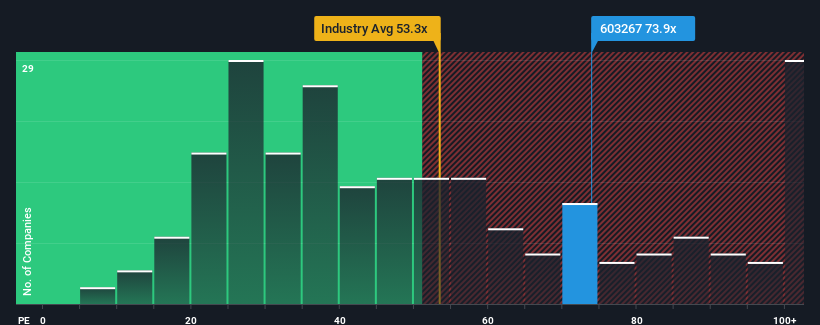

Looking at the bigger picture, the stock has also gained 26% in the last year. However, the company’s price-to-earnings (P/E) ratio of 73.9x is raising some eyebrows.

This P/E seems high, as nearly half of all firms in China have P/E ratios under 38x, and it’s not uncommon to see ratios below 21x. While a high P/E ratio isn’t always cause for alarm if growth expectations are strong, it’s worth investigating why investors are willing to pay such a premium.

A Closer Look at Growth

A high P/E is often justifiable when a company’s growth potential outshines the broader market. However, Beijing Yuanliu Hongyuan Electronic Technology hasn’t delivered the best growth lately. The company’s earnings dipped by 60% in the last year, and earnings from three years ago have receded by 81%. This decline might cause concern among shareholders.

Fortunately, analysts predict a more positive outlook. They anticipate the company’s earnings per share (EPS) to increase by 115% in the upcoming year. This is notably higher than the market’s projected growth rate of 37%.

Given this forecast, it’s understandable why Beijing Yuanliu Hongyuan Electronic Technology’s P/E ratio is above average. Investors appear to be banking on this anticipated strong future growth, which justifies a higher price for the stock.

Key Takeaways

Beijing Yuanliu Hongyuan Electronic Technology shares have recently seen strong momentum, which has contributed to a higher P/E ratio. While the price-to-earnings ratio is not universally applicable, it offers a valuable measure of market sentiment.

The high P/E ratio is supported by the expectation of superior growth in the future. Investors seem to believe that potential downsides to earnings growth are not severe enough to warrant a lower multiple. Therefore, a sharp drop in the share price in the near term seems unlikely under these circumstances.

However, it’s crucial to be aware of any risks. Beijing Yuanliu Hongyuan Electronic Technology has two warning signs that investors should consider.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.