Bitcoin Breaks $100,000 Amidst Anticipation of Pro-Crypto Policies

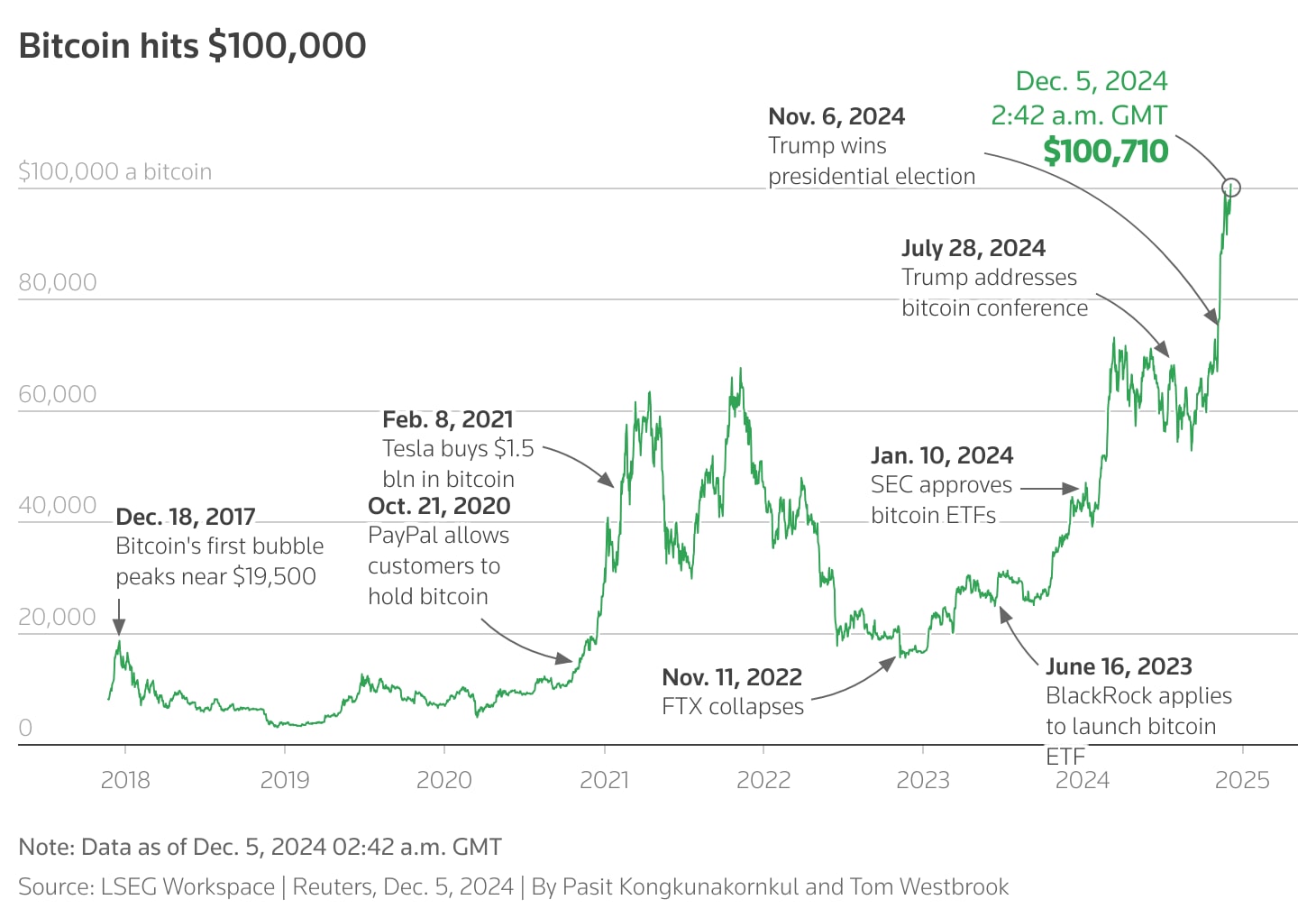

Bitcoin reached a historic milestone on Thursday, surpassing $100,000 for the first time. This surge was celebrated by both enthusiasts and skeptics, signaling a maturation of digital assets as investors anticipate a more favorable regulatory environment under a potential U.S. administration supportive of cryptocurrencies.

After breaching the $100,000 mark early Thursday, Bitcoin’s value climbed to an all-time high of $103,649, buoyed by the nomination of Paul Atkins, a known supporter of cryptocurrencies, to lead the Securities and Exchange Commission (SEC) under President-elect Donald Trump. Bitcoin was last trading at $98,803, reflecting a 0.95% increase for the day.

The cryptocurrency market’s total value has nearly doubled year-to-date, reaching a new high of over $3.8 trillion, according to CoinGecko. By comparison, Apple (AAPL.O) is valued at approximately $3.7 trillion.

