Check Point Software Technologies (CHKP) might not be a household name, but the cybersecurity firm has already surged an impressive 15% in 2025. The good news for investors is that Check Point appears well-positioned to continue this upward trajectory.

The company is seeing its revenue pipeline expand, largely thanks to the growing adoption of artificial intelligence (AI) tools in the cybersecurity sector. Let’s examine Check Point’s recent results closer to see why this cybersecurity stock could deliver more gains.

Check Point’s Growth: Set to Accelerate?

Check Point ended 2024 with $2.66 billion in total revenue, representing a 6% increase year-over-year. Its non-GAAP (adjusted) earnings per share grew at a slightly faster rate, increasing by 9% to $9.16 per share for the year. While this growth rate might not be incredibly high, investors should consider that Check Point’s growing revenue pipeline could fuel faster growth in the future.

This is demonstrated by a 12% year-over-year increase in its remaining performance obligations (RPO) in Q4 2024. This growth was double the pace of the company’s revenue growth during the same quarter. A rising RPO signals positive news for investors. The metric “represents the total value of non-cancellable contracted products and/or services that are yet to be recognized as revenue,” implying Check Point is securing more business than it’s currently recognizing. As the company fulfills these contracts, its growth rate has the potential to improve.

A key factor driving increased contract signings is the company’s focus on incorporating AI tools. Check Point has launched several AI-driven cybersecurity tools. One key example is the Infinity AI Copilot, a generative AI-powered security assistant designed to help organizations improve the efficiency of their security analysts. The adoption of generative AI in cybersecurity is projected to grow at a 24% annual rate through the end of the decade, making Check Point’s AI-focused approach a wise strategy. This product development emphasis seems to be yielding results, with double-digit growth for the Infinity Platform in the fourth quarter of 2024. The demand for Quantum Force, the company’s AI-powered firewall product, is also increasing. This strong demand led to an 8% year-over-year increase in sales of Check Point’s products and licenses during the last quarter. While this may seem modest, it’s worth noting that product and license sales grew at a slower pace during the first three quarters of the year. The implication here is that Check Point is poised to accelerate its growth, and may even surpass its own expectations.

Adding to Check Point’s appeal is its attractive valuation, making the stock appear as a smart buy at this time.

Valuation and Growth Prospects

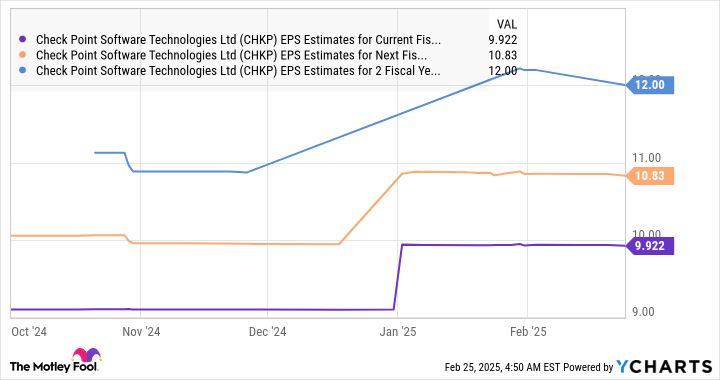

Check Point anticipates its fiscal year 2025 revenue to rise between 4% and 8%. The company has guided for slightly stronger bottom-line growth, with earnings growth of 5% to 11%. At the midpoint of this guidance, Check Point’s full-year earnings could reach $9.90 per share. While this forecast is solid, the possibility of faster growth than what the company has predicted cannot be discounted. Because, new contracts are accumulating at a faster pace than present sales. If Check Point can deliver better-than-expected results, the market may reward it with further upside.

Furthermore, Check Point is trading at a forward earnings multiple of just 22, lower than the Nasdaq-100 index’s forward earnings multiple of 28 (using the index as a proxy for tech stocks). Analysts predict a rise in Check Point’s earnings growth over the next couple of years, seeming plausible considering the points above.

Assuming Check Point achieves earnings of $12 per share in 2027 and trades at a multiple in line with the Nasdaq-100 index’s forward earnings multiple of 28, the stock price could reach $342. That would reflect a 59% increase from current levels. Investors searching for a cybersecurity stock with an appealing valuation and the potential for accelerating growth should examine Check Point Software closely, as it is well-positioned to maintain its bull run in the future.