Guangdong Skychem Technology Co., Ltd. (SHSE:688603) – Is the High Valuation Warranted?

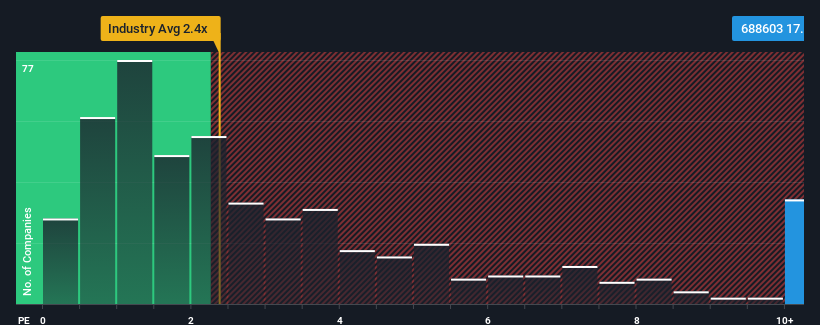

When evaluating stocks, one key metric is the price-to-sales (P/S) ratio. Often, a high P/S ratio can signal overvaluation. This is the case with Guangdong Skychem Technology Co., Ltd. (SHSE:688603), which currently boasts a P/S ratio of 17.1x. This is significantly higher than the median P/S ratio of roughly 2.4x seen across most companies within China’s chemicals industry. However, a high P/S isn’t always a reason to immediately move on. Let’s explore what might be driving this high valuation.

How Guangdong Skychem Technology Has Been Performing

Guangdong Skychem Technology has demonstrated impressive revenue growth. The market seems very optimistic about the company’s continued performance, reflected in its elevated P/S ratio. This projection would need to be accurate; otherwise, the company’s stock might be significantly overpriced.

To better understand the P/S ratio, it is useful to analyze the company’s recent financial data.

Last year, Guangdong Skychem Technology experienced a solid 6.9% revenue growth. However, there has been a 2.8% overall decline in revenue over the past three years. This mixed performance may give shareholders some pause.

Looking forward, the lone analyst covering the company predicts a substantial 45% revenue increase over the next year. The projections for the industry as a whole is closer to 25%. This substantial difference could be the explanation for the high P/S ratio. Many investors are evidently betting on strong future expansion and are willing to pay a premium for the stock.

The Final Word

While the price-to-sales ratio alone does not mandate a sell decision, it does provide insights into a company’s growth outlook.

Guangdong Skychem Technology’s high P/S appears to be due to forecasted revenue growth outpacing the rest of the chemicals industry, as anticipated. Shareholders seem comfortable with the current P/S, anticipating continued revenue growth. Unless the analysts have miscalculated significantly, these positive revenue forecasts should help maintain share price strength.

Investors should also consider the balance sheet, which is an area for risk analysis. You can also access a free balance sheet analysis report. Moreover, profitable companies with solid earnings growth records generally offer more safety. You also have access to a free compilation of other companies with sound P/E ratios and strong earnings growth.