Carpenter Technology: Performance Driven by Financial Strength?

Carpenter Technology Corporation (NYSE:CRS) has shown a positive trend, with its stock price increasing by 7.8% over the past three months. This has led to an analysis of the company’s key financial indicators, as long-term market outcomes often reflect a company’s fundamental strength.

Return on Equity (ROE) and Its Significance

This analysis will focus on Carpenter Technology’s Return on Equity (ROE). ROE is a crucial metric that evaluates how effectively a company’s management uses its capital. It essentially reveals the profit generated for each dollar of shareholder investment.

To calculate ROE, the following formula is used:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Based on this formula, Carpenter Technology’s ROE is calculated as follows:

16% = US$269m ÷ US$1.7b (Based on the trailing twelve months to December 2024).

This means that for every $1 of equity, the company earned $0.16 in profit.

ROE and Earnings Growth

An examination of the connection between ROE and earnings growth is essential. Companies that can reinvest profits for future growth often show higher growth rates.

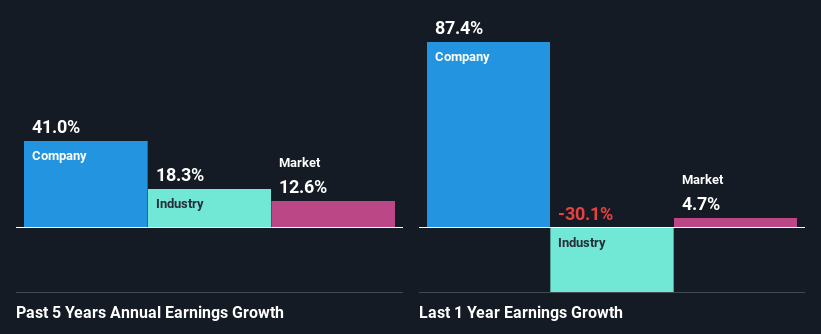

Carpenter Technology’s ROE, currently at 16%, is considered respectable, especially when compared to an industry average of 11%. This has seemingly contributed to a 41% net income growth over the last five years. High earnings retention or effective management may also play a role in this growth. The company’s growth also outpaces the industry’s average net income growth of 18% in the same period.

Assessing Carpenter Technology’s Financial Strategies

The valuation of a company is significantly linked to its earnings growth. Investors must understand whether the market has priced in the company’s expected earnings growth.

Carpenter Technology’s low three-year median payout ratio of 18% indicates that the company is retaining a large portion (82%) of its profits. This suggests that management is reinvesting most of the profits to grow the business, as evidenced by the company’s growth. Furthermore, Carpenter Technology has a history of paying dividends for at least ten years. Analyst estimates suggest that the company’s future payout ratio is expected to drop to 8.8% over the next three years, and at the same time, its ROE is expected to rise to 21%.

Conclusion

Overall, this analysis suggests that Carpenter Technology is performing well, mainly due to its high rate of return and significant reinvestment in its business. This has, in turn, led to impressive earnings growth. However, industry analyst forecasts indicate a possible slowdown in the company’s earnings growth.