CETC Cyberspace Security Technology’s Valuation: Is the Share Price Justified?

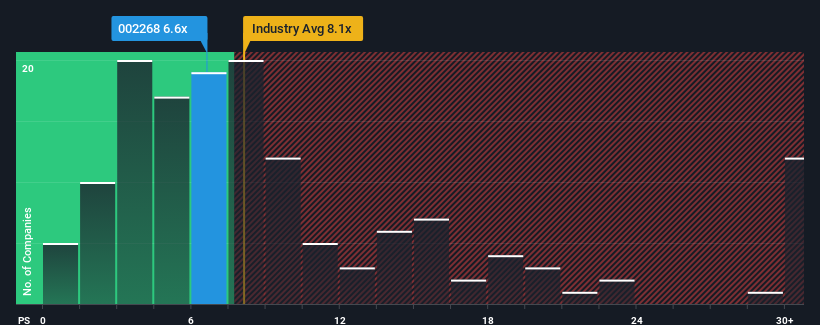

With a median price-to-sales (P/S) ratio of approximately 8.1x in China’s software industry, it might seem unremarkable that CETC Cyberspace Security Technology Co., Ltd. (SZSE:002268) has a P/S ratio of 6.6x. However, this might represent a missed opportunity or a potential problem if there’s no valid justification for the ratio.

What Does CETC Cyberspace Security’s P/S Indicate?

Consider that CETC Cyberspace Security Technology’s financial performance has been weak lately, as its revenue has decreased. Investors might believe that recent revenue performance is sufficient to keep in line with the existing industry standard. If not, shareholders could feel anxious about the share price’s viability.

While no analyst estimates are available for CETC Cyberspace Security Technology, examining data on the company’s earnings, revenue, and cash flow could provide further insight.

CETC’s Revenue Growth Trend

There’s an inherent assumption that a company’s P/S ratio should match the industry’s, and that’s a crucial factor for CETC Cyberspace Security Technology. Financial reports from the last year reveal that the company’s revenue dropped by 24%. Revenue also shows a downward trend over the long term, down 20% over the last three years. Consequently, shareholders might have reservations about the company’s medium-term revenue growth rates.

Comparing this to the industry, which is projected to grow by 28% in the next 12 months, the company’s downward trajectory, based on recent medium-term revenue results, presents a troubling picture. It’s concerning that CETC Cyberspace Security Technology’s P/S exceeds that of its industry peers. The current sentiment appears to be high, as investors are less bearish and aren’t selling their stock at the moment. There’s a risk that current shareholders may face future disappointment if the P/S drops to levels more aligned with the recent negative growth rates.

Conclusion

The price-to-sales ratio’s main purpose may not be as a valuation tool, but rather as a way to gauge current investor sentiment and future expectations. That CETC Cyberspace Security Technology currently trades at a P/S similar to the rest of the industry is unexpected, especially given its recent revenue declines over the medium term, while the industry is poised for growth. Given falling revenue in the context of growing industry forecasts, a potential share price decline could be on the horizon, and that would result in a lower P/S. If recent medium-term revenue trends remain, shareholders’ investments will be at risk, and potential investors could overpay unnecessary premiums.

It’s important to consider other risks, such as the two warning signs identified for CETC Cyberspace Security Technology. Ensure that you seek out a great company, not just your first idea. If increasing profitability aligns with your idea of a great company, take a look at the list of companies with strong recent earnings growth (and a low P/E).