Blockchain’s Journey: From Bitcoin to Business

Blockchain, which officially emerged in 2009 with the introduction of Bitcoin, has a history stretching back decades. Though widely associated with Bitcoin, the underlying technologies predate the cryptocurrency. In its early days, blockchain’s decentralized, peer-to-peer (P2P) architecture gave it a ‘Wild West’ reputation, seeming too risky for business use. This perception began to shift in 2016, as open-source communities developed complete enterprise platforms. Despite frequent scary headlines about cryptocurrencies, governments and businesses are now researching and deploying blockchain to meet diverse needs, especially in the face of increasing cyberthreats and data privacy concerns.

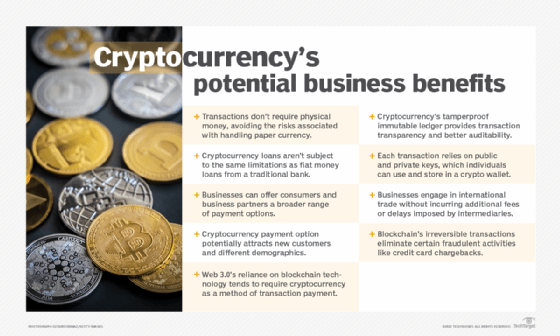

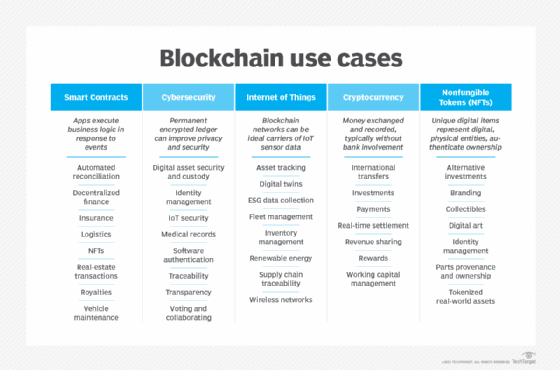

Blockchain offers several key benefits: security, immutability, traceability, and transparency across a distributed network. This makes it suitable for use cases difficult to support with traditional infrastructures.

Unpacking Blockchain: A Public Ledger

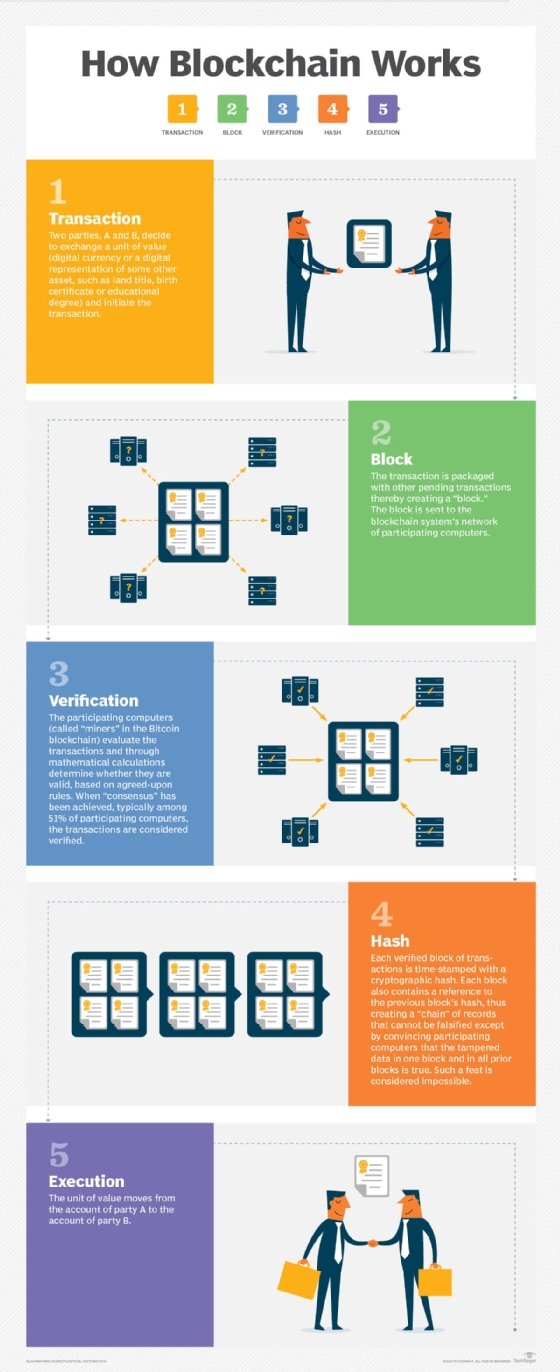

Blockchain functions as a public ledger for recording transactions without a third-party validator. This distributed database, deployed on a P2P network, consists of data blocks that are linked together in a continuous chain, creating an immutable record.

Each computer in the network maintains its own copy of the ledger, which eliminates a single point of failure. Blocks are added sequentially, are permanent, and tamperproof. The first block is called the Genesis block.

Each block includes a unique alphanumeric string called a hash, based on the block’s timestamp. Blocks are added to the chain by using the previous block’s hash to establish a link. Before a block is added, a process known as consensus validates its authenticity. Most, if not all, nodes on the blockchain network must agree that the calculation of the new block’s hash is correct. This agreement ensures that all copies of the distributed ledger are in the same state.

Initially, blockchain provided a distributed, public ledger to support Bitcoin, allowing transactions to be recorded without a central authority. Costs associated with third-party verification were eliminated, and transparency, traceability, and security surpassed that of conventional methods.

Genesis of the Blockchain

Although blockchain’s history is relatively short, its influence today is widespread, with applications growing rapidly.

Historical Building Blocks

Several key developments shaped the evolution of blockchain:

- 1979: Ralph Merkle introduced Merkle trees for secure public key distribution and digital signatures.

- 1982: David Chaum described a system for establishing and trusting computer systems within mutually suspicious groups, which included elements that would become central to blockchain.

- 1991: Stuart Haber and W. Scott Stornetta published a paper on timestamping digital documents to prevent tampering.

- 1993: Cynthia Dwork and Moni Naor published a paper on Proof of Work (PoW) to combat junk mail.

- 1997: Adam Black introduced Hashcash, a PoW algorithm to counter denial-of-service attacks.

- 1999: Markus Jakobsson and Ari Juels coined the term ‘Proof of Work.’

- 2000: Stefan Konst introduced cryptographically secured chains. These chains could be traced back from the Genesis block to prove authenticity, serving as the basis for modern blockchain models.

- 2004: Hal Finney introduced reusable PoW, a mechanism that plays a vital role in Bitcoin mining.

- 2008: Satoshi Nakamoto published a white paper introducing the concept of cryptocurrency and blockchain. The paper outlined a blockchain infrastructure for secure, P2P transactions without intermediaries. Nakamoto’s real identity remains a mystery.

- 2009: Bitcoin was launched during the Great Recession. Nakamoto mined the first Bitcoin block, validating the blockchain concept, and released Bitcoin v0.1 as open-source software.

- 2010: Programmer Laszlo Hanyecz paid 10,000 Bitcoin for two pizzas. This transaction would be worth millions today. Jed McCaleb launched Mt. Gox, which handled over 70% of all Bitcoin transactions at its peak, but it was hacked, tarnishing Bitcoin’s reputation. By year-end, Nakamoto disappeared from the Bitcoin scene.

- 2011: Bitcoin reached parity with the U.S. dollar, the euro, and the British pound sterling. Mt. Gox was hacked, causing a drop in Bitcoin’s value. Litecoin was released, representing one of the earliest Bitcoin spinoffs.

- 2012: Interest in cryptocurrencies solidified. The Bitcoin Foundation was established to promote Bitcoin. McCaleb and Chris Larsen founded OpenCoin, which developed the Ripple transaction protocol.

