Guangdong Aofei Data Technology (SZSE:300738) Shares Rocket on Optimistic Outlook

Shares of Guangdong Aofei Data Technology Co., Ltd. (SZSE:300738) have experienced a remarkable surge, reflecting strong investor confidence in the company’s future. The stock has gained an impressive 72% in the last month alone, adding to a substantial 168% increase over the past year.

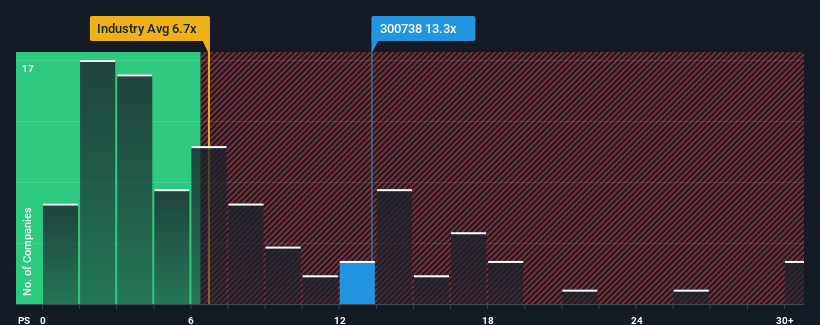

Considering the recent price jump, the company’s price-to-sales (P/S) ratio stands at 13.3x. This figure is notably high when compared to the broader IT industry in China, where nearly half of the companies have P/S ratios below 6.7x, and ratios under 3x are not uncommon. This discrepancy suggests that investors are anticipating continued strong revenue performance, which warrants further investigation to determine if the valuation is justified.

Analyzing Guangdong Aofei Data Technology’s Performance

Guangdong Aofei Data Technology has demonstrated robust performance, with substantial revenue growth compared to its peers. This strong revenue performance appears to be the primary factor driving the high P/S ratio, as investors seem to believe this trend will persist. However, if this expectation proves incorrect, shareholders could face overvaluation concerns.

To gain a clearer understanding of the future, investors can review the company’s free report for analyst forecasts.

Revenue Forecasts and the High P/S Ratio

A high P/S ratio often assumes that a company will significantly outperform its industry. Reviewing the last year of revenue growth, Guangdong Aofei Data Technology showed a remarkable increase of 43%, and a total revenue growth of 60% over the past three years. The company’s revenue generation has clearly been exceptional during this period.

Looking ahead, analysts predict an annual growth rate of 34% for the coming year. This projection significantly exceeds the industry’s anticipated growth of 17%. This difference helps to explain why Guangdong Aofei Data Technology is trading at a premium P/S ratio compared to the industry average.

Evidently, shareholders are hesitant to sell shares, likely due to their optimism about the company’s financial future, and the potential for continued growth.

The Bottom Line on Guangdong Aofei Data Technology’s P/S

Guangdong Aofei Data Technology’s P/S ratio has increased significantly over the past month, correlating with a rise in share prices. Although it’s usually advisable to be cautious when making investment decisions solely based on price-to-sales ratios, the P/S can reflect market sentiment on a company.

In summary, the high P/S ratio of Guangdong Aofei Data Technology appears justified given the projected revenue growth, which investors believe will outperform the wider IT sector. At present, shareholders are comfortable with the valuation, as they seem confident about the company’s revenue prospects. Under these conditions, a strong drop in the share price is unlikely in the near future.

Disclaimer: This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.