COSCO SHIPPING Technology’s Market Cap Down as Public Companies Take the Hit

Public companies, the largest shareholders of COSCO SHIPPING Technology Co., Ltd. (SZSE:002401), bore the brunt of a recent market downturn. Last week, the company’s market capitalization fell by CN¥792 million.

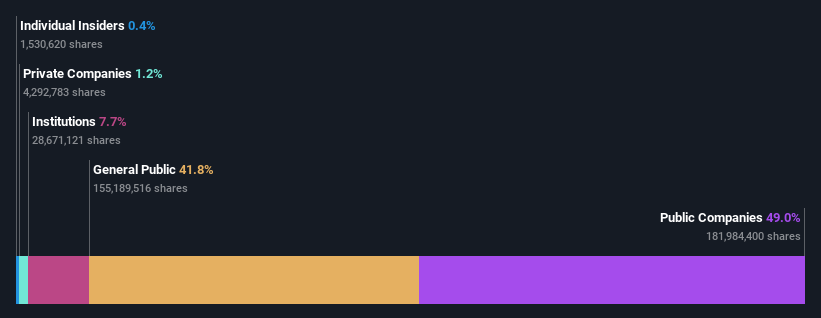

Key Insights into Ownership

- Significant Influence: Public companies, holding approximately 49% of the shares, have considerable power to shape management and governance decisions. This concentration of ownership means the general public has substantial influence, making their interests vital.

- Top Shareholders: The top two shareholders control over half the business (51%), granting them substantial influence over company strategy.

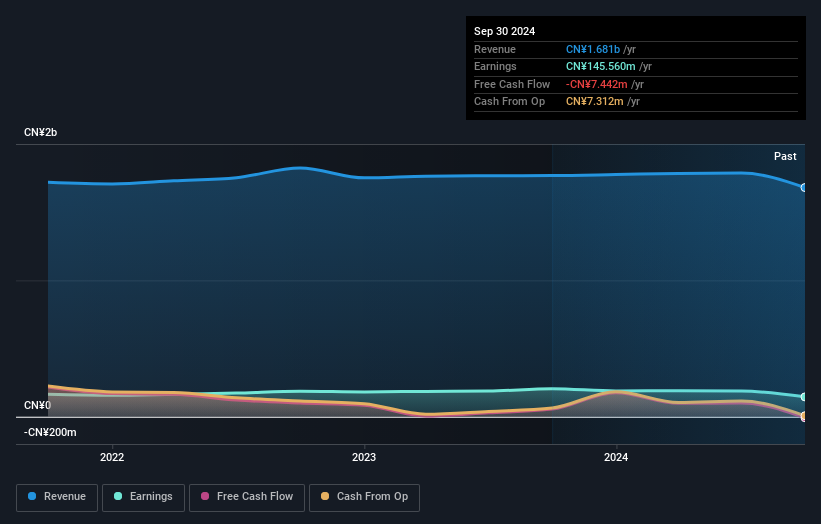

- Future Performance: Studying shareholder structures and past performance data can offer insights into a company’s potential.

Ownership Breakdown

A close look at COSCO SHIPPING Technology’s shareholder base reveals the distribution of power.

-

Public Companies: Public companies are the dominant shareholders, with a 49% stake. This signifies that these entities stand to gain or lose the most from their investment.

- The recent decrease in market cap to CN¥6.2 billion indicates that public companies experienced the greatest losses compared to other shareholder groups last week.

-

Institutional Investors: Institutions also hold a significant portion of the company. This can often suggest a degree of credibility within the investment community, although this should be viewed with caution.

-

Other Shareholders: COSCO SHIPPING Development Co., Ltd. is the largest shareholder, owning 49% of the shares. The National Council for Social Security Fund holds 2.3%, and Ping An Asset Management Co., Ltd. has approximately 1.1% of the company’s stock.

-

Majority Ownership: The fact that the top two shareholders hold majority ownership (over 50%) means they can significantly impact the company’s strategic direction.

Hedge Funds and Insider Ownership

-

Hedge Funds: The company is not owned by hedge funds.

-

Insiders: Insiders, which generally include board members, own less than 1% of COSCO SHIPPING Technology. This suggests that the board’s shareholdings may be limited, which could be seen either positively or negatively. Given the company’s CN¥6.2 billion market capitalization, board members’ shareholdings don’t exceed CN¥25 million.

General Public’s Role

- General Public: The general public controls about 42% of the stock, meaning individual investors have some degree of influence over decisions. However, this may not be enough to change company policy if it clashes with larger shareholders.

Note: The figures in this article are based on data from the last twelve months.