Carpenter Technology’s P/E Ratio: What Does It Mean?

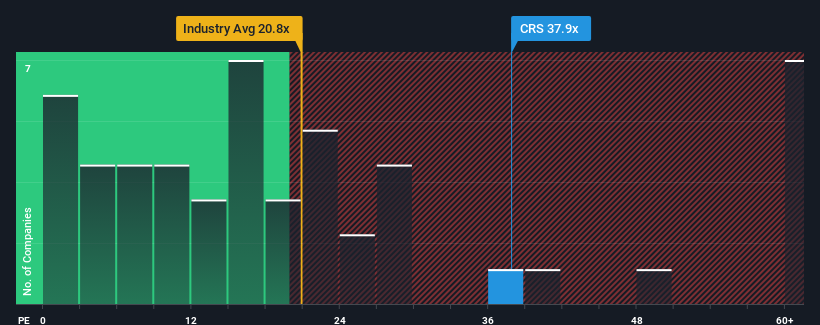

Carpenter Technology Corporation (NYSE:CRS) currently boasts a price-to-earnings (P/E) ratio of 37.9x. This figure, while seemingly high compared to the US market average – where roughly half of companies have P/E ratios below 17x and values under 10x are common – warrants a closer look rather than an immediate sell signal.

Recent positive trends in Carpenter Technology’s earnings are a key factor. The company’s earnings have been growing at a faster rate than many others. This has led to increased expectations for continued strong performance, which is reflected in its elevated P/E ratio.

To gain a comprehensive perspective on analyst estimates, you may want to review a free report on Carpenter Technology.

Growth Expectations and Historical Performance

A high P/E ratio, such as Carpenter Technology’s, often implies an expectation that the company will significantly outperform the market. Examining its historical performance, the company delivered an impressive 84% gain in its bottom line over the past year. However, it’s important to note that the Earnings Per Share (EPS) has not seen any significant rise in the last three years. This may present a mixed signal to some investors.

Looking ahead, seven analysts tracking the company predict a growth rate of 31% annually over the next three years. This is considerably more optimistic than the projected 11% annual expansion for the broader market.

These forecasts explain why Carpenter Technology is trading at a higher P/E ratio than the market average. Investors seem willing to pay a premium, anticipating a more prosperous future for the company.

The Investor Sentiment Factor

Ultimately, the price-to-earnings ratio is a tool for evaluating investor sentiment and future expectations, rather than a simple valuation metric. The strong P/E ratio reflects the positive outlook for future earnings. Shareholders appear confident that anticipated earnings will materialize, and the stock price is likely to remain strong unless these conditions change.

It’s always crucial to consider the risks involved. Every company faces challenges. For Carpenter Technology, there are always potential risks to acknowledge. Every investment has its risks.

Disclaimer: This article is for informational purposes only and should not be considered financial advice.