Healthcare State of Health Tech 2024: Navigating Resilience in the Age of AI

In this second annual report, we delve into the healthcare technology sector’s enduring strength and recovery across both public and private markets. A significant focus will be placed on the burgeoning opportunities for early-stage health tech companies, particularly in this era of rapid AI implementation.

The Year of Resilience

As 2024 draws to a close, the health tech landscape is defined by one key characteristic: resilience. The sector has demonstrated an impressive ability to adapt and flourish, mirroring the mythical phoenix. Following the market corrections and heightened scrutiny that defined 2023, a new crop of companies is not just surviving but succeeding, showcasing how the industry is evolving to meet the demands of investors for clear pathways to profitability. Efficiency and a differentiated approach to value creation are now critical.

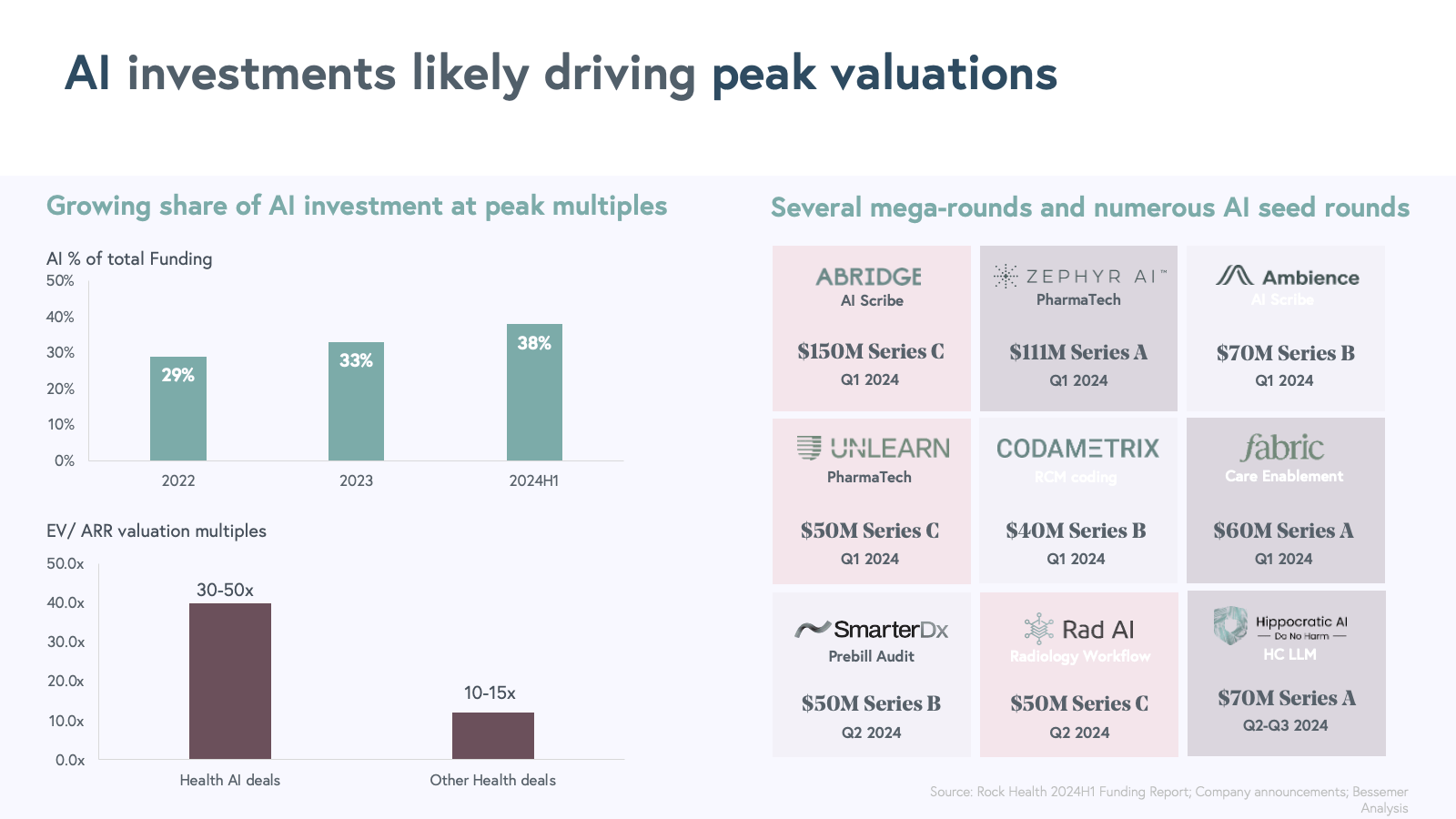

Despite these hurdles, positive signs of private market recovery are visible among companies achieving product-market fit and scaling efficiently. One of the most dynamic developments has been the explosion of interest in artificial intelligence within healthcare. Rock Health estimates that venture capitalists are allocating a significant portion, 38%, of new investment dollars in healthcare to AI-enabled technologies. This ‘era of cognition,’ driven by advancements in AI and machine learning, is poised to reshape the delivery and management of care.

