Guangzhou Great Power Energy and Technology Stock Climbs 31%, P/S Ratio Appears Fair

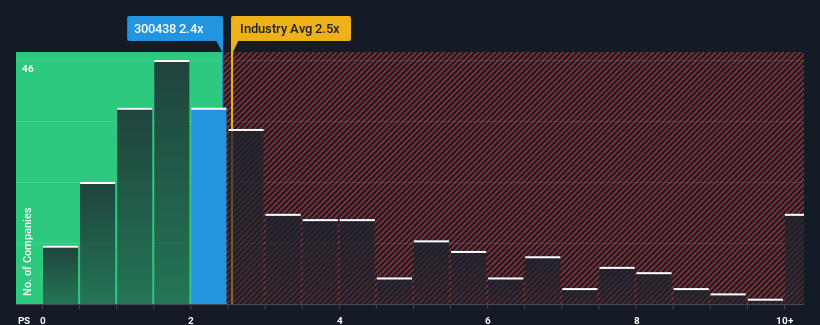

Shares of Guangzhou Great Power Energy and Technology Co., Ltd (SZSE:300438) have experienced a remarkable surge, increasing by 31% over the past month. This follows a prior period of fluctuation, and looking back, the stock has appreciated by 46% in the last year. Even with the rise in price, its price-to-sales (P/S) ratio of 2.4x appears reasonable when compared to the Electrical industry in China, where the median P/S ratio is approximately 2.5x.

However, investors should not overlook the P/S ratio without further analysis, as it could indicate either overlooked opportunities or potential risks.

Recent Performance and Revenue Trends

Recent revenue data indicates a decline for Guangzhou Great Power Energy and Technology, a contrast to the positive revenue growth seen by most other companies. The market may anticipate improvements in revenue, which could be reflected in the stock’s P/S ratio. If the revenue does not rise, current shareholders might become concerned about the stock’s viability.

For detailed analyst forecasts, a complimentary report about Guangzhou Great Power Energy and Technology is available.

Revenue Growth Metrics and P/S Ratio

There’s an assumption that a company’s P/S ratio should align with industry standards. Over the past year, the company’s revenues decreased by 18%. Nevertheless, the three-year trend shows a substantial 35% increase in overall revenue, which presents a mixed picture.

Looking ahead, analysts project a 26% growth in the next year, based on estimates from five analysts. This growth is in line with the 25% expansion predicted for the broader industry. Therefore, Guangzhou Great Power Energy and Technology’s P/S ratio is consistent with its peers.

Most investors appear to anticipate average growth and are currently willing to pay a moderate price for the stock.

Conclusion

Guangzhou Great Power Energy and Technology has gained considerable momentum recently, causing its P/S ratio to align with the industry average. While the P/S ratio might be considered less reliable in some sectors, in this case it is a reasonable indicator for measuring business sentiment. Guangzhou Great Power Energy and Technology’s P/S is adequate, given that its revenue growth is comparable to the rest of the industry. Shareholders appear to be content with the existing P/S, suggesting confidence in future revenue figures.

Unless there is any change in the market, a significant fluctuation in the share price remains somewhat improbable. The company’s balance sheet includes other crucial risk factors. A complimentary balance sheet analysis of Guangzhou Great Power Energy and Technology, covering six key checks, can help investors evaluate most of the primary risks.

If these risks cause you to doubt your investment in Guangzhou Great Power Energy and Technology, an interactive list of quality stocks provides alternative investment ideas.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation.