eCloudvalley Digital Technology (TWSE:6689): An Attractive Opportunity?

Recent analysis suggests that eCloudvalley Digital Technology Co., Ltd. (TWSE:6689) might be a stock worth keeping an eye on. Despite its relatively small market capitalization, the company has demonstrated a notable 13% share price increase on the Taiwan Stock Exchange (TWSE) over the past few months.

Market Dynamics and Valuation

The stock’s recent performance, though not yet exceeding its yearly peak, suggests a positive trajectory. Small-cap stocks like eCloudvalley Digital Technology often present unique opportunities to investors due to less public information, which can create potential for mispricing.

Currently, however, the stock appears to be trading at a premium. The analysis indicates that eCloudvalley Digital Technology is trading at a price-to-earnings (P/E) ratio significantly above its industry average. With a P/E ratio of 37.91x, it exceeds the industry average of 23.18x, suggesting the stock’s price may be inflated relative to its peers.

Future Outlook and Investment Considerations

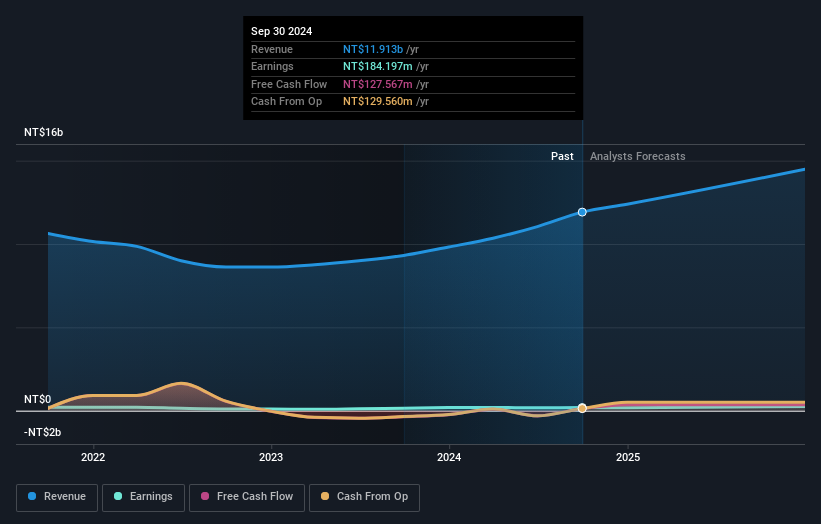

However, the financial outlook remains promising. eCloudvalley Digital Technology is expected to achieve a profit growth of 24% in the coming year. This positive outlook suggests further potential for share valuation driven by increased cash flow.

Investment Recommendations

For existing shareholders, the current valuation may present a strategic decision point. If the investor believes the stock should trade at a lower price, selling at the current high and repurchasing when the price declines could maximize profits.

For potential investors, now may not be the most opportune time to invest, considering the current price exceeds industry peers. Nevertheless, the potential for favorable growth suggests that potential investors should monitor the stock, waiting for a more favorable entry point.

Before making any investment decisions, potential investors should consider all factors, including analyzing any potential risks, such as the two warning signs associated with eCloudvalley Digital Technology (one of which, according to the source, is a notable concern). Further research is warranted to assess the long-term viability and growth potential of the company.

Disclaimer: This article is based on data and forecasts from the source and should not be considered financial advice. It does not constitute a recommendation to buy or sell any stock.