Fujian Zitian Media Technology’s Stock Plummets, Signaling Concerns

Fujian Zitian Media Technology Co., Ltd. (SZSE:300280) investors have endured a difficult period, marked by a substantial 32% drop in the company’s share price over the past month. This recent downturn compounds a year of poor performance, culminating in a 72% decline over the last twelve months.

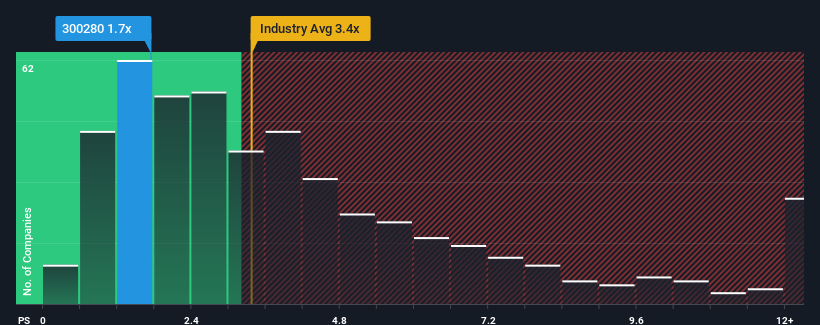

Despite this significant price drop, the company’s price-to-sales (P/S) ratio of 1.7x might suggest a potentially undervalued stock. Considering that approximately half of all companies in the Machinery industry within China have P/S ratios exceeding 3.4x, and some even reaching above 6x, the current valuation of Fujian Zitian Media Technology appears low by comparison. However, this low P/S ratio warrants a closer examination to understand the underlying reasons and determine its justification.

Declining Revenue and Industry Underperformance

A key factor contributing to the company’s challenges is the declining revenue. This downturn may be a reflection of the market’s perception of the company’s revenue performance compared to the broader industry. Those optimistic about Fujian Zitian Media Technology hope the stock can be acquired at a lower valuation.

To understand the earning, revenue, and cash flow of the company, a free report is available to provide a detailed analysis of its historical performance.

The assessment of the company’s P/S ratio must consider the assumption that the underperformance of the industry is reasonable for Fujian Zitian Media Technology. In reviewing the company’s recent financials, revenues have dropped significantly, by 64%. Consequently, revenue from three years prior have also fallen by 45% overall. Unfortunately, revenue growth over that period has not been strong.

Compared to the industry, which is projected to experience 22% growth in the next 12 months, the recent results of the medium-term revenue performance paint a concerning picture. Given this, it seems reasonable for Fujian Zitian Media Technology’s P/S to be below the majority of other companies. However, this decline in revenue may lead to an unstable P/S over a longer period. The company’s P/S may fall even further without improvement of the top-line growth.

Potential Risks and Future Outlook

The stock’s decline mirrors the decrease in its P/S. While the P/S ratio is considered an inferior value measure in particular industries, it remains a key business sentiment indicator. The shrinking revenue of Fujian Zitian Media Technology is contributing to its low P/S, given the industry’s projected growth. Investors seem to be accepting the low P/S as a measure of the company’s future revenue surprises. Recent medium-term revenue trends suggest that any share price movement in the near future will probably be insignificant.

It is important to be aware of risks associated with investments. Fujian Zitian Media Technology has two warning signs. When selecting companies for investment, strong recent earning growths and a low P/E are important factors to consider.

Disclaimer: This article provides commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in any stocks mentioned.