CoreWeave, an artificial intelligence (AI) cloud-computing startup with backing from Nvidia (NVDA), has struck a substantial, nearly $12 billion contract with OpenAI. This five-year agreement will provide OpenAI with the necessary computing power to train and operate its sophisticated AI models. The timing of the deal is particularly strategic, as CoreWeave recently filed for an IPO (Initial Public Offering) in New York, aiming to raise $4 billion. This partnership not only solidifies CoreWeave’s standing in the AI cloud market but also lends credibility to the company’s ambitious growth plans. With the IPO on the horizon, the agreement is expected to attract increased investor interest and bolster confidence in CoreWeave’s ability to deliver advanced computing services.

Initially launched in 2017 as a cryptocurrency mining operation, CoreWeave has since transitioned into AI cloud computing. It currently operates over 250,000 Nvidia GPUs. This new agreement with OpenAI is poised to attract further investment and strengthen CoreWeave’s market position as it prepares for its IPO. Furthermore, the nearly $12 billion contract helps fill the void left by Microsoft, which recently canceled a planned deal with CoreWeave due to delivery concerns. Despite this setback, Microsoft (MSFT) has committed to spending $10 billion on its services by 2030, accounting for 62% of CoreWeave’s revenue last year.

Why This Deal Matters for OpenAI

As part of the agreement, OpenAI will acquire a $350 million equity stake in CoreWeave during its IPO. For OpenAI, the deal represents a strategic move to expand and diversify its computing resources. While Microsoft remains OpenAI’s primary partner, the AI firm aims to reduce its reliance on a single provider. By partnering with CoreWeave, OpenAI gains access to the necessary resources for developing and deploying new AI models, while maintaining greater flexibility.

OpenAI has also recently collaborated with SoftBank (SFTBY) on a $500 billion data center project called “Stargate” and forged cloud deals with Oracle. These initiatives are designed to give OpenAI greater control over its computing infrastructure, enabling it to meet the growing demand for advanced AI models.

Is Nvidia a Good Stock to Buy?

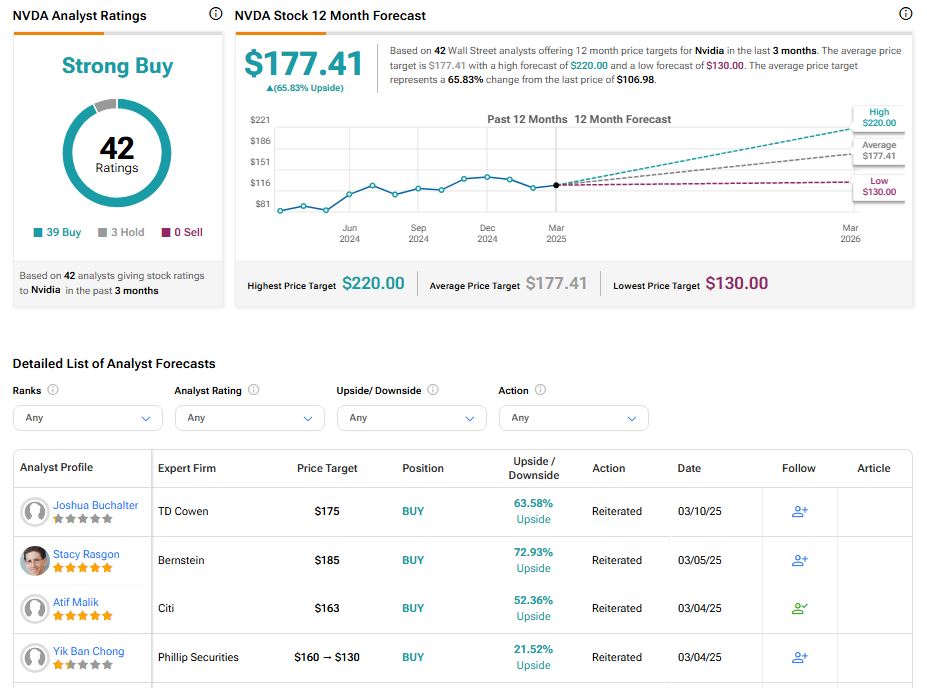

According to TipRanks, NVDA stock holds a Strong Buy consensus rating based on 39 Buy ratings and three Hold ratings assigned over the past three months. The average share price target for Nvidia, at $177.41, suggests a potential upside of 65.83%.