Every quarter, investors get a glimpse into the strategies of major investment funds. These funds are required to file a 13-F form with the U.S. Securities & Exchange Commission, disclosing their holdings at the end of each quarter. This information, released to the public 45 days later, allows us to track the investment decisions of prominent figures like billionaires. One such billionaire to watch is Chase Coleman, whose Tiger Global Management fund has consistently demonstrated an astute understanding of the artificial intelligence (AI) investment trend. Coleman has a significant stake in this rapidly evolving sector, with approximately 43% of his portfolio allocated to five AI stocks.

It is important to note that these are not Coleman’s five largest holdings overall, but they constitute his largest positions in the AI sector. At the end of the fourth quarter, Coleman’s top AI holdings were:

- Meta Platforms (META -0.36%), representing 16.5% of the portfolio.

- Microsoft (MSFT -0.90%), representing 8.5%.

- Alphabet (GOOG 0.88%) (GOOGL 0.88%), representing 7.4%.

- Amazon (AMZN -0.72%), representing 5.3%.

- Nvidia (NVDA 1.92%), representing 4.9%.

These holdings collectively account for about 43% of Coleman’s total portfolio. Given the size of these individual positions, their performance can significantly influence the fund’s overall returns. However, with this carefully selected group of AI industry leaders, Coleman’s fund is well-positioned to thrive.

One key factor to consider in 2025 is the substantial capital expenditure these companies are making, primarily to expand computing power. Meta, Microsoft, Alphabet, and Amazon are anticipated to have record capital expenditure costs this year. These expanded investments are designed to satisfy internal AI demands and meet increasing external demand in their cloud computing business segments (Microsoft’s Azure, Amazon Web Services (AWS), and Google Cloud). While this spending benefits many companies, one stands out as the primary beneficiary: Nvidia.

Nvidia’s graphics processing units (GPUs) are at the heart of the AI arms race. Although each of these companies has developed in-house AI accelerators that can outperform Nvidia’s GPUs under certain workload configurations, GPUs remain widely used and in high demand, especially in cloud computing. Despite the competition, Nvidia is likely to continue to be a strong performer. Each of the five companies also possesses a strong base business that helps fund these critical investments, which is an important indicator of the long-term potential of these highly successful companies. With Coleman’s portfolio, the positioning is smart, with high success within the current business models as well as substantial long-term upside due to AI proliferation.

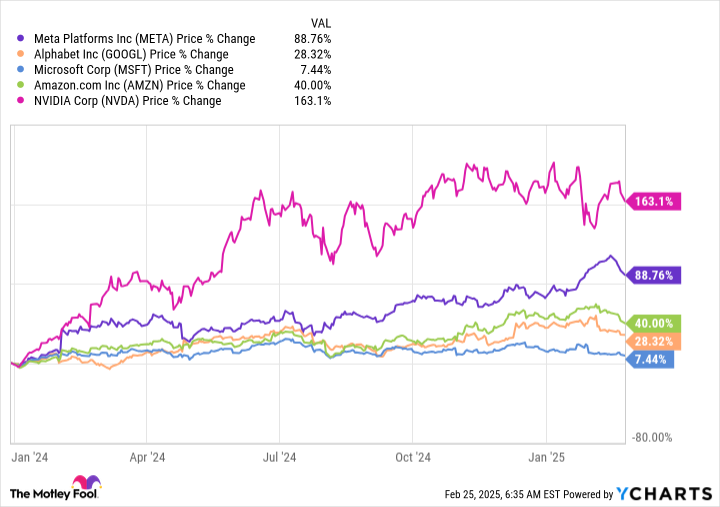

It is worth noting that Coleman and Tiger Global Management did not add to or sell any of these AI stocks during the fourth quarter. In fact, they maintained their existing stakes in Nvidia, Meta, and Microsoft. They haven’t purchased additional Alphabet and Amazon shares since the first quarter of 2024. Except for Microsoft, all of these companies have delivered impressive gains since the beginning of the year, generating substantial profits for Coleman and his team.

However, the growth of each of these companies is far from over, and significant upside potential remains. If you don’t already own them, it’s not too late to invest in many of these AI leaders. Coleman’s decision to maintain his positions indicates his continued confidence in the long-term prospects of these companies.

Like Coleman, other billionaires are staying invested in these AI leaders, with increasing holdings even as some approach all-time highs. Therefore, it could be a safe investment. In conclusion, the actions of Tiger Global and Chase Coleman serve as a solid example and indicator that the AI markets are still a good bet.