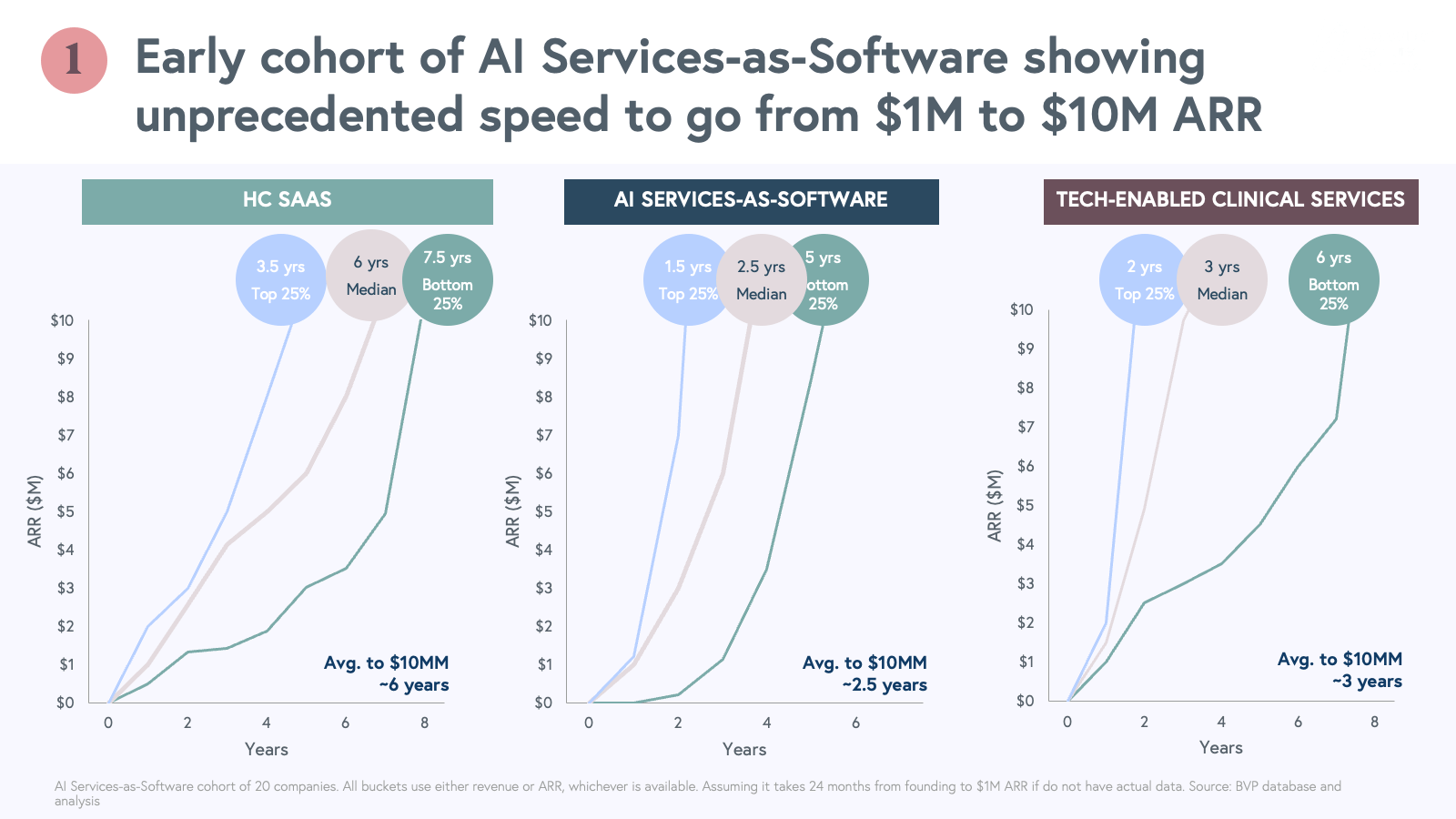

Hundreds of new companies have emerged at the intersection of health and AI. Over 20 startups are rapidly achieving product-market fit and expanding from $1 to $10 million in annual recurring revenue (ARR) in record time.

This report will analyze the current state of the health tech market, assess the performance of both public and private companies, and, for the first time, publish benchmarks for AI-powered health companies that constitute a new business category. We will also explore emerging trends and provide predictions for the future of health tech.

