China Health Technology Group Holding (HKG:1069) and its Debt: A Closer Look

It’s a common saying that volatility, rather than debt, presents the greatest risk for investors. However, considering a company’s balance sheet is vital when assessing risk. Debt often plays a role when a business struggles. This analysis examines the financial health of China Health Technology Group Holding Company Limited (HKG:1069) and its debt profile.

When Does Debt Become Problematic?

Debt and other liabilities pose challenges for a company when it struggles to meet its obligations. This can be due to insufficient free cash flow or an inability to secure capital at favorable terms.

In the worst-case scenario, a company’s inability to repay creditors can lead to bankruptcy. A more common downside is dilution through raising new equity at lowered prices, harming shareholders.

Many companies manage their debt effectively, using it to their advantage.

Analyzing China Health Technology Group Holding’s Debt

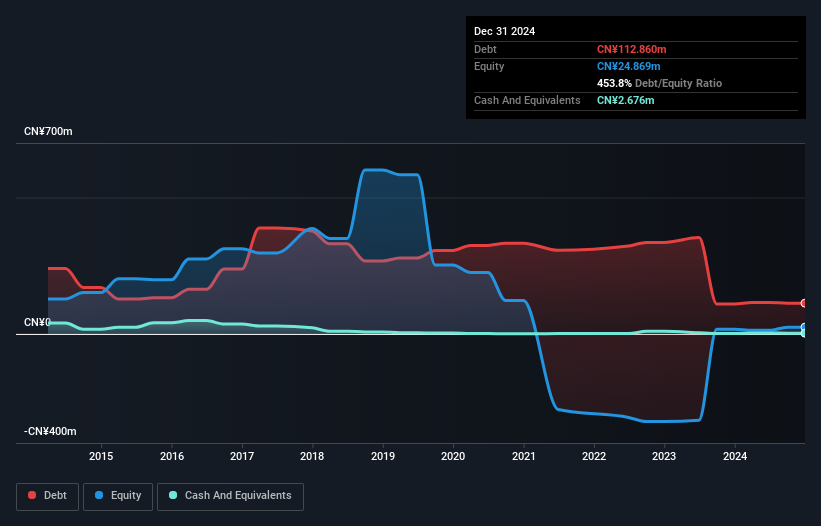

Examining a company’s cash and debt together offers context. As of December 2024, China Health Technology Group Holding had CN¥112.9 million in debt. However, it had CN¥2.68 million in cash to offset this. Resulting in net debt of about CN¥110.2 million.

Balance Sheet Assessment

Analyzing the latest balance sheet information, it’s apparent that China Health Technology Group Holding faced liabilities of CN¥53.4 million due within 12 months and CN¥112.9 million due beyond that timeframe.

The company’s assets included CN¥2.68 million in cash and CN¥23.6 million in receivables due within a year. This indicates that its liabilities exceed the sum of its cash and near-term receivables by CN¥139.9 million.

This deficiency weighs heavily on the company. If China Health Technology Group Holding was compelled to pay its creditors today, a significant recapitalization would likely be necessary. This is a situation that investors should monitor closely.

Earnings and Debt Servicing

Debt should never be viewed in isolation. It’s essential to consider a company’s earnings potential as those earnings are what will service the debt. It’s definitely worth looking at the earnings trend.

In the previous year, China Health Technology Group Holding was not profitable at the EBIT level. The company’s revenue grew by 9.1% to CN¥60 million. However, it reported an EBIT loss of CN¥22 million. Adding this to the company’s significant liabilities, it’s essential to view this stock cautiously.

However, a statutory profit of CN¥3.6 million combined with free cash flow of CN¥2.4 million leads to some potential for financial improvement.

Conclusion

While the balance sheet is a key indicator of financial health, not all investment risk originates there. Further exploration into potential risks and other relevant factors is essential.

Ultimately, some investors tend to favor companies with no net debt.

Disclaimer: This analysis is for general informational purposes only and not financial advice.