Carpenter Technology’s High P/E: A Sign of Market Optimism?

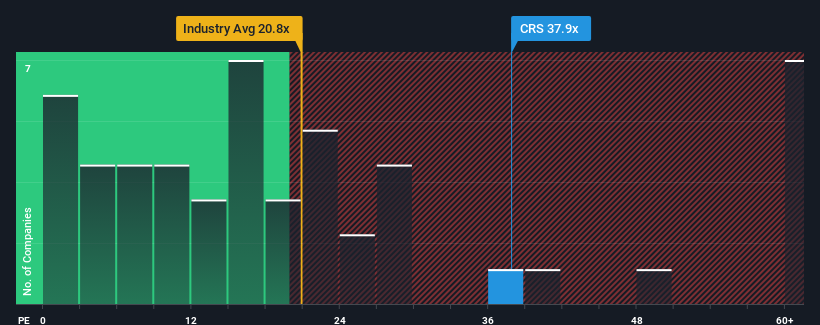

Carpenter Technology Corporation (NYSE:CRS) currently boasts a price-to-earnings (P/E) ratio of 37.9x. This figure is considerably higher than the median P/E of approximately 17x seen in the broader United States market, where even ratios below 10x are common. However, a high P/E isn’t always a red flag; sometimes there are good reasons behind it.

Strong Recent Performance

Carpenter Technology has enjoyed impressive earnings growth recently, outperforming many of its peers. This positive performance appears to be driving investor confidence, which, in turn, has pushed the P/E ratio upward. This suggests investors are anticipating that this strong earnings performance will continue.

Growth Prospects and Analyst Estimates

For a P/E multiple as high as Carpenter Technology’s to be considered reasonable, the company needs to demonstrate a capacity to significantly outperform the market. In the past year, Carpenter Technology’s bottom line has seen substantial growth, increasing by 84%. However, while earnings have seen rapid growth, the company’s earnings per share (EPS) has not seen significant growth over the past three years. Analyst forecasts project average growth of 31% annually over the next three years. In comparison, the broader market is projected to expand by just 11% each year.

Investor Sentiment

The high P/E ratio of 37.9x suggests that shareholders are optimistic about the company’s future, holding the stock with confidence as they anticipate its continued success. These expectations will likely continue to provide solid support to the share price, as long as the company meets the expectations of these investors.

Key Takeaway

Generally, the price-to-earnings ratio serves less as a valuation tool and more as a gauge of current investor sentiment. The high P/E of Carpenter Technology appears tied to the company’s promising earnings outlook and strong expectations, which are making the stock attractive to many investors.

Should you have any concerns about investing in the stock, the company has also been identified as having 1 warning sign that investors may want to explore.

This article is for informational purposes only and does not constitute financial advice.