Market Review: Where We’ve Been in 2024

Public Market Performance

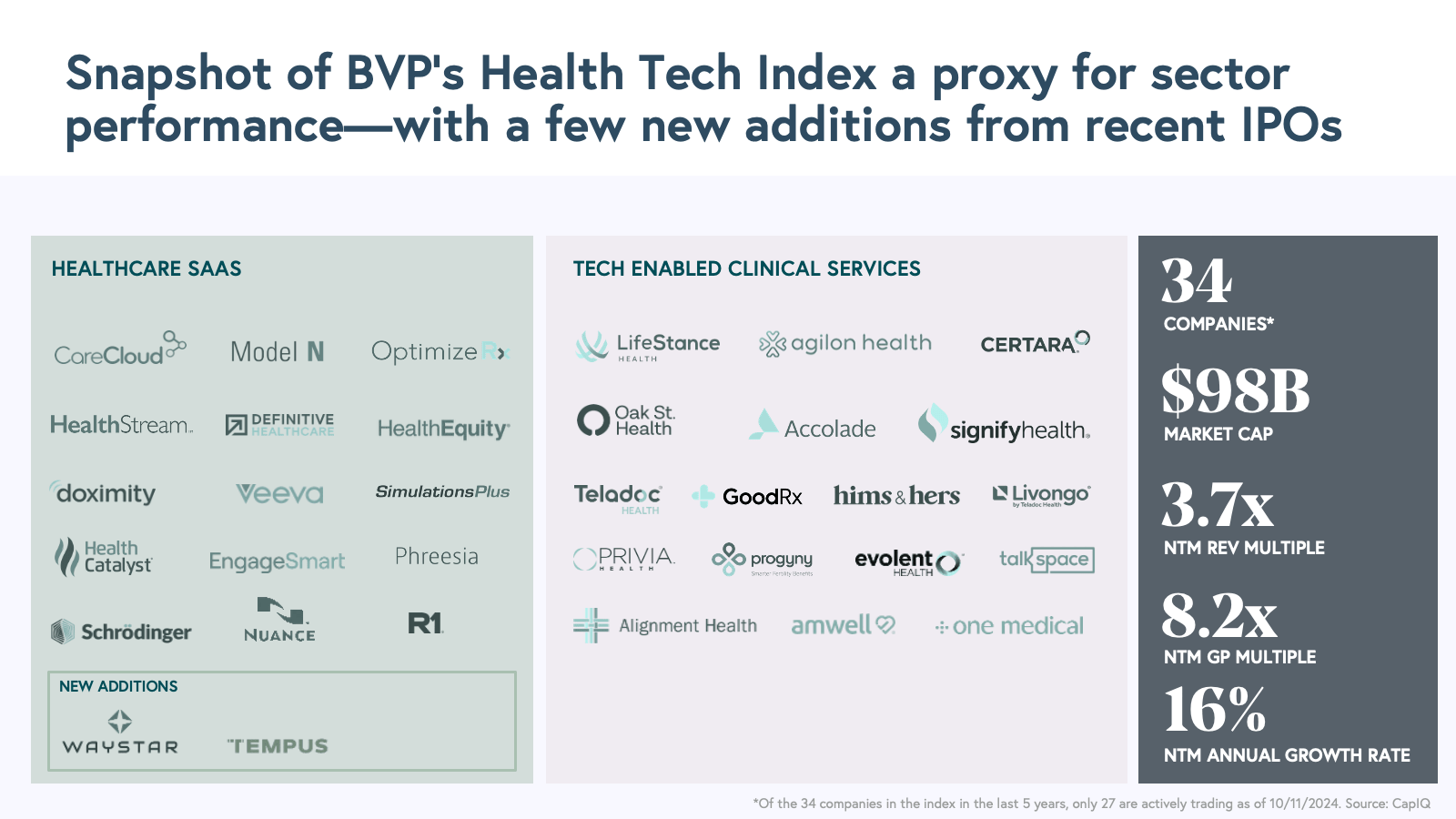

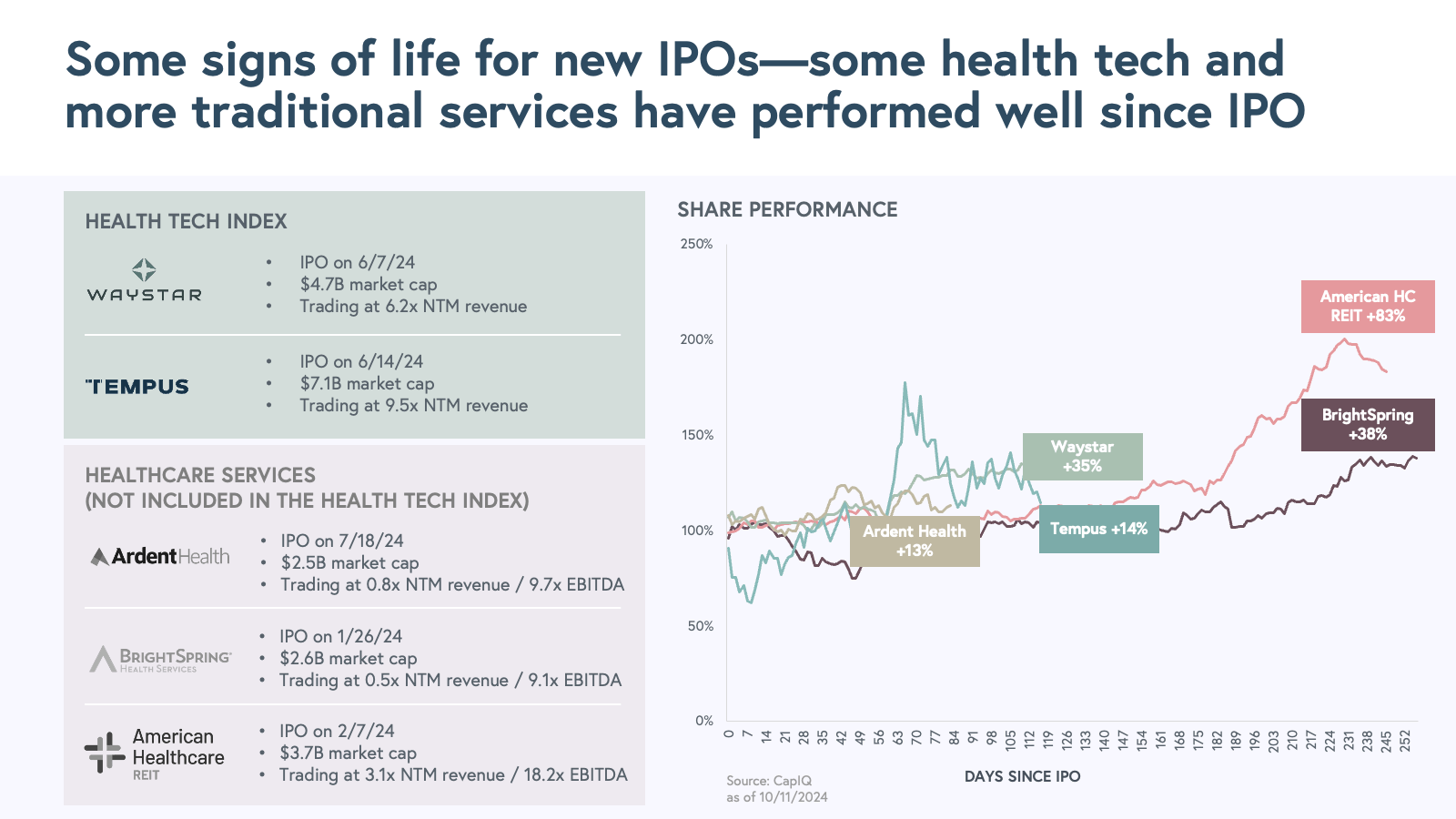

To monitor the overall performance of the health tech sector, we’ve updated our health tech index, which offers a snapshot of the public market’s performance. This year, we’re excited to include two fresh additions to our index: Tempus and Waystar, both of which completed their initial public offerings (IPOs) in 2024.

Our expanded index, now encompassing 34 companies, represents a combined market capitalization of $98 billion. However, that figure is just a fraction of the value held within health tech’s private market.

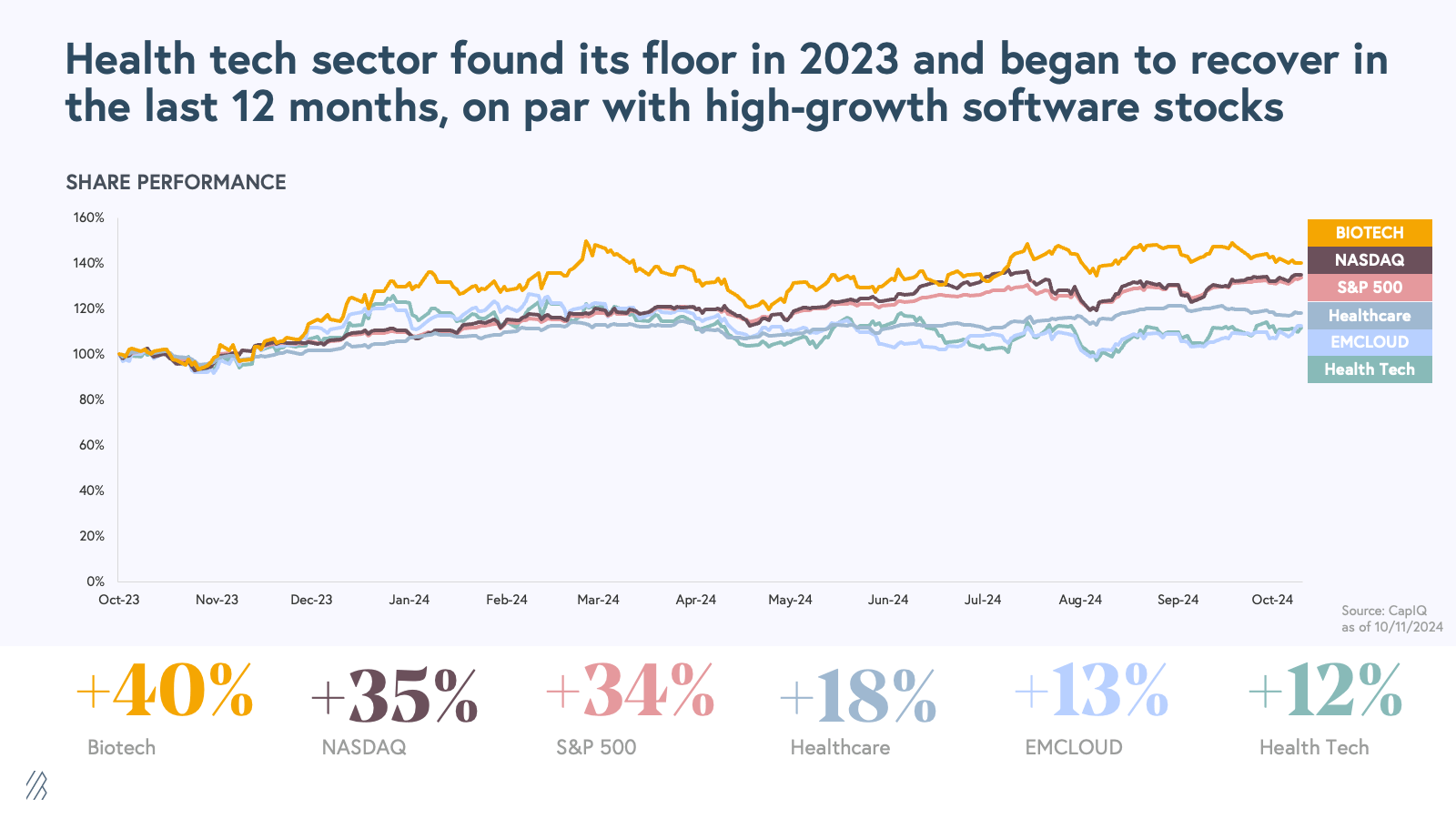

While the sector’s overall performance remains below its 2021 peak, there have been notable improvements compared to last year’s report. The last 12 months have demonstrated encouraging signs of recovery:

- Last year, we predicted that the health tech sector had hit a trough. Since then, public health tech stocks have increased in value by 12%.

- Health tech performance is in line with high-growth software stocks (e.g., the BVP Nasdaq Emerging Cloud Index (EMCLOUD)) and the incumbent healthcare index.

