Formosa Sumco Technology: Is the Stock Price Justified?

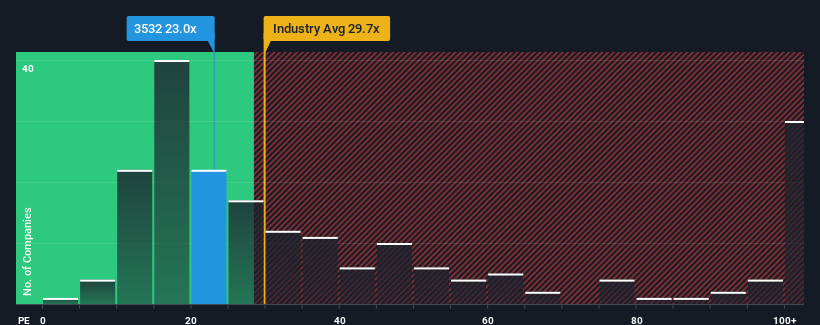

Formosa Sumco Technology (TWSE:3532) currently has a price-to-earnings (P/E) ratio of 23x. This is comparable to the median P/E of about 22x in Taiwan. However, investors should always scrutinize whether a P/E ratio is an accurate reflection of a company’s future prospects. A moderate P/E could potentially indicate either an opportunity or a warning sign.

Financial performance is a key indicator. Formosa Sumco Technology’s earnings have recently declined. However, its P/E ratio could be moderate because investors anticipate that the company will improve and align with the market in the near future. If that doesn’t happen existing shareholders might become worried about the share price’s viability.

Formosa Sumco Technology’s P/E compared to the industry.

To gain a better understanding of future trends, consider an analysis of Formosa Sumco Technology’s earnings, revenue, and cash flow.

Growth and P/E Ratio

Formosa Sumco Technology’s P/E ratio typically aligns with companies that are expected to generate moderate growth and perform in tandem with the market. Unfortunately, the company’s profits fell by 60% over the last year. Although earnings per share (EPS) have increased by 16% over the past three years. This indicates that the company has managed to grow earnings reasonably well.

Considering the market is projected to grow by 21% in the next 12 months, Formosa Sumco Technology’s performance is somewhat weaker. The company’s P/E ratio is trading at almost the same level compared to the market. Most investors seem to be overlooking the recent limited growth rates and are still willing to pay a premium for the stock. Investors who take that approach could be setting themselves up for disappointment down the line.

What the P/E Ratio Reveals

The P/E ratio can provide insights into what other market participants think about a company. Formosa Sumco Technology’s three-year earnings trends do not appear to be significantly affecting its P/E as much as expected. The company’s earnings look worse than current market expectations. When weak earnings are combined with slower-than-market growth, there is a risk that the share price will decrease, sending the moderate P/E lower. Unless the recent conditions improve, these prices may be considered unreasonable.

Formosa Sumco Technology has four warning signs in their investment analysis, with three of them being concerning. Consider researching companies with strong growth and low P/E if you are searching for investment opportunities.

This article by Simply Wall St is general in nature and is not financial advice. It aims to bring you long-term-focused analysis driven by fundamental data.