Chengdu Lihang Technology: Assessing the Valuation

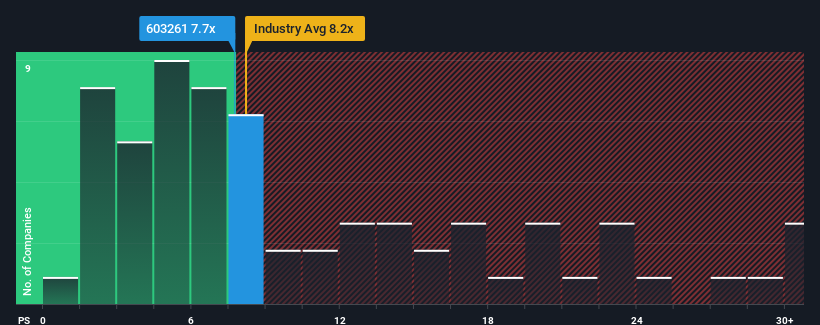

Chengdu Lihang Technology Co.,Ltd. (SHSE:603261) currently trades at a price-to-sales (P/S) ratio of 7.7x. This valuation is similar to the median P/S of 8.2x for the Aerospace & Defense industry in China. However, the fact that their P/S is in line with the industry while their recent financial results have been poor may be cause for concern.

Recent Performance and Revenue Decline

Chengdu Lihang Technology CoLtd’s financial performance has been disappointing lately, with revenue in decline. Last year, the company experienced a considerable revenue decline of 30%. As a result, revenue from three years ago has also fallen by 17%. This downward trend contrasts sharply with the industry’s projected growth of 54% over the next 12 months.

P/S Ratio in Context

The P/S ratio is concerning because Chengdu Lihang Technology is trading at a similar multiple to the industry, despite its unfavorable revenue trends. A P/S ratio is usually considered more acceptable when a company’s revenue performance aligns more closely with the industry average.

Given the company’s recent performance, matching the industry’s P/S suggests investors may be overly optimistic, or perhaps unwilling to sell their stock at the current price. Such a situation is generally unsustainable, and a continued trend of declining revenues is likely to place downward pressure on the company’s share price.

Key Takeaways for Investors

The similarity of the company’s P/S ratio with industry averages is a key observation. The disparity between the company’s falling revenues and the industry’s projected growth is a notable area for caution. It may be wise for investors to exercise caution, given the company’s recent financial performance. Unless there is an improvement in the medium-term outlook, the company’s shareholders may face ongoing difficulties.

Risk Factors

Before investing in Chengdu Lihang Technology CoLtd investors should be aware of potential risks. There are also other vital risk factors to consider and we’ve discovered 2 warning signs for Chengdu Lihang Technology CoLtd (1 is significant!) that you should be aware of before investing here.

Disclaimer: This article is for general informational purposes only. It is not financial advice. Always conduct your own research when considering an investment.