Big tech is on a spending spree, snapping up promising startups at an unprecedented rate, as companies like Google, Nvidia, and Meta aggressively pursue acquisitions. This trend is fueled by the relentless race to dominate the AI landscape, a potentially less restrictive regulatory environment, and current market conditions.

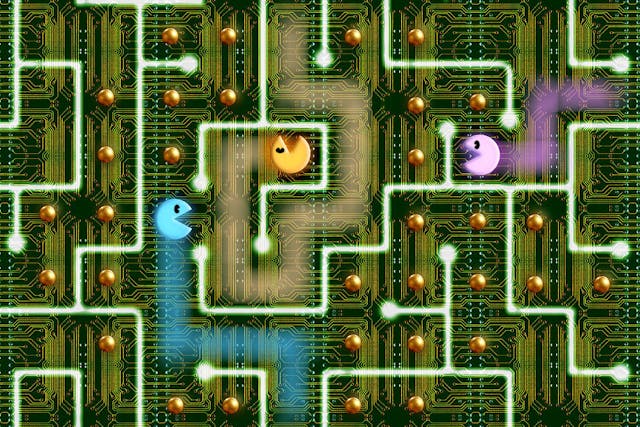

The tech world often resembles a game of Pac-Man. Major players navigate a complex maze of hardware, software, and talent. Their goal is to build products that revolutionize the world – or simply generate significant profits – while dodging threats. These ghosts include regulatory scrutiny, product obsolescence, and consumer backlash. They are constantly looking to consume the next power pill or a small pocket of growth in the form of a startup. Successful acquisitions, such as Meta’s acquisition of Instagram in 2012 or Google’s purchase of YouTube in 2006, often become core components of a company’s platform.

With artificial intelligence reshaping nearly every tech sector and a potential shift in the U.S. administration’s approach to acquisitions, this trend is likely to continue in 2025.

Last week, Google finalized its acquisition of Wiz, a cybersecurity startup. After an initial $23 billion bid was rejected, Google sweetened the deal, agreeing to a $32 billion takeover. This included a considerable 10% break fee, an indication of Google’s determination to acquire Wiz. According to Bloomberg reports, Meta’s $800 million offer for FuriosaAI, a Korean startup specializing in AI hardware infrastructure, was rejected.

If a startup holds something a tech giant desires–whether it’s a revolutionary product, cutting-edge technology, or a highly skilled team – acquisition becomes a trade-off of time for money. Data from CB Insights reveals that in the first quarter of 2025, 11 venture-backed startups were acquired for over $1 billion each, totaling a record-breaking $54.5 billion. This figure was largely driven by Google’s Wiz deal. In the previous year, only two startups surpassed the $1 billion mark in acquisitions.

There are several reasons to expect this wave of acquisitions to persist. The regulatory environment is undergoing significant changes. Lina Khan, former chair of the Federal Trade Commission, had an increasingly visible approach for reviewing deals. Her successor, Andrew Ferguson, is expected to adopt a less hands-on approach to scrutinizing M&A activities. Speaking to CNBC on March 13th, Ferguson stated that if the FTC found evidence of antitrust violations, the agency would pursue legal action. He emphasized a policy of either litigating violations or allowing the market to operate freely.

Sellers may also be more inclined to transact than before. David Chen, head of global technology investment banking at Morgan Stanley, noted that sellers’ willingness to engage in transactions has improved, partly due to market volatility. Concerns about a potential recession and the possibility of a bear market may make entering the fold of a major corporation more appealing to founders and leaders of thriving startups.

For potential acquirers, the AI boom presents numerous deal opportunities, but it also presents a key question: should we build or should we buy? Given the rapid pace of change in AI, tech giants, already investing heavily in capital expenditures, may be willing to spend more to acquire valuable tools and talent.

Just recently, Nvidia reportedly acquired Gretel, a synthetic data startup. The terms of the deal were not disclosed, but the acquisition followed Gretel’s $320 million valuation. Acquiring Gretel is a significant move for Nvidia, as the company hasn’t historically been as acquisitive as some of its peers. Data from Crunchbase indicates that Nvidia has acquired just 30 companies, while Google has acquired 267 and Microsoft has bought 256.

With investors eager to invest in AI-driven companies, this trend is expected to persist. The financial strength of big tech companies further supports this expectation. However, policy uncertainties could disrupt this scenario.

What becomes of these startups absorbed by big tech? As some experts observed, many could have become public companies, key competitors, or both.