Gospell Digital Technology’s Rebound: Is It Enough?

Shares of Gospell Digital Technology Co., Ltd. (SZSE:002848) have recently seen a 25% increase in value over the past month. While this might bring some relief to investors, the stock remains down 19% over the last year, indicating that the recent gains have only partially offset previous losses.

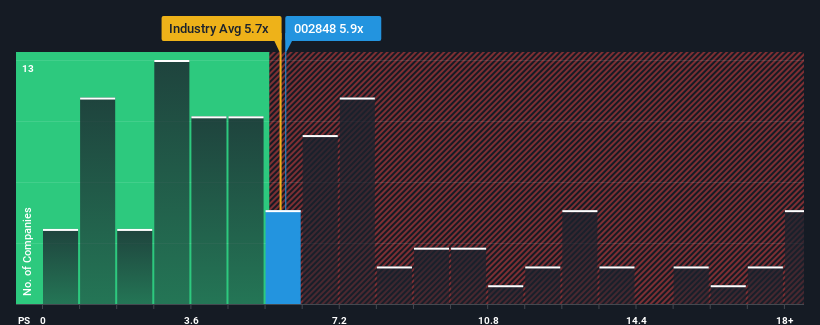

Despite the price increase, the company’s price-to-sales (P/S) ratio currently stands at 5.9x. This is comparable to the median P/S ratio of 5.7x in China’s Communications industry. However, the P/S ratio may not tell the whole story. The P/S ratio’s relevance comes into question due to a decline in revenue.

Recent Performance: A Closer Look

Gospell Digital Technology’s revenue has been declining. Without further context, investors may wonder why the P/S ratio remains in line with the industry. The company’s recent revenue performance may not justify its current valuation.

Want a full report on the company’s earnings, revenue, and cash flow? A detailed report on Gospell Digital Technology is available for further information.

Revenue Growth: Concerning Trends

To justify its current P/S ratio, Gospell Digital Technology needs to demonstrate growth that aligns with the broader industry. Revenue decreased by 40% in the last year. Looking at the last three years, there has been an aggregate decline of 66%. This suggests that the company’s revenue growth has been undesirable.

In stark contrast, the industry is predicted to grow by 33% in the next 12 months. The company’s steady downward momentum based on recent medium-term revenue results creates a challenging outlook.

Given these factors, it’s somewhat alarming that Gospell Digital Technology’s P/S is on par with most other companies. Many investors appear to be overlooking the recent poor growth in hopes of a turnaround. Given the current P/S may lead to future disappointments, existing shareholders should remain aware of the risks.

Key Takeaway

The recent stock momentum has brought Gospell Digital Technology’s P/S in line with the rest of the industry. While price-to-sales ratios provide insights into market sentiment, they should be considered carefully when forming investment decisions.

Despite declining revenues and expected industry growth, this comparable P/S ratio is unexpected. It suggests a disconnect between the current valuation and the company’s financial performance. Continued revenue declines could place investments at risk. Potential investors must approach with caution and be aware of the premium they might pay.

Disclaimer: This analysis is based on historical data and analyst forecasts and is not financial advice. It does not constitute a recommendation to buy or sell any stock. The analysis may not factor in recent company announcements or qualitative material.