Guangdong Aofei Data Technology (SZSE:300738) Signals Strong Investor Confidence Amidst 72% Share Price Surge

Shares of Guangdong Aofei Data Technology Co., Ltd. (SZSE:300738) have experienced a significant surge in recent weeks, climbing an impressive 72% in the last month alone. This recent performance builds upon an already substantial increase, with the stock price having grown by 168% over the past year. This recent momentum suggests a strong investor belief in the company’s growth prospects.

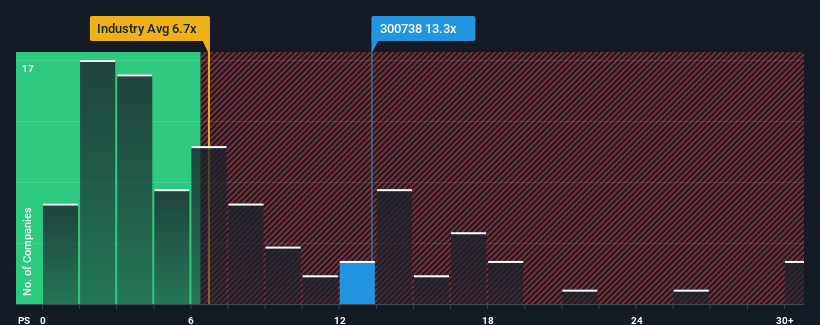

Following this notable price increase, the company’s price-to-sales (P/S) ratio now stands at 13.3x. This figure is notably high when compared to the broader IT industry in China, where nearly half of the companies have P/S ratios below 6.7x, and ratios under 3x are not uncommon. This high P/S ratio deserves closer scrutiny to assess the justification behind it. The premium might be attributed to exceptional growth expectations.

Analyzing the High P/S Ratio

Guangdong Aofei Data Technology’s financial performance has been robust. The company has demonstrated revenue growth that outpaces most of its peers. This strong revenue performance is likely a key factor driving the high P/S ratio, as investors seem to anticipate continued strong results. However, if revenue growth were to slow, investors could risk overpaying for the stock.

To understand future projections for Guangdong Aofei Data Technology, one can consult the company’s freely available reports. These analyses often include forecasts from industry analysts.

Revenue Forecasts and Industry Comparisons

The high P/S ratio suggests that investors expect Guangdong Aofei Data Technology to significantly outperform the industry average. Looking at the past year, the company indeed achieved substantial revenue growth of 43%. This is further amplified by the total revenue growth of 60% observed over the last three years. These figures indicate a solid track record of revenue expansion.

Analysts predict that the company will see revenue growth of 34% in the coming year. This is materially higher than the 17% growth expected for the IT industry as a whole. Given these figures, it becomes clearer why Guangdong Aofei Data Technology is trading at a premium compared to its industry peers. Shareholders appear reluctant to sell, likely anticipating a prosperous future.

The Bottom Line on Guangdong Aofei Data Technology’s P/S

Guangdong Aofei Data Technology’s P/S ratio has increased due to the rise in share price. While price-to-sales ratios can provide insights into market sentiment, they should be considered alongside other investment factors. The current P/S reflects investors’ view of the company’s strong revenue growth exceeding the IT industry average. At present, investors are comfortable with the P/S, confident that future revenues remain secure. It appears unlikely that the share price will decline significantly in the near future. Therefore, the company’s strong revenue growth has clearly motivated investors to buy and hold the stock.

For prospective investors, it’s advisable to explore potential warning signs associated with the company and find out if the company is a great fit for your portfolio. For those interested in trading Guangdong Aofei Data Technology, use the lowest-cost platform trusted by professionals, Interactive Brokers.