ENF Technology Stock Analysis: Are Investors Overlooking Underlying Weaknesses?

ENF Technology Co., Ltd. (KOSDAQ:102710) has experienced a significant surge in its stock price, gaining 26% in the past month. This recent momentum has driven investor interest, but a closer look reveals potential concerns about the company’s valuation.

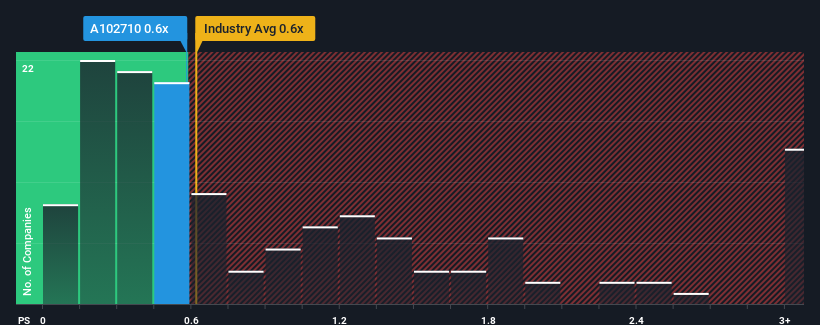

While the recent gains are encouraging, the company’s annual share price return of 9.2% appears less impressive when compared to the recent month’s performance. Currently, ENF Technology’s price-to-sales (P/S) ratio sits at 0.6x. This places the company’s valuation on par with the broader Chemicals industry in Korea, a factor that is potentially misleading to investors.

“If the P/S ratio is not justified, investors could be missing out on a potential opportunity or ignoring looming disappointment,” the recent analysis warns. This raises questions about whether the recent share price increase is sustainable in the long term. To gain a comprehensive assessment, investors can access a free report on ENF Technology for a deeper analysis of its historical performance.

Revenue Growth and Industry Comparisons

Over the past year, ENF Technology has shown steady revenue growth. However, despite the overall increase in revenue, its performance in comparison to the industry raises concerns. The Chemicals industry is expected to grow at 11% over the next year, considerably higher than the company’s recent annualized growth rates.

Given these figures, the fact that ENF Technology’s P/S ratio aligns with most other companies suggests that the market is either misinterpreting the company’s revenue potential or potentially overlooking fundamental issues.

Potential Risks and Investor Caution

The analysis suggests that investors may be overly optimistic, potentially setting themselves up for future disappointment. The market’s current valuation suggests that the company performs well in its relative industry standing. Despite this, the analysis reveals concerns that, if recent revenue performance is not improved, the company’s stock price may not be sustainable.

Investors are encouraged to approach ENF Technology stock with caution. The analysis further highlights three specific warning signs, one of which raises some discomfort over its potential for future earnings performance.

For investors seeking profitable companies, a list of companies with low price-to-earnings ratios is available, offering opportunities to grow earnings and diversify their portfolios. A detailed analysis including fair value estimates, potential risks, dividends, insider trades, and financial condition, can be accessed to determine if ENF Technology is potentially undervalued or overvalued.