The Rise and Fall of FTX

The cryptocurrency exchange platform FTX experienced a meteoric rise after launching in 2019, but its ascent was followed by a dramatic collapse in November 2022. This article explores the events leading up to FTX’s downfall, the resulting legal battles, and the broader impact on the cryptocurrency market.

Understanding the Cryptocurrency Context

Cryptocurrencies, which rely on encryption and blockchain technology for secure transactions, gained popularity as investment vehicles and payment methods. Their value can fluctuate dramatically, as demonstrated by the Shiba Inu coin’s massive surge in 2021.

Digital trading platforms like FTX provided a way for individuals to buy, sell, and trade cryptocurrencies. These platforms also offered digital wallets for storing cryptocurrencies. Prior to its collapse, FTX was among the leading platforms in this space.

FTX’s Rapid Ascent

Sam Bankman-Fried founded FTX in 2019. The platform quickly attracted customers and significant investment from venture capital firms. By January 2022, FTX was valued at $32 billion.

The Downfall

The company’s fortunes took a turn in November 2022. What initially appeared to be an accounting mistake turned out to be a massive fraud, resulting in billions of dollars in losses for customers and investors. Customer funds were improperly diverted to accounts controlled by Alameda Research, a cryptocurrency trading firm also founded by Bankman-Fried. This revelation triggered FTX’s collapse.

What was FTX?

FTX was among the largest digital currency exchange platforms, facilitating the buying and selling of cryptocurrencies. The platform offered users a digital wallet to store their holdings directly within their accounts.

Growth Through Aggressive Marketing

FTX aggressively expanded its market share through acquisitions and marketing campaigns, including Super Bowl ads, celebrity endorsements, and naming rights for the Miami Heat’s arena. These campaigns often promised higher returns than traditional savings accounts.

What is FTT?

Cryptocurrency platforms often create their own digital tokens to incentivize users. FTX created its own token, FTT, in May 2019. Holding FTT offered various perks, such as discounts.

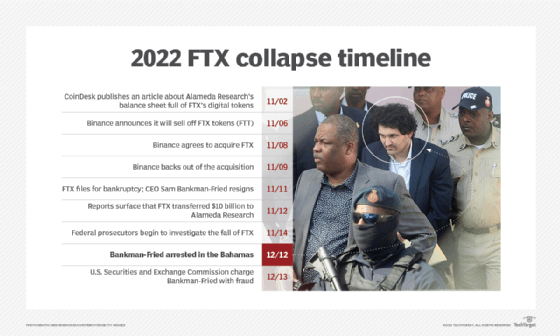

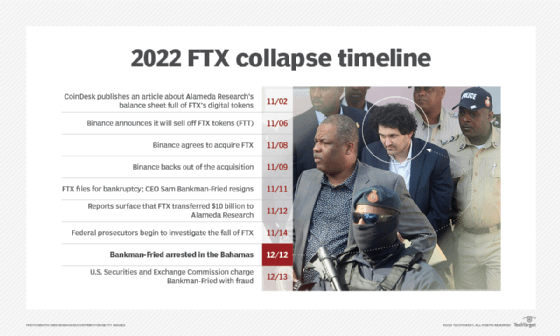

The Beginning of the End

The value of Bitcoin and other cryptocurrencies began to decline in late 2021 and early 2022. While many platforms struggled, FTX continued to acquire competitors. However, the downfall began with a November 2022 CoinDesk article highlighting Alameda Research’s heavy reliance on FTX’s FTT token. A leaked balance sheet revealed a concerning lack of diversification and close ties between the two companies. Alameda borrowed heavily from FTX, largely using customer deposits. Notably, FTX and its related companies failed to produce standard financial reports or undergo regular audits, obscuring the true financial state of the company.

The Bankruptcy

On Nov. 8, Binance, a cryptocurrency exchange platform and a competitor of FTX, initially agreed to acquire FTX. Binance’s CEO, Changpeng Zhao, was among FTX’s early investors. However, the deal was called off due to concerns about the handling of customer funds and ongoing U.S. investigations.

In November 2022, FTX’s collapse unfolded rapidly over 10 days, beginning with the disclosures in the CoinDesk article. Binance’s decision to sell its FTT tokens further eroded confidence, triggering a wave of customer withdrawals. When FTX couldn’t meet the withdrawal demands, the company filed for bankruptcy.

Criminal Charges and Lawsuits

Sam Bankman-Fried was arrested on Dec. 12, 2022, and faced multiple fraud charges. He was indicted with eight criminal counts, including money laundering and wire fraud. He was released on a $250 million bond. As of January 2023, approximately $5 billion in assets had been recovered, while an estimated $8 billion remained missing. FTX investors filed a class action lawsuit against FTX and its celebrity endorsers, alleging fraud and a Ponzi scheme.

Impact on the Cryptocurrency Market

While the FTX scandal initially lowered the demand for cryptocurrency, Bitcoin recovered to values of over $21,000 by January 2023. The Securities and Exchange Commission and the U.S. Congress began to plan to regulate the cryptocurrency industry in the wake of FTX’s collapse. The government does not insure cryptocurrency funds like traditional banks.

In January 2023, Genesis, a cryptocurrency lender, filed for bankruptcy, owing nearly $3.4 billion, partly due to the downturn in the wake of the FTX scandal. The consequences of the FTX collapse on the cryptocurrency market are unknown, but it may deter investors.

FTX Debtors’ Report

In April 2023, the FTX debtors released a report that found failures in the FTX Group’s management team. The report cited security failures, a lack of the use of multifactor authentication, inadequate accounting procedures, and the absence of financial controls.

FTX Sues Bankman-Fried’s Parents

FTX is suing Bankman-Fried’s parents, alleging they embezzled millions of dollars for their own personal gain. The suit alleges that Joe Bankman and Barbara Fried ignored the red flags related to their son’s fraud at FTX. Both are Stanford law professors. The lawsuit claims, among other allegations, that Fried encouraged her son to avoid disclosing campaign finance rules.

Bankman-Fried Found Guilty

On Nov. 2, 2023, Bankman-Fried was found guilty on seven federal counts of fraud and money laundering. On March 28, 2024, he was sentenced to 25 years in federal prison and ordered to pay over $11 billion in forfeiture.

FTX to Repay Customers

On Jan. 31, 2024, FTX announced it would not restart its cryptocurrency exchange and would instead liquidate its assets and return funds to customers. On Oct. 7, 2024, a Delaware bankruptcy judge approved FTX’s reorganization plan, which would provide creditors with 119% of their allowed claims, as of November 2022.

FTX Executives’ Prison Sentences Reduced

Ryan Salame and Caroline Ellison, former FTX executives, are expected to be released from prison earlier than originally scheduled.