The highly anticipated State of the French Tech Ecosystem 2024 report has been released by Alex Dewez, a partner at 20VC. This comprehensive analysis provides a detailed look at the current state of French startups, complementing Atomico’s State of European Tech report. While European startups raised $45 billion in 2024, a mere $2 billion decrease from 2023, this represents a significant drop compared to 2022 numbers.

In France, the trends are similar, with €7.1 billion in venture funding in 2024, slightly up from €6.8 billion in 2023. However, this is still down from €11.8 billion in 2022. The data on private companies can vary; according to EY and Les Échos, venture funding actually decreased in 2024 compared to 2023 (€7.8 billion versus €8.3 billion). The consensus is that venture funding is relatively stable year over year, with artificial intelligence playing an increasingly crucial role.

The AI Factor

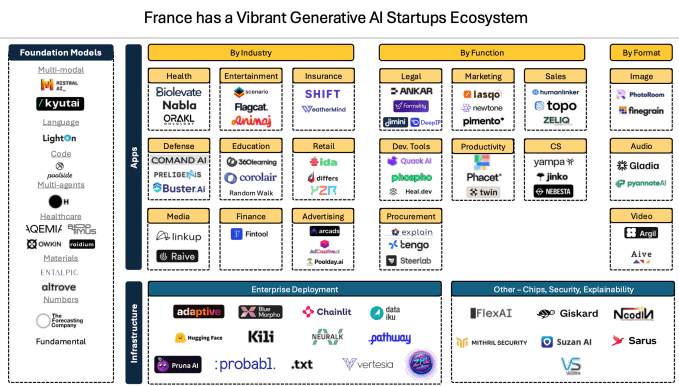

Artificial intelligence now accounts for 27% of total funding for French startups. AI startups have seen an 82% increase in funding in 2024 compared to the previous year, while non-AI funding has dropped by 11%. This dichotomy presents two possible interpretations. The pessimistic view suggests that without AI, the startup funding landscape would be in a slowdown. Conversely, the optimistic perspective sees AI as the next significant opportunity for startups, attracting more tech investors to this vertical.

France’s Position in European Tech

Despite the challenges, France remains the third-largest tech ecosystem in Europe, behind the UK and Germany, based on total funding amounts. Paris stands as the second European city, ahead of Berlin and behind London. The country is home to 45 unicorns, with three new additions in 2024: Pennylane, Pigment, and Poolside. However, 2024 has also seen significant bankruptcies, including Ynsect, Cubyn, Masteos, Luko, and Cityscoot, highlighting the difficulties faced by startups in raising growth rounds without strong financial performance.

Emerging Trends and Challenges

Dewez identifies several late-stage companies with the potential to go public, including Back Market, Dataiku, Doctolib, Qonto, and Content Square. These companies boast over $300 million in annual recurring revenue, 20-30% year-over-year growth, and are either profitable or nearing profitability. However, France, like the UK, remains a challenging market for IPOs. Most French tech companies are likely to consider listing in the US, but this poses difficulties for those without existing US customer bases.

Exit Strategies and Future Concerns

While the total number of exits has decreased by 14% year over year, Dewez notes that the total exit amount has remained stable at around €12 billion over the past three years. A concerning trend is the decreased investment pace by UK funds in French startups, which may have broader implications for the French tech ecosystem’s health in the coming years.