European startup Cino, a real-time shared payment app designed to streamline bill splitting, has secured €3.5 million in a seed-funding round. The investment was led by Balderton Capital, a London-based venture capital firm.

Unlike platforms like Venmo and Splitwise, which require one person to pay the full amount and then request reimbursement from others, Cino enables users to split the bill and pay their share directly at the point of payment. This approach has resonated with Gen Z, a demographic that reportedly shuns “financial awkwardness” and is less inclined to use joint bank accounts.

Cino, which launched in 2023, initially operated in continental Europe. With this new funding, the company plans to expand its services to the U.K. The app was founded by Elena Churilova, the CEO, previously of Bumble and Booking.com, and Lina Saleh, the COO, a Cornell University alumna.

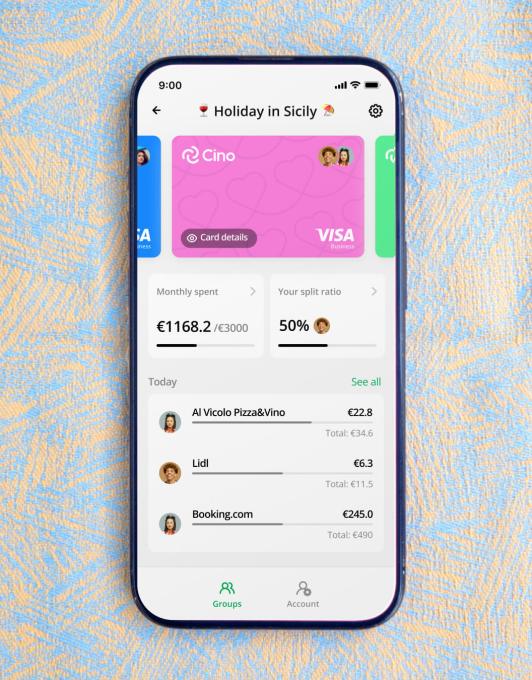

To use Cino, individuals connect their payment cards to the mobile app, which then generates a virtual card. Users can form shared payment groups and set custom split ratios for expenses like restaurant bills. According to the company, once a purchase is made, each group member’s share is automatically deducted.

All transactions are visible within the group feed for transparency, and members can join or leave these payment groups at any time. Currently, all users must have a Cino account for the app to function, but the company is developing a new feature allowing direct joins through Apple Pay or Google Pay.

Cino reports 100% month-over-month growth in markets such as Finland and Italy. Customers reportedly use the app an average of 17 times a month, spending up to €3,000. “The way to set it up is similar to how WhatsApp works,” explained Churilova in an interview with TechCrunch. “You just create groups, and then we issue virtual cards. You can add people, remove people from that virtual card, and also change the split ratio.”

Churilova’s inspiration for Cino stemmed from her own experiences splitting expenses with colleagues while employed at Bumble: “I tried every single tool out there possible to figure out how to make my weekends not into accounting exercises,” she said. “Then I just had this moment of thinking, like, ‘Why is no one building a way to pay together?’”

The app also utilizes a network effect to drive growth, as new users can invite a few others to join for free during their initial six months. “For too long, people have accepted standard bill-splitting, debt tracking, and repayment requests as the only way to manage shared expenses — simply because there was no alternative,” stated Greta Anderson of Balderton Capital in a statement. “Cino’s viral growth demonstrates that there is an alternative which users love.”

Connect Ventures and Tera Ventures also invested in this round, along with angel investors including Barney Hussey-Yeo, founder of Cleo.