Investing in the AI Revolution: Four Stocks to Watch in March

Artificial intelligence (AI) continues to be a dominant force in the market and, as we move through March 2024, the trend is unlikely to slow. This presents considerable opportunities for investors. Here are four stocks that are well-positioned to benefit from the ongoing AI investment boom, divided into two categories: AI facilitators and AI hardware providers.

AI Facilitators

Alphabet (GOOGL) and Meta Platforms (META)

Alphabet (GOOG, GOOGL) and Meta Platforms (META) are key players in facilitating the AI arms race. Both companies have developed impressive generative AI models, with Alphabet offering Gemini and Meta providing Llama. While their approaches and deployment strategies differ, both have built substantial user bases.

By facilitating the AI arms race, both companies are solidifying their position with a user base that is expected to drive long-term returns. Meta’s model is available for free, using the data generated from its platform to train future models. Alphabet offers Gemini as a free platform, but the premium subscription unlocks additional features. The company has also integrated Gemini into its core Google Search business.

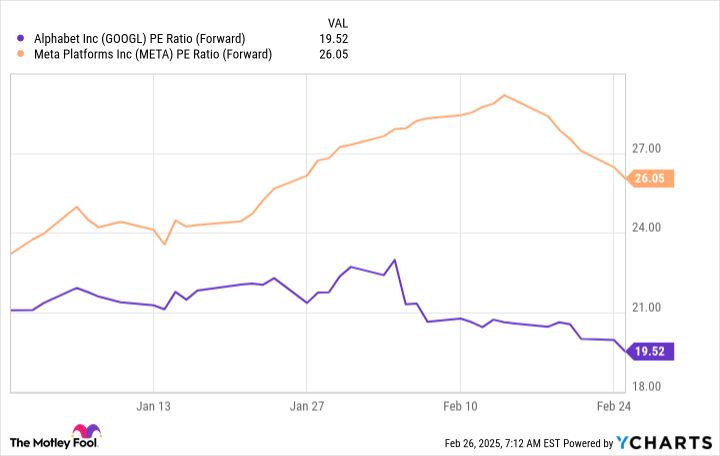

Both companies are heavily investing in AI capabilities to meet the surging demand. Furthermore, recent market weakness has caused a dip in the stocks, offering a potential opportunity for investors. With a forward price-to-earnings ratio of approximately 19.5 for Alphabet and 26 for Meta, the stocks appear to be strong buys, considering their growth potential.

Forward PE ratio for Alphabet (GOOGL).

AI Hardware Providers

Taiwan Semiconductor (TSM) and ASML (ASML)

Underpinning AI innovations are the chip manufacturers and equipment suppliers. Here, Taiwan Semiconductor (TSM) and ASML (ASML) stand out.

Taiwan Semiconductor is the world’s largest contract chip manufacturer. It’s seeing a major surge in demand for AI chips, with management anticipating a compound annual growth rate (CAGR) of approximately 45% over the next five years for its AI-related chips. This massive growth rate underscores the high demand for hardware in the AI sector.

To meet this demand, Taiwan Semiconductor relies on equipment from companies like ASML. ASML makes the extreme ultraviolet lithography machines essential for laying microscopic traces on chips. These incredible machines are essential for the chip technology that powers today’s AI systems.

ASML holds a significant technological edge, protected by decades of research and billions of dollars in investment. Both companies are key beneficiaries of the AI arms race but also benefit from the wider growth of chip usage. With reasonable valuations, both stocks offer compelling entry points for investors. These stocks look like great long-term investments, with any dip acting as a potential buying opportunity.

Forward PE ratio for ASML.

In conclusion, these four stocks—Alphabet, Meta Platforms, Taiwan Semiconductor, and ASML—represent strong investment opportunities as the AI revolution continues to reshape the market.