Dufu Technology: High P/E Raises Eyebrows After Recent Stock Dip

Shareholders of Dufu Technology Corp. Berhad (KLSE:DUFU) have faced a significant setback, with the company’s stock price plummeting 27% in the last month. This decline comes after a period where shareholders were anticipating positive developments. Over a year, the stock has dropped 31%.

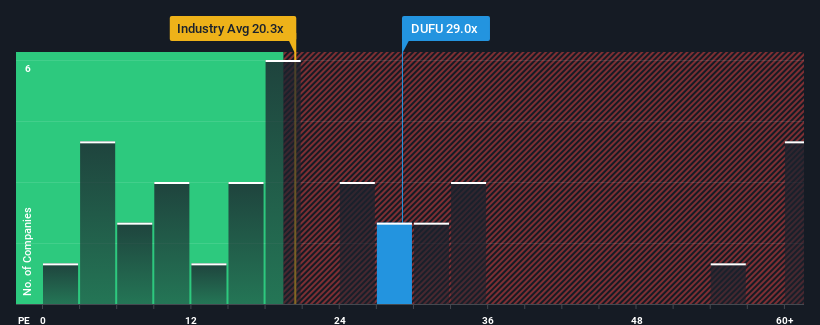

Despite this significant price drop, Dufu Technology Berhad’s price-to-earnings (P/E) ratio of 29x remains high. This P/E appears quite elevated compared to the broader Malaysian market, where approximately half of the companies have ratios below 14x, and ratios below 8x are not uncommon.

However, the P/E ratio alone doesn’t tell the whole story. The high P/E could suggest that investors expect the company’s future performance to outpace its peers. An important factor to consider here is that Dufu Technology Berhad’s earnings decreased over the previous year, which is not ideal. This information is key to assessing whether its current P/E ratio is sustainable.

Analyzing Dufu’s Growth

A high P/E ratio is more justifiable when a company demonstrates strong growth that surpasses the market. Unfortunately, Dufu Technology Berhad’s earnings have been declining. Over the past year, the company’s bottom line decreased by 8.5%. Furthermore, earnings from three years ago have fallen by 70% overall.

Considering the market’s projected 17% expansion over the next year, Dufu’s current performance is concerning. Given this challenging financial performance, the company’s P/E ratio appears even more inflated compared to its peers.

The Final Word

Even with the recent stock price decline, Dufu Technology Berhad’s P/E ratio remains high. While the P/E ratio may not be the best means of evaluating value in all industries, it can be a useful indicator of market sentiment. Given that Dufu Technology Berhad currently trades at a much higher-than-expected P/E, and considering the recent declines in earnings over the medium-term, the high P/E raises concerns.

Based on current earnings trends, shareholders’ investments could be at considerable risk, and potential investors risk paying an excessive premium. It’s also important to note that the investment analysis of Dufu Technology Berhad has revealed two warning signs.

For more detailed information, including earnings, revenue, and cash flow, you can access a free report on Dufu Technology Berhad. When evaluating investment opportunities, it’s always important to consider the entire company – not just a single metric.

Disclaimer: This article is based on historical data and analyst forecasts and is not intended as financial advice. It does not constitute a recommendation to buy or sell any stock.