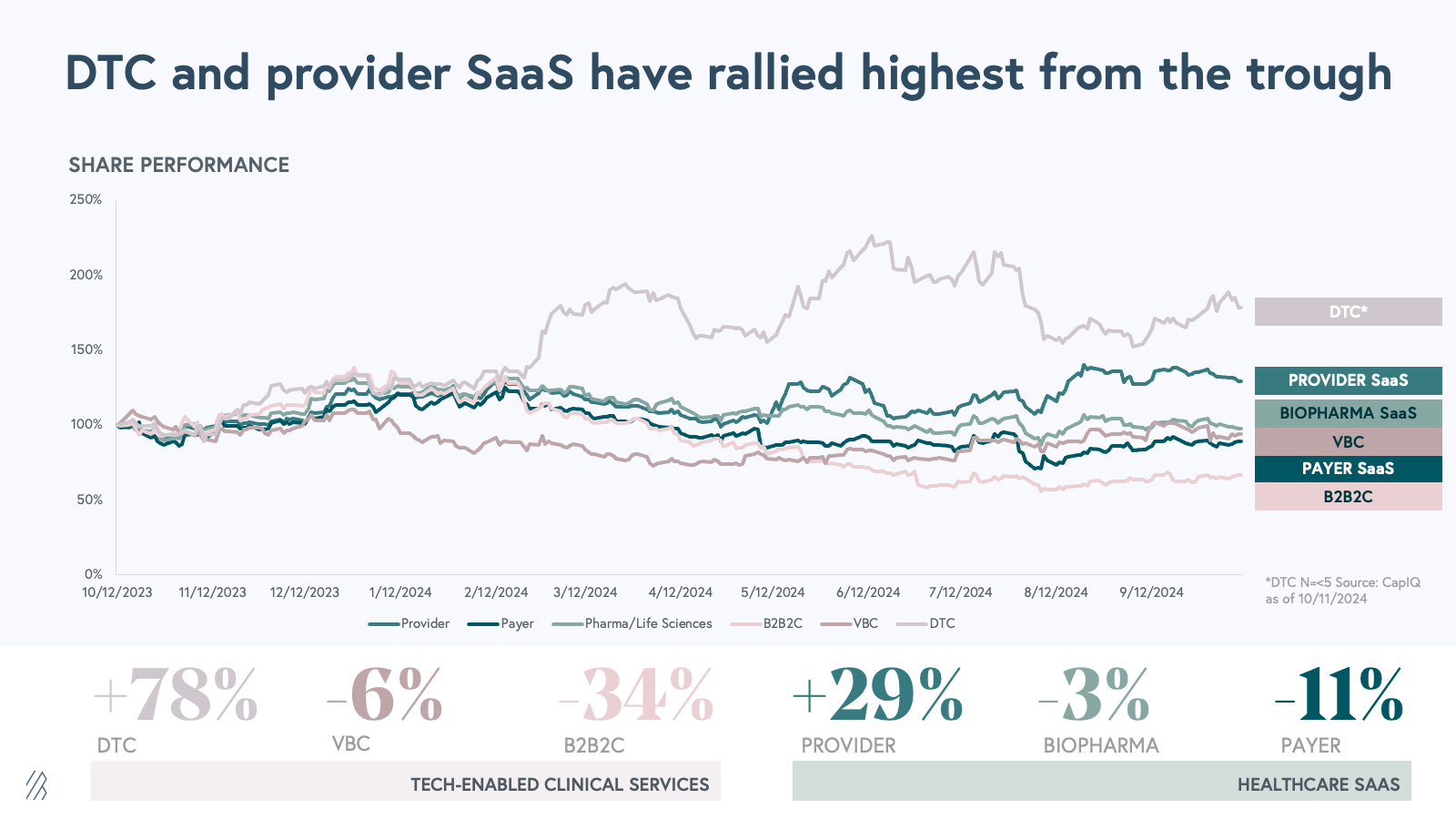

- The direct-to-consumer (DTC) subsector showed the strongest rebound from its 2022 low. DTC gained ~25% in 2024, driven by exceptional performance from companies like HIMS. Generally, investors have been wary of DTC companies in Healthcare due to the fickle nature of consumer behavior and lack of differentiated distribution channels. However, the recent performance of this sector calls into question whether consumer demand and large market tailwinds (including GLP-1, longevity, etc.) will open up a renaissance for this model.

- On the healthcare software side, provider SaaS has also seen significant improvement, supported by the addition of Waystar and Tempus to our index. This highlights the need for a fresh cohort of IPOs to help revitalize the sector.

In addition to the successful post-IPO performance of Waystar and Tempus, we’ve observed early signs of an opening IPO window, with some other healthcare services companies going public (though they are not included in our health tech index). These new public offerings have brought much-needed energy to the public health tech sector.

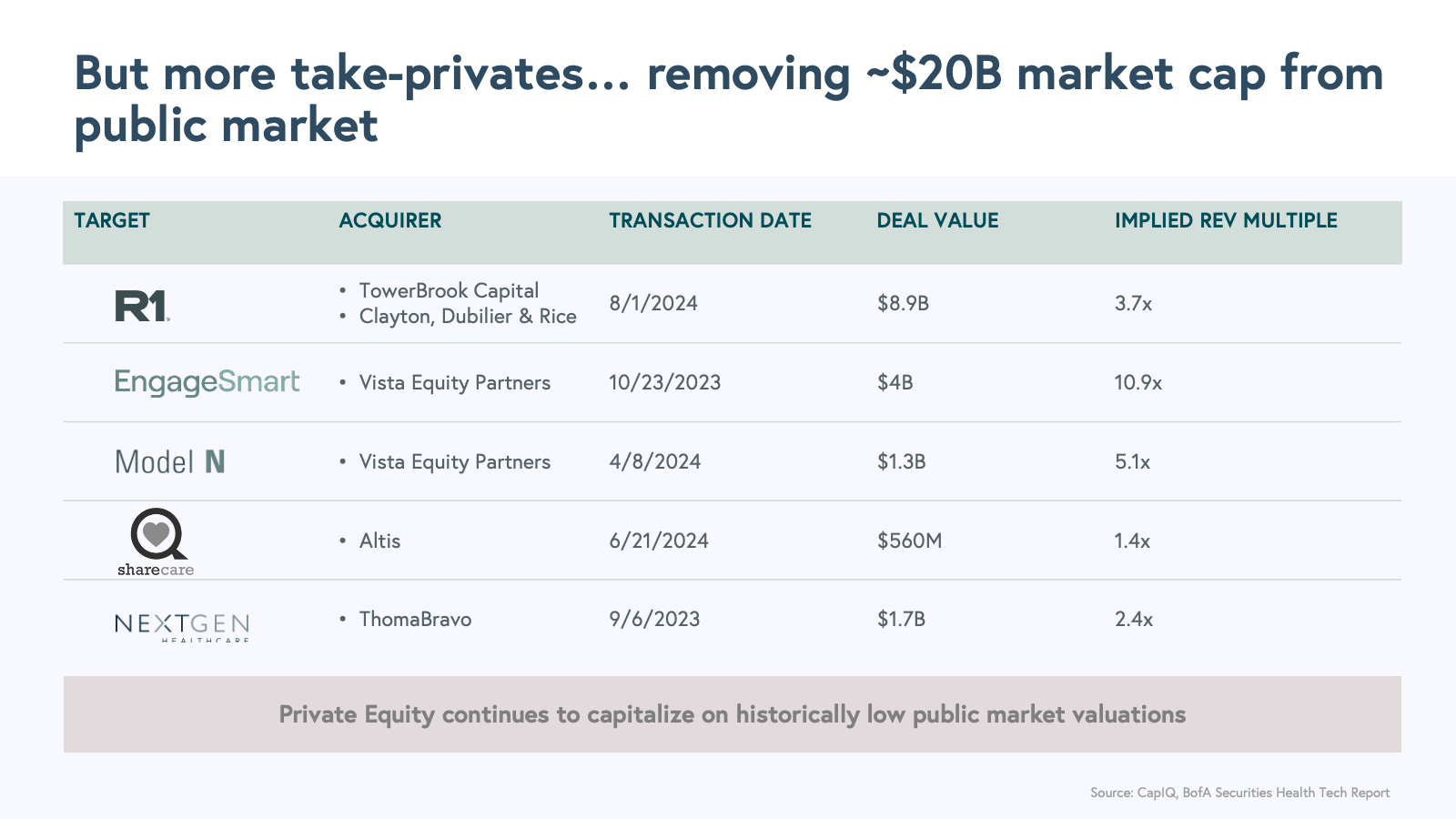

However, this positive trend has been somewhat offset by the loss of $20 billion in market capitalization due to take-private transactions as private equity firms are taking advantage of historically low valuations.

Notable examples include R1 RCM’s $8.9 billion take-private deal in August and EngageSmart’s $4 billion take-private deal in October 2023. While these transactions reflect the underlying value in the sector, they reduce the overall public market capitalization of health tech companies. This trend reflects a turning point, as investors increasingly seek to overhaul businesses with technology like AI.

Looking ahead to 2025, we’re cautiously optimistic about the emergence of a new cohort of companies with the potential to go public and reinvigorate the sector. Fresh market capitalization and new public listings will inject life into health tech’s public market cohort, driving its next phase of growth. These are some factors that could make this possible:

- Improving macroeconomic conditions and the Federal Reserve easing interest rates.

- The uncertainty of a presidential election outcome left behind.

- A few examples of IPOs in other markets including high-growth cloud, biotech and fintech.

- A cohort of private companies across tech-enabled clinical services and healthcare SaaS companies await their debut.

We are confident these prospects are showing continued strong profitable growth, untapped market opportunity, and proven outcomes and ROI to their customers. These companies have the potential to serve as bellwethers for the next generation of public health tech firms. It’s a matter of when, not if, these companies go public. As you’ll see below, there has been plenty of recent private market investment into great growth stage businesses.

The success of these upcoming IPOs will be crucial in attracting investor interest and fueling innovation and growth.

Private Market Investment Activity

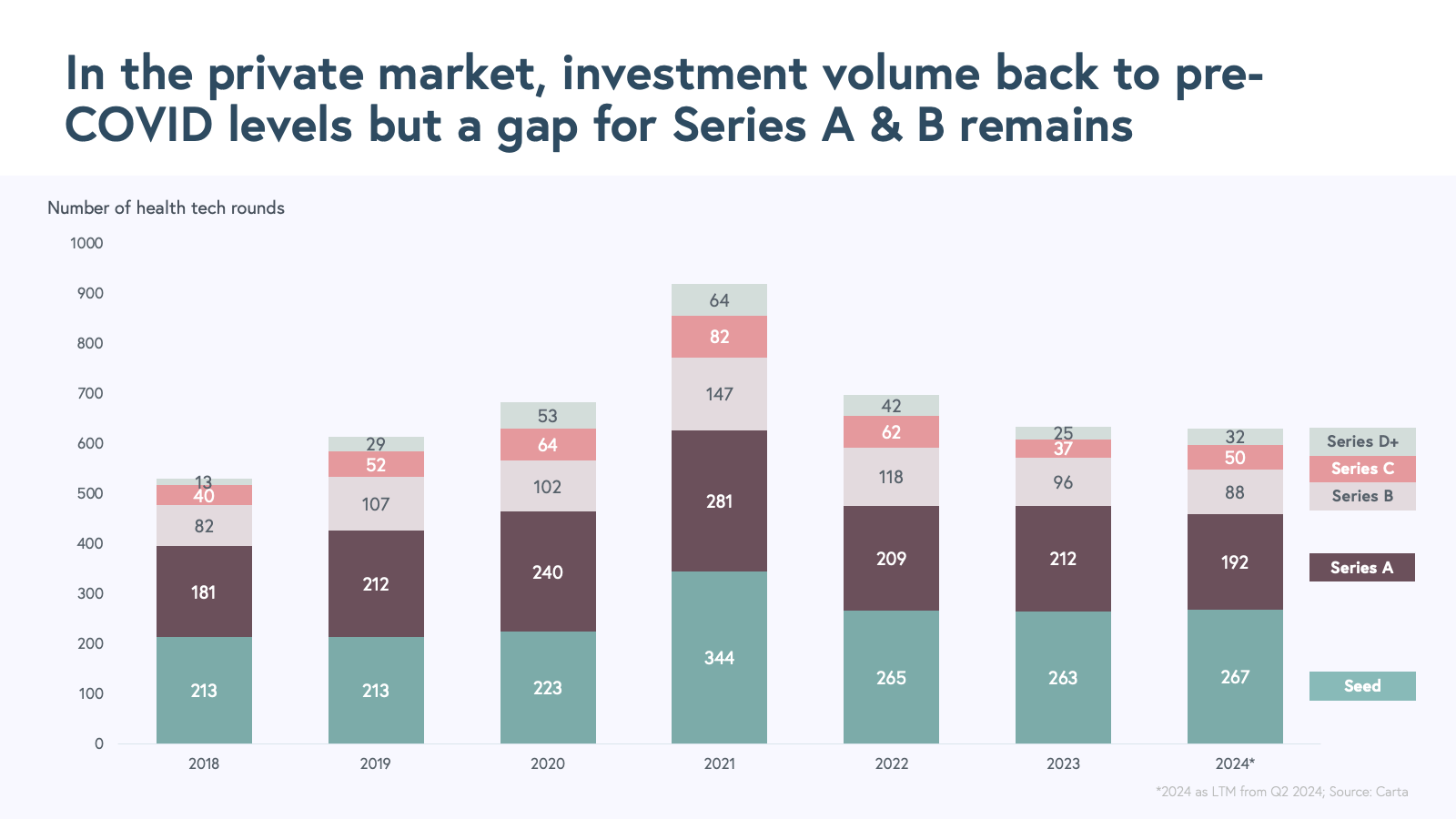

The private health tech market in 2024 demonstrates commendable resilience and adaptability. Following a period of market correction, there are encouraging signs of recovery. Private market investments have rebounded to pre-COVID levels, according to Carta data, with Seed and Series C+ rounds nearing 2020 deal volume. A dynamic scene has emerged with new companies, especially among Seed deals, that focus on the intersection of AI and healthcare.

Established businesses with scale have successfully secured late-stage rounds as they shift their focus to growth and profitability.

