BigBear.ai Shares Tumble After Dismal Q4 Performance

BigBear.ai (BBAI), a data analytics firm, recently reported fourth-quarter 2024 results that fell short of market expectations. The news triggered a considerable decline in the company’s stock value, reflecting investor concern over the financial performance.

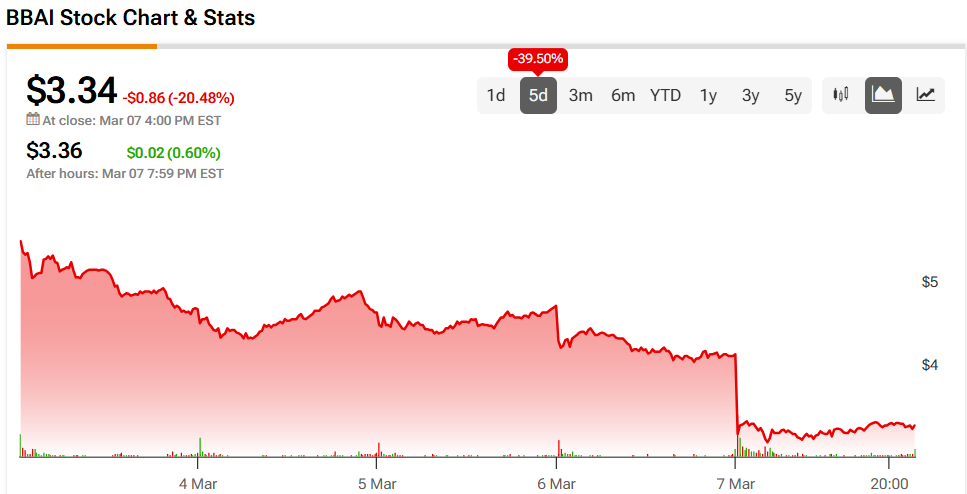

Stock chart showing the drop in BBAI stock following the earnings report.

Missed Financial Targets

Both sales figures and profit projections for Q4 2024 underperformed. The company’s losses were three times larger than forecasted. Moreover, projections for the entirety of 2025 suggest a considerable shortfall compared to analysts’ estimates.

These financial setbacks triggered a 39.50% drop in BBAI’s stock value following the earnings report. This reaction underscores the challenges the company currently faces.

Revenue Growth Amidst Broader Challenges

Despite the overall disappointing results, BigBear.ai experienced some areas of growth. Revenue for Q4 2024 increased by 8% year-over-year, largely fueled by revenue from government contracts with the Department of Homeland Security and Digital Identity programs.

Recent Contract Wins

BigBear.ai has secured several significant contracts, including a deal with the Department of Defense’s Chief Digital and AI office (CDAO) to enhance the Virtual Anticipation Network (VANE) prototype. The company also won a prime Indefinite Delivery/Indefinite Quantity (IDIQ) contract with the U.S. Department of Navy’s SeaPort Next Generation (SeaPort NxG) program. These wins open avenues for the company to provide its technologies and support to various federal agencies.

Increased Costs and Profitability Concerns

The boost in revenue for Q4 2024, reaching $43.8 million, failed to offset other financial issues. While the gross margin increased, changes in the fair value of derivative liabilities related to convertible notes and warrants contributed to a net loss of $108.0 million for the quarter, a significant increase from the $21.3 million loss recorded in Q4 2023.

The non-GAAP adjusted EBITDA for Q4 2024 was $2.0 million, down from $3.7 million in Q4 2023, largely due to higher SG&A expenses. SG&A expenses increased to $22.2 million in Q4 2024 from $18.2 million in the same quarter of the previous year. However, the ending backlog grew considerably to $418 million, a 2.5x increase from the end of 2023.

Management has forecast 2025 revenue between $160 million and $180 million and a negative single-digit million adjusted EBITDA.

Analyst Reactions and Outlook

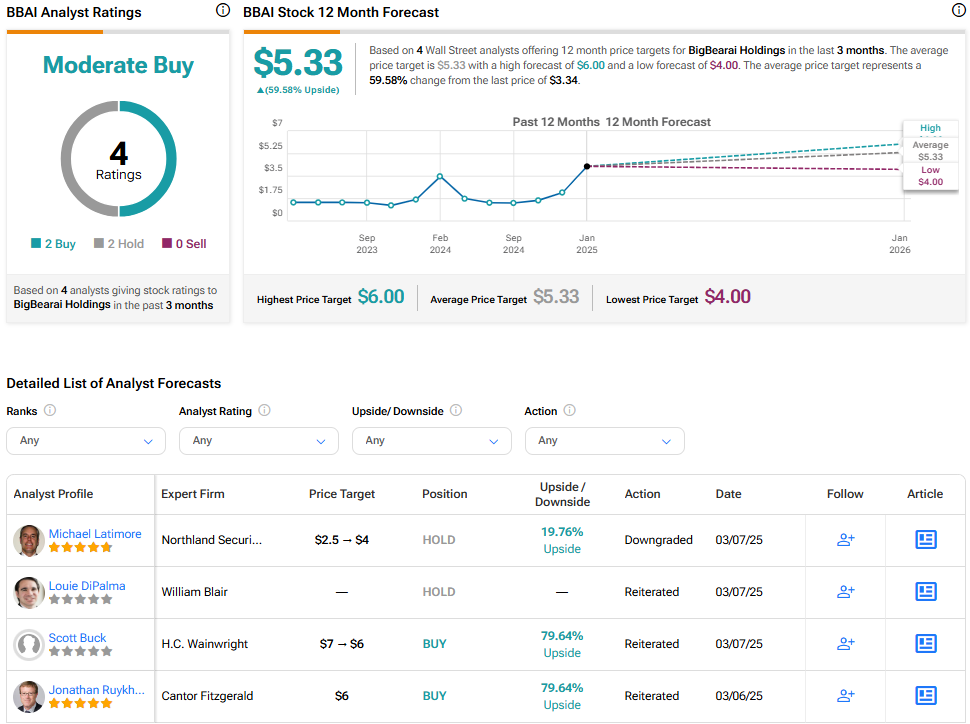

Analysts covering BigBear.ai have responded to the financial results with a cautious approach. William Blair’s Louie DiPalma maintained a neutral “Hold” rating, citing lower-than-expected guidance for 2025. Meanwhile, Cantor Fitzgerald’s Jonathan Ruykhaver reassumed coverage with an “Overweight” rating and revised the firm’s price target from $8 to $6. Overall, the stock is rated a Moderate Buy, with an average price target that suggests a noteworthy upside.

Chart showing the recent analyst ratings for BBAI stock.