Chainalysis: A New CEO and a Crypto-Friendly Climate

Chainalysis, the blockchain analytics firm valued at $8 billion, is navigating a new era under its recently appointed CEO, Jonathan Levin. With the potential for a more crypto-friendly regulatory environment in the new Trump administration, the company is poised for significant growth.

Founded in 2014, Chainalysis specializes in tracing digital transactions on the blockchain, assisting in the investigation of cryptocurrency-related crimes. Its software has been instrumental in uncovering illicit activities, ranging from North Korea-linked heists to the fallout from the FTX exchange collapse.

“This administration is thinking about crypto as a strategic technology for the United States, in terms of its ability to produce new financial rails and create a technology advantage that endures,” says Jonathan Levin, co-founder of New York City-based Chainalysis.

As the mainstream adoption of cryptocurrency expands, the need for robust oversight grows. Chainalysis is positioned to meet this demand. In December, Levin succeeded Michael Gronager, who co-founded the company.

The new administration’s stance on cryptocurrency is expected to benefit companies like Chainalysis. Early indications suggest a strategic reserve of cryptocurrencies and the appointment of crypto advocates to key government positions. Additionally, the Securities and Exchange Commission is expected to announce more crypto-friendly policies.

Chainalysis’s primary customer is the U.S. federal government, holding contracts with entities like the Internal Revenue Service, the Federal Bureau of Investigation, and the State Department, estimated to be worth $100 million, according to government databases.

Chainalysis’s technology has played a crucial role in various investigations, including the recovery of assets after the FTX collapse and tracking those evading sanctions in Ukraine. When hackers made off with nearly $1.5 billion in cryptocurrency from the Dubai-based crypto exchange Bybit in February, analysts deployed Chainalysis’ software to trace the stolen funds.

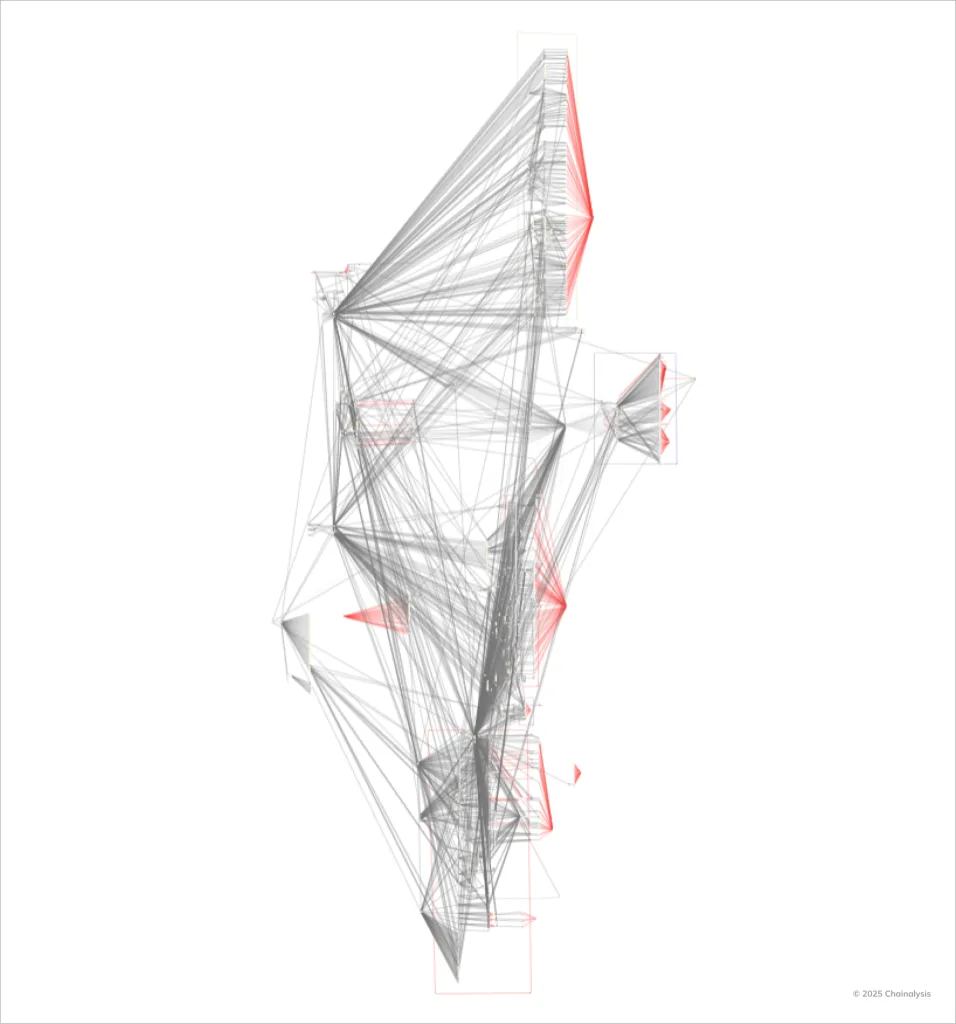

A Chainalysis Reactor graph showcases the complexity of the laundering efforts thus far: the web of intermediary addresses, token swaps, and cross-chain movements that not only attempt to obscure the stolen funds, but also demonstrate the far-reaching consequences of this exploit across the broader crypto ecosystem.

Chainalysis’s research team has helped recover over $40 million in stolen cryptocurrency. The company’s valuation reached $8.6 billion after a funding round in 2022. While annual revenue figures remain private, and profitability is still on the horizon, Chainalysis has attracted significant investment, including support from sovereign wealth funds, Accel, Blackstone, and BNY Mellon.

The company reports a 30 percent increase in customer base and a 60 percent improvement in cash flow over the past year. Levin is focused on expanding the company’s offerings, particularly in the private sector. He has also appointed Valentina Longo as the company’s first chief financial officer, after her tenure at the head of Sword Health.

“The transition from being a co-founder to a CEO means looking at the business with new eyes and seeing the new opportunities that are arising out of the market dynamics and some technology opportunities,” says Levin. “We need to see into the future of what crypto technology is going to produce over the next few years and expand our offerings in the market, as well as doubling down on some of our existing customers.”

Levin, who previously served as chief strategy officer, is managing all R&D. His primary focus is on expanding Chainalysis’s presence in the private sector.