Bitcoin’s evolution from a fringe movement to a mainstream asset class has created millionaires, popularized “decentralized finance,” and taken place during a turbulent period since its inception 16 years ago.

Bitcoin’s value has more than doubled this year and has increased by over 50% in the four weeks following Donald Trump’s decisive election victory. This period also coincided with the election of numerous pro-crypto lawmakers to Congress.

Trump celebrated the milestone on his social media platform, Truth Social, stating: “CONGRATULATIONS BITCOINERS!!! $100,000!!! YOU’RE WELCOME!!! Together, we will Make America Great Again!”

“We’re witnessing a paradigm shift,” commented Mike Novogratz, founder and CEO of U.S. crypto firm Galaxy Digital. He added that “Bitcoin and the entire digital asset ecosystem are on the brink of entering the financial mainstream – this momentum is fuelled by institutional adoption, advancements in tokenisation and payments, and a clearer regulatory path.”

Trump, who previously criticized crypto, has embraced digital assets during his campaign, pledging to make the United States the “crypto capital of the planet” and to establish a national bitcoin stockpile.

“We were trading basically sideways for about seven months, then immediately after Nov. 5, U.S. investors resumed buying hand-over-fist,” said Joe McCann, CEO and founder of Asymmetric, a Miami digital assets hedge fund.

Bitcoin supporters have applauded Trump’s nomination of Atkins to the SEC. Atkins, a former SEC commissioner, has been involved in crypto policy as co-chair of the Token Alliance and the Chamber of Digital Commerce.

“Atkins will offer a new perspective, anchored by a deep understanding of the digital asset ecosystem,” said Blockchain Association CEO Kristin Smith, who looks forward to working with him and ushering in a “new wave of American crypto innovation.”

Several crypto companies, like Ripple, Kraken, and Circle, are also vying for positions on Trump’s promised crypto advisory council.

Bitcoin’s price over time.

Bitcoin’s Resilience

Bitcoin has demonstrated resilience through considerable price declines. Its move into six-figure territory is a notable comeback from a drop below $16,000 in 2022, during the collapse of the FTX exchange, whose founder, Sam Bankman-Fried, was later incarcerated.

Analysts attribute the growing acceptance of bitcoin by large investors as a primary driver behind the record-breaking surge. U.S.-listed bitcoin exchange-traded funds, approved in January, have facilitated substantial buying, with more than $4 billion flowing into these funds since the election.

Geoff Kendrick, global head of digital assets research at Standard Chartered, notes that “Roughly 3% of the total supply of bitcoins that will ever exist have been purchased in 2024 by institutional money.”

“Digital assets, as an asset class, is becoming normalised,” he noted. It is becoming increasingly financialized, with the launch of bitcoin futures in 2017 and a strong debut for options on BlackRock’s ETF (IBIT.O) in November.

Crypto-related stocks have seen substantial gains alongside Bitcoin, with shares of MARA Holdings (MARA.O) and Coinbase (COIN.O) increasing approximately 65% in November. Software firm MicroStrategy, which has invested heavily in Bitcoin, holding around 402,100 bitcoins as of December 1, has gained around 540% this year.

Trump himself launched a new crypto venture, World Liberty Financial, in September, though details remain scarce. Billionaire Elon Musk, a significant Trump ally, is also a proponent of cryptocurrencies.

The Road Ahead for Bitcoin

Despite the optimism, some consider bitcoin to be more of a speculative investment vehicle and not suited for payments. Federal Reserve Chair Jerome Powell compared bitcoin to gold on Wednesday, noting that “it’s virtual, it’s digital.” He also stated: “People are not using it as a form of payment, or as a store of value. It’s highly volatile, it’s not a competitor for the dollar.”

Analysts suggest that the broader adoption of Bitcoin may help stabilize volatility. Sean Farrell, head of digital asset strategy at Fundstrat Global Advisors, said, “That is not to say that there will not be 30-50% drawdowns over time, but my base case is that the nature of the drawdowns will be less severe than what we saw in the last bear market.” He added that “Passive flows into ETFs, a liquid options market, corporate treasury adoption, and nation state adoption will likely play a large role in dampening volatility.”

Cryptocurrencies face criticism for their high energy consumption and use in criminal activities. The underlying technology is far from revolutionizing how money moves globally. On Wednesday, the U.S. and Britain announced they had disrupted a money laundering ring that used cryptocurrency to help wealthy Russians avoid sanctions and launder cash for drug traffickers.

While estimates vary, the Cambridge University Centre for Alternative Finance estimates that bitcoin consumes roughly the same amount of electricity each year as Poland or South Africa. However, as Russian President Vladimir Putin pointed out at an investment conference on Wednesday: “Who can prohibit it? No one.” Its longevity underscores a degree of resilience.

Shane Oliver, chief economist and head of investment strategy at AMP in Sydney, said: “As time goes by it’s proving itself as part of the financial landscape. I find it very hard to value it … it’s anyone’s guess. But it does have a momentum aspect to it and at the moment the momentum is up.”