Cathie Wood, the visionary behind Ark Investment Management, has a keen eye for disruptive technologies. Her exchange-traded funds (ETFs) focus on innovative fields like electric vehicles, robotics, and, most prominently, artificial intelligence (AI).

Wood believes that software companies represent a substantial opportunity in the AI landscape. She anticipates that these companies could see $8 in revenue for every $1 spent on chips from suppliers such as Nvidia. This conviction is reflected in Ark’s ETFs, which include significant holdings in AI software stocks like Tesla, Palantir Technologies, and Amazon. Furthermore, through the Ark Venture Fund, Wood has invested in several groundbreaking AI software start-ups, including OpenAI, Anthropic, and Elon Musk’s xAI.

One company poised to benefit if Wood’s predictions hold true is C3.ai (AI). This company is helping businesses across various industries accelerate their adoption of AI software applications. Here’s a closer look at why C3.ai could be a compelling long-term investment.

Accessible AI Solutions for Businesses

C3.ai has developed over 130 ready-made AI applications that can be deployed in as little as three months after the initial customer briefing. These applications cater to diverse industries, including oil and gas, manufacturing, utilities, and financial services. They help businesses to predict equipment failures, reduce carbon emissions, streamline supply chains, and even detect fraud.

C3.ai has strategically cultivated strong partnerships with the world’s leading cloud service providers: Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. This partnership has created a symbiotic relationship. C3.ai gains access to a broad pool of potential customers, while cloud providers can offer a wider range of AI solutions, potentially increasing enterprise spending on their platforms.

Businesses can seamlessly run C3.ai’s applications through AWS, Azure, and Google Cloud. This integration offers several benefits, including access to massive computing capacity for deploying software at scale and enhanced security to protect valuable internal data.

During C3.ai’s fiscal 2025 third quarter (ended Jan. 31), the company secured 47 new agreements via its partner network, a 74% increase compared to the same time last year. Notably, the company is also pursuing a joint sales campaign with Microsoft Azure, targeting 621 potential accounts worldwide.

Record Revenue, but a Caveat

C3.ai reported record revenues of $98.7 million during the fiscal 2025 third quarter, marking a 26% year-over-year increase. This growth rate represents an acceleration from the prior year’s 18%. The company has now achieved revenue growth of 20% or more for four consecutive quarters. This positive momentum can be attributed to C3.ai’s shift to consumption-based pricing two and a half years ago, which is now yielding results in faster growth.

However, there is a downside. While many tech companies have been cutting costs to improve their bottom lines, C3.ai continues investing heavily in research and development and marketing to expand its product portfolio and acquire new customers. While this isn’t inherently negative, it contributed to a GAAP (generally accepted accounting principles) net loss of $80.2 million, a 10% increase year over year. The loss was reduced to a more manageable $15.7 million on a non-GAAP basis, excluding $62.6 million in stock-based compensation. C3.ai held $724 million in cash, equivalents, and marketable securities at the end of the third quarter. This should allow them to handle losses of that magnitude for the foreseeable future.

Investors may eventually become concerned about the company’s need to issue new shares to raise money. This dilutes their holdings and negatively impacts their returns, so achieving profitability will need to become a high priority.

Is C3.ai Stock a Buy Right Now?

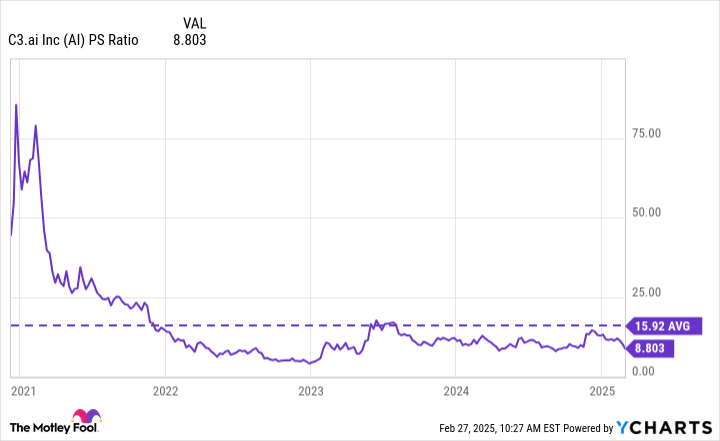

C3.ai went public in December 2020, and its stock price initially soared to a record high of $161 that same month. At the time, it was significantly overvalued, with a price-to-sales (P/S) ratio exceeding 80. This valuation reflected investor enthusiasm during a period of overall market exuberance. The stock underwent a sharp sell-off shortly after, and while it has since recovered somewhat, it still trades about 85% below its all-time high.

An area of optimism is its P/S ratio, which now sits at a more reasonable 9.4. This is due to both the stock price decline and the company’s solid revenue growth over the past few years.

According to a study by McKinsey and Company, approximately 72% of organizations are using AI in at least one business function. However, only 8% are using AI in five or more functions. This indicates that many companies are still in the early stages of AI adoption.

As AI technology becomes more sophisticated, businesses will likely deploy it more widely, much like the adoption of cloud computing. Many of these companies will turn to third-party providers like C3.ai for their needs, as it is often more cost-effective than developing in-house AI applications. As Cathie Wood has suggested, this could make AI software a far more valuable opportunity than hardware in the long run.

C3.ai CEO Thomas Siebel estimates that the addressable market for enterprise AI could reach $1.3 trillion by 2032, citing research by Bloomberg. The company has only begun to tap into this opportunity, suggesting that the stock could prove to be an excellent long-term investment.