Gospell Digital Technology: Stock Rebound Masks Underlying Revenue Concerns

Shares of Gospell Digital Technology Co., Ltd. (SZSE:002848) have seen a 25% increase in the last month, offering some relief to investors. However, this rebound doesn’t fully compensate for the stock’s losses over the past year, where it remains down 19%.

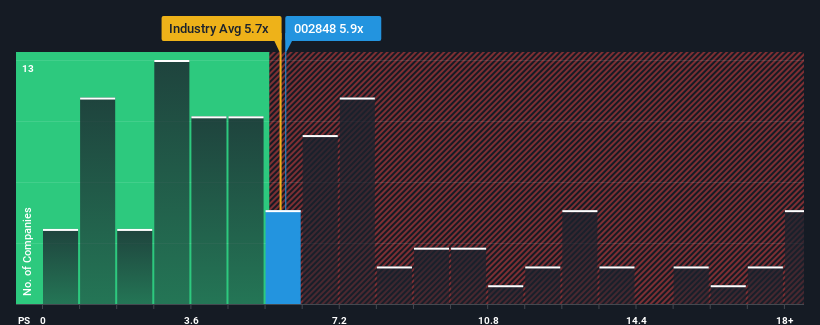

Even with this recent price jump, the company’s price-to-sales (P/S) ratio of 5.9x appears in line with the Communications industry in China, which has a median P/S ratio of about 5.7x. This might lead investors to overlook some potential challenges ahead.

Recent Performance & Revenue Trends

A key area of concern for Gospell Digital Technology is its declining revenue. Over the past year, the company’s revenues have fallen by 40%. The last three years show an aggregate revenue decrease of 66%.

This trend contrasts sharply with the industry’s projected growth rate of 33% over the next 12 months. This discrepancy is noteworthy, as it calls into question the sustainability of the company’s current P/S ratio.

The fact that Gospell Digital Technology’s P/S ratio aligns with the industry average, despite these negative revenue trends, suggests that investors may be overly optimistic or unaware of the risks.

Risks and Investor Outlook

Given its recent revenue performance, existing shareholders may face future disappointment if the P/S ratio adjusts to reflect the company’s recent negative growth. Potential investors could also be at risk of overpaying if current trends continue.

In conclusion, while Gospell Digital Technology’s stock has gained upward momentum lately, the matching of its P/S ratio to the industry average is unexpected, considering the firm’s shrinking revenues.

It’s important to be aware of potential warning signs like the ones mentioned above and to conduct thorough due diligence before investing.