- 2013: Coinbase reported selling $1 million worth of Bitcoin in a single month. The first reported Bitcoin ATM launched. Both Thailand and China banned cryptocurrencies. The FBI shut down Silk Road.

- 2014: Vitalik Buterin published a white paper proposing a decentralized application platform, creating Ethereum. Ethereum paved the way for blockchain technology to be used for applications other than cryptocurrency. Financial institutions began to recognize the potential.

- 2015: The Ethereum Frontier network launched, enabling developers to write and deploy smart contracts. The Linux Foundation launched the Hyperledger project. Nine investment banks formed the R3 consortium to explore blockchain’s benefits.

- 2016: The term ‘blockchain’ gained wider acceptance as a single word. A bug in the Ethereum decentralized autonomous organization code was exploited, which led to a ‘hard fork’.

- 2017: Bitcoin hit a record high of nearly $20,000. Japan recognized Bitcoin as legal currency. Seven European banks formed the Digital Trade Chain Consortium.

- 2018: Bitcoin’s value dropped. Stripe, Google, Twitter, and Facebook banned cryptocurrency advertising. The European Commission launched the Blockchain Observatory and Forum. Baidu introduced its blockchain-as-a-service platform.

- 2019: Walmart launched a supply chain system based on the Hyperledger platform. Amazon announced the general availability of its Amazon Managed Blockchain service.

- 2020: A Deloitte survey revealed that nearly 40% of respondents incorporated blockchain into production. Interest increased in combining blockchain with AI to optimize business processes.

- 2021: Bitcoin reached an all-time high of almost $69,000. Coinbase went public. The DeFi market grew by 600% year-over-year. NFT art sold for over $69 million at Christie’s. Interest in blockchain for applications other than cryptocurrency continued. The global blockchain technology market was valued at almost $6 billion in 2021 and projected to surpass $1 trillion by 2030.

- 2022: NFTs continued their ascent, many eco-friendly blockchain networks emerged, and blockchain applications increased among companies. Inflation and the Omicron variant caused prices for Bitcoin and other cryptocurrencies to plummet. The collapse of the FTX exchange amplified fears about cryptocurrency’s riskiness. More than 100 countries were involved in creating their own central bank digital currencies (CBDCs).

- 2023: Businesses are proceeding with increased caution with blockchain, but the SEC indicted executives at the Coinbase and Binance exchanges and filed charges against crypto-asset entrepreneur Justin Sun. The government continues to consider new U.S. regulation of cryptocurrency.

Blockchain: How It Works

Blockchain’s secure and transparent transactions without intermediaries potentially will change business operations for decades. Technologies like AI, IoT, NFTs, and the metaverse will be significantly impacted by blockchain. Projections estimate the business value of blockchain at over $360 billion by 2026 and $3.1 trillion by 2030.

Expect several trends to drive blockchain’s increased valuation:

- Blockchain as a cloud-based technology for digital transformation and data migration.

- AI and blockchain working synergistically to increase efficiency and generate data for more reliable machine learning models.

- Increased NFT use cases, opening new revenue avenues for content producers.

- Blockchain IoT leading to faster, more affordable, and more secure digital transactions.

- Smart contracts for simpler and more automated transactions.

- Foundational role for blockchain in Web 3.0 and the development of the metaverse.

- DeFi enabling more open and inclusive lending, borrowing, and services.

- Blockchain-as-a-service enabling companies to create and manage blockchain applications.

- Proof-of-stake protocol gaining momentum as a viable alternative.

- Government adoption of distributed ledger technology in place of paper-based systems.

Businesses must carefully weigh the risks, evaluate the financial costs, and be selective with their blockchain deployments, as the technology continues to advance in security, privacy, scalability, and interoperability. Governments will likely respond to cyber attacks, scams, and indictments by implementing federal, state, and local legislative and regulatory efforts.