DongHua Testing Technology’s Stock on the Rise: Are Strong Financials Driving the Market?

DongHua Testing Technology (SZSE:300354) has experienced a significant surge in its stock price, increasing by an impressive 44% over the past three months. This raises the question: is this upward trend a reflection of the company’s solid financial performance? Considering the market’s tendency to reward companies with robust financials over the long term, it’s worth examining the factors at play.

To assess the situation, we’ll focus on DongHua Testing Technology’s Return on Equity (ROE), a key metric. ROE provides valuable insights into a company’s efficiency in generating returns from shareholder investments. In essence, it reveals how effectively a company transforms investments into profits.

Calculating Return on Equity

The formula for calculating Return on Equity is as follows:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Based on this formula, and using the trailing twelve months data up to September 2024, we can assess DongHua Testing Technology’s ROE:

14% = CN¥104m ÷ CN¥737m

The ‘return’, in this context, represents the after-tax profit earned over the past twelve months. This means that for every CN¥1 of shareholder investment, the company generates a profit of CN¥0.14.

ROE and Earnings Growth: The Connection

Thus far, we’ve established that ROE measures a company’s efficiency in generating profits. We can then evaluate a company’s prospects for future profit generation by considering how much of its profits it elects to reinvest, or “retain.” Generally speaking, all other factors being equal, companies with a high ROE alongside a high profit retention rate tend to achieve higher growth rates compared to those that lack these attributes.

Analyzing DongHua Testing Technology: ROE and Earnings Growth

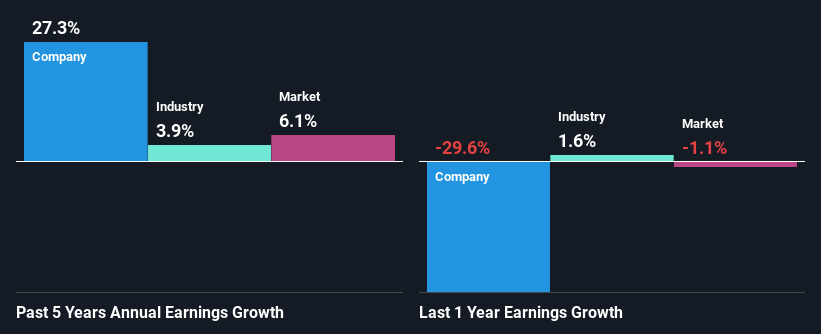

At first glance, DongHua Testing Technology’s ROE appears to be relatively strong. Furthermore, the company’s ROE stands favorably when compared to the industry average of 6.2%. This likely contributed to the significant 27% net income growth observed over the past five years. However, this growth could also be attributed to other factors, such as high earnings retention rates or efficient management.

When comparing DongHua Testing Technology’s net income growth to the industry average, the company’s growth figure is notably higher, especially when contrasted with the industry’s 3.9% growth rate over the same five-year period.

Earnings growth is a crucial element in stock valuation, and it’s essential for investors to determine whether the market has accurately priced in a company’s anticipated earnings growth or decline. Analyzing this can help investors assess the stock’s future prospects.

Fair Valuation and Profit Reinvestment

It is important to consider the valuation of DongHua Testing Technology relative to its peers. Furthermore, the company has a low three-year median payout ratio of 19%, indicating that it reinvests a substantial 81% of its earnings back into the business. This suggests a management strategy focused on growing the business, a trend supported by the company’s demonstrated growth. Additionally, DongHua Testing Technology has been consistently paying dividends for at least a decade, demonstrating its commitment to sharing profits with its shareholders.

Conclusion

Overall, DongHua Testing Technology’s performance appears quite strong. The company’s significant investment in its business, coupled with a high rate of return, has led to considerable earnings growth. According to the latest industry analyst forecasts, the company’s earnings are expected to accelerate.

Disclaimer: This analysis is based on historical data and analyst forecasts and is not intended as financial advice. Always conduct your own thorough research before making any investment decisions.