China Electronics Huada Technology: Value or Value Trap?

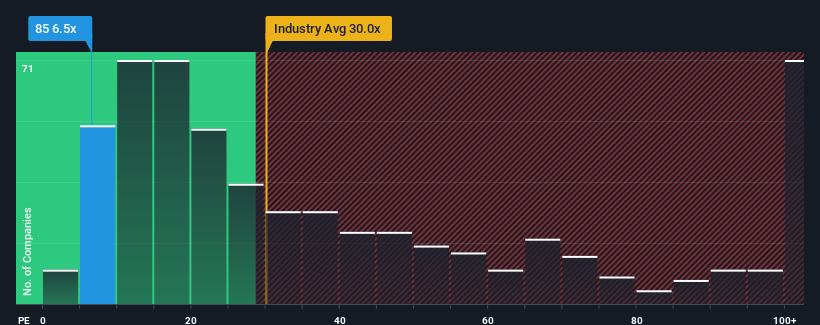

China Electronics Huada Technology Company Limited (HKG:85) currently presents a price-to-earnings (P/E) ratio of 6.5x. This might appear bullish at first glance, given that the average P/E ratio for Hong Kong companies is considerably higher, often exceeding 11x, and sometimes reaching over 23x. However, investors should delve deeper to understand the reasoning behind the seemingly low valuation.

P/E Ratio vs. Industry Comparison

The company’s reduced P/E ratio likely reflects underlying concerns about its financial performance. Over the past year, China Electronics Huada Technology’s earnings have declined, a trend that could be causing investors to temper their expectations for future performance. If the market anticipates continued or accelerated earnings deterioration, the P/E ratio will likely remain suppressed. For those holding the stock, this isn’t ideal if the company cannot reverse its performance decline.

Growth Considerations

To justify its current P/E ratio, China Electronics Huada Technology would need to demonstrate growth that at least keeps pace with the market. However, the company’s profits have fallen by approximately 50% in the last year. While earnings per share have not declined over the past three years, shareholders may be dissatisfied with the unstable medium-term growth rates.

When compared to the market’s one-year forecast for a 19% expansion, China Electronics Huada Technology’s recent, medium-term earnings trajectory appears less appealing on an annualized basis. This helps explain why its P/E ratio is below that of most other companies. It seems that investors anticipate the low growth rates to continue and are unwilling to pay more for the stock.

Key Takeaway

The P/E ratio is useful for understanding what the market thinks of a company’s overall health. In the case of China Electronics Huada Technology, the three-year earnings trends are contributing to its low P/E, as they are worse than market expectations. The potential for improved earnings doesn’t appear strong enough to justify a higher P/E at this time.

Unless the recent medium-term conditions improve, the stock price may be limited around current valuation levels.

It’s also important to note that there are indications of potential issues and risks that investors should monitor.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice.