Fanli Digital Technology’s Stock Performance Under Scrutiny

It’s hard to ignore the 28% drop in the stock price of Fanli Digital Technology Co., Ltd. (SHSE:600228) over the past three months. This decline prompts questions about whether the market is overlooking the company’s underlying financial strengths and focusing too heavily on the negatives.

Stock prices generally reflect a company’s long-term financial performance. Therefore, this analysis will delve into Fanli Digital Technology’s financial performance, with a particular focus on its Return on Equity (ROE).

Decoding Return on Equity (ROE)

ROE is a crucial metric for shareholders, as it reveals how efficiently a company reinvests their capital. It’s essentially a profitability ratio that shows the return on equity generated from shareholder investments. The latest analysis of Fanli Digital Technology’s financials involves determining its ROE.

How to calculate Return on Equity

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) / Shareholders’ Equity

Based on this formula, here’s the ROE for Fanli Digital Technology:

6.9% = CN¥35 million ÷ CN¥509 million (Based on the trailing twelve months to September 2024).

This means that for every CN¥1 invested by shareholders, the company generated a profit of CN¥0.07.

ROE and Earnings Growth: What’s the Connection?

ROE serves as a key indicator of a company’s potential for future earnings. To gauge growth potential, we must also evaluate how much profit the company reinvests for future expansion. Generally, firms with both a high ROE and high profit retention tend to achieve higher growth rates compared to those without these characteristics.

Comparing Fanli Digital Technology’s Earnings Growth and 6.9% ROE

Initially, Fanli Digital Technology’s ROE of 6.9% may not seem particularly impressive. However, it is roughly in line with the industry average of 6.8%, so it shouldn’t be immediately dismissed.

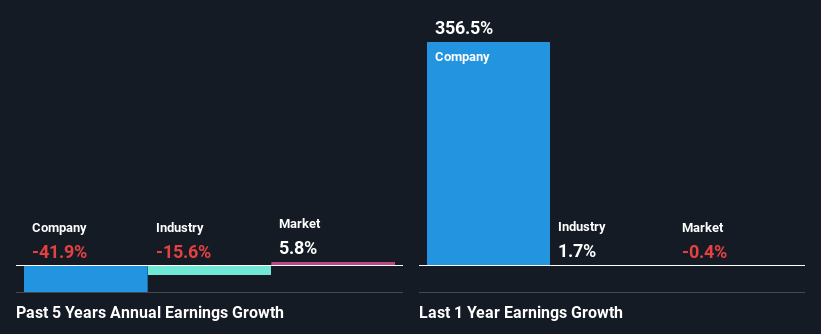

However, the company’s net income has declined by 42% over the past five years. Given that the ROE is already somewhat low, this earnings decline might be a consequence of this. Further comparison with the industry reveals a concerning performance. Even in comparison to the industry, which saw its earnings shrink by 16% over the same period, Fanli Digital Technology’s performance is disappointing.

Is Fanli Digital Technology Using Its Retained Earnings Effectively?

Fanli Digital Technology doesn’t issue regular dividends, which suggests the company is retaining all its profits. The question is why is the company retaining earnings if they are not being used to grow the business? There could be different reasons for this, one of them is the company’s business could be deteriorating.

Conclusion

Overall, the performance of Fanli Digital Technology warrants close examination. It may have a high rate of reinvestment, but its low ROE does not appear to be returning benefits to its investors and, in fact, appears to be negatively impacting earnings growth. Investors should consider Fanli Digital Technology with caution, considering a deeper look at the business’s risk profile. For that, review the risks dashboard that highlights the two risks identified for Fanli Digital Technology.

Disclaimer: This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation.