GKHT Medical Technology’s Financials Under Scrutiny

It’s been a challenging few months for GKHT Medical Technology Co., Ltd. (SZSE:301370), with the stock price down 8.0% over the past three months as of March 2, 2025. This decline raises the question: are the markets reacting to genuine financial concerns, or is negative sentiment overshadowing the company’s underlying performance?

Given that market outcomes are often driven by fundamental financial data, it’s essential to analyze GKHT Medical Technology’s financial standing.

Return on Equity (ROE) Analysis

One key metric to consider is the Return on Equity (ROE), a critical tool for assessing how effectively a company generates returns from its shareholders’ investments. In simple terms, ROE measures a company’s profitability relative to its equity capital.

To calculate ROE, the formula is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Based on the trailing twelve months up to September 2024, GKHT Medical Technology’s ROE is:

6.7% = CN¥170m ÷ CN¥2.5b

This indicates that for every CN¥1 of equity, the company earned CN¥0.07 in profit.

ROE and Earnings Growth: A Close Look

ROE provides insights into a company’s profit generation efficiency. However, we must also assess how much profit the company reinvests, or “retains,” for future growth. This, in turn, offers clues about the company’s growth prospects.

Generally, companies with high ROE and high-profit retention tend to have higher growth rates. However, GKHT Medical Technology’s ROE of 6.7% appears modest, and it aligns closely with the industry average of 6.7%.

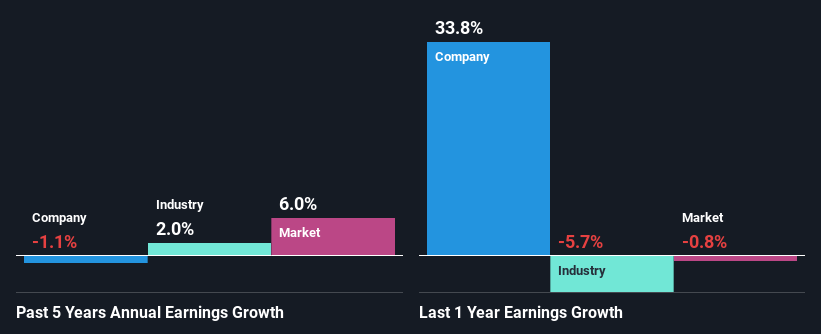

Furthermore, the company’s net income growth over the past five years has been relatively flat. Given the moderate ROE, this could be a contributing factor to the stagnant earnings growth. Comparing the company’s growth with the industry average, GKHT Medical Technology’s growth has been slightly less than the industry’s 2.0% over the last several years.

Is GKHT Making Effective Use of Retained Earnings?

Despite a moderate three-year median payout ratio of 34% (meaning the company retains 66% of profits), GKHT Medical Technology’s earnings growth has been stagnant. Some other possible explanations include the business potentially declining. Further, the company recently began paying a dividend, suggesting management may prioritize dividends over earnings growth.

Conclusion and Outlook

Overall, the performance of GKHT Medical Technology can be interpreted in multiple ways. While the company has a high rate of reinvestment, the low ROE suggests that this investment may not be generating substantial returns for investors. Moreover, it appears to have a negative impact on earnings growth.

To gain deeper insights into GKHT Medical Technology’s profit history, consider this data visualization of past earnings, revenue, and cash flows.