The Series A and B Crunch

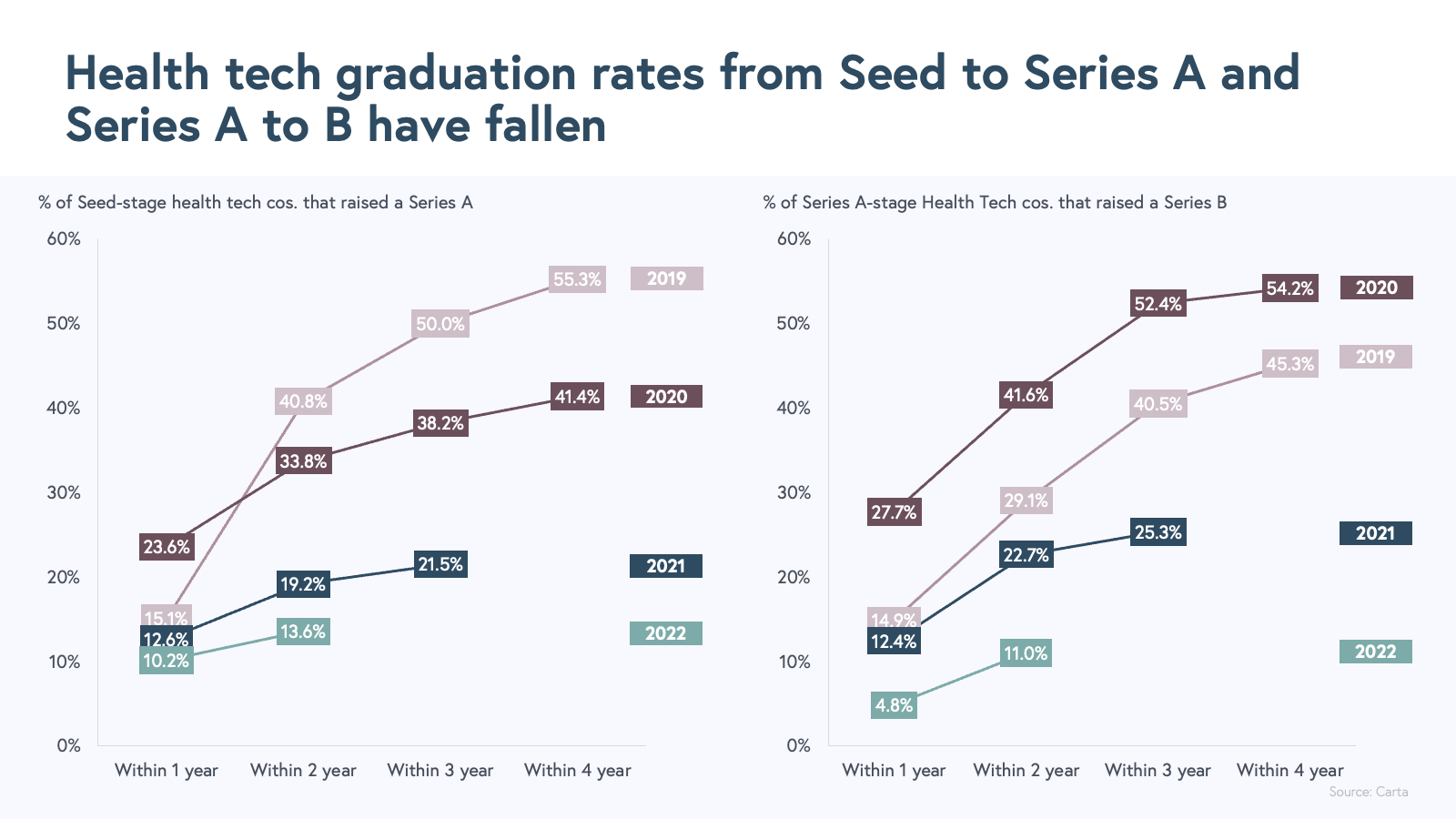

However, a gap remains—fewer Series A and B financings. This underscores the ongoing challenges facing early-stage ventures in this evolving market. Our analysis reveals a concerning trend regarding the progression of Seed-funded companies to Series A:

- The rate at which Seed-funded companies progress to Series A within one, two, or three years has significantly declined for recent cohorts.

- Companies that raised Series A financings in 2021 and 2022 are facing challenges in securing Series B funding.

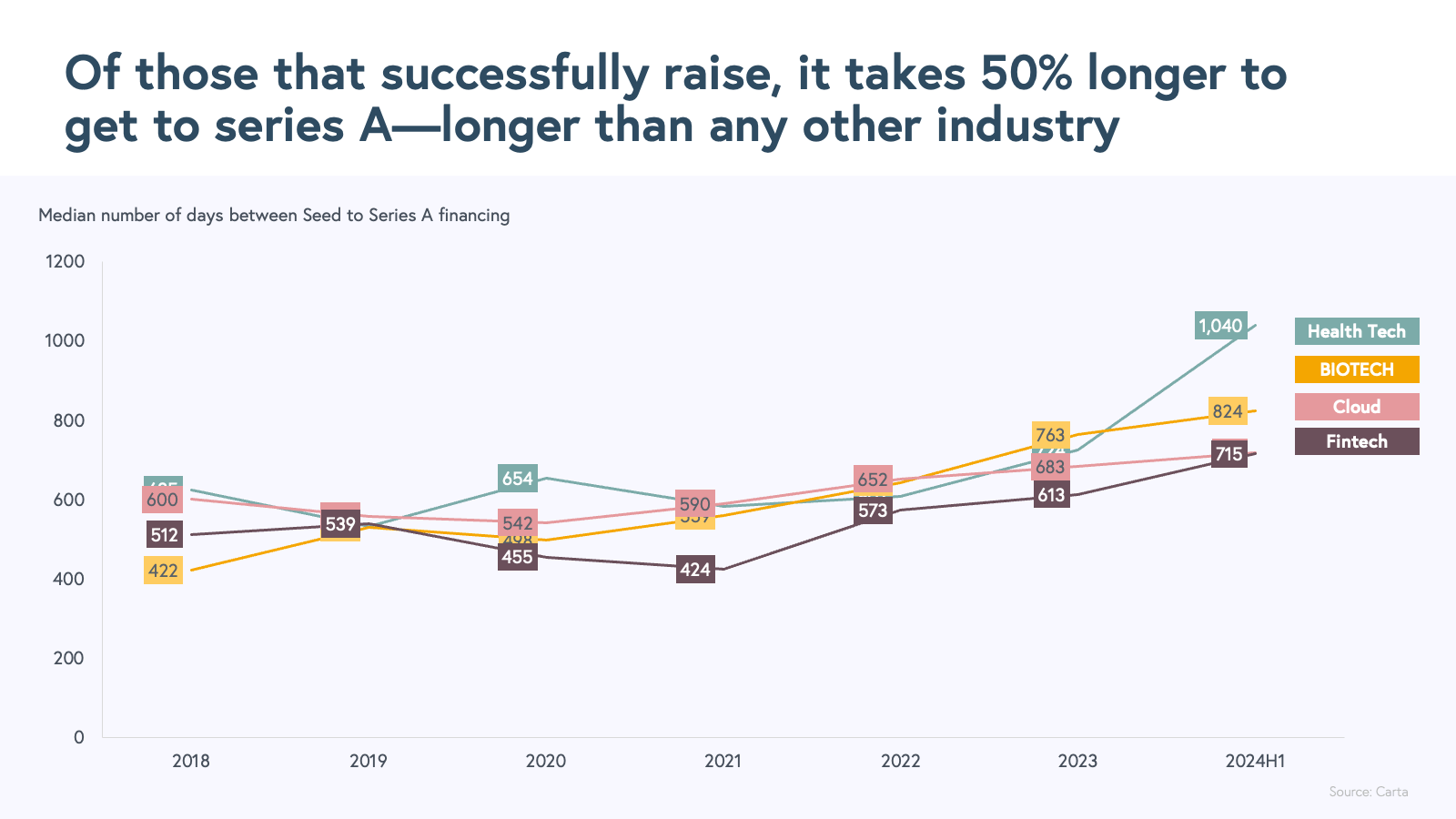

- The median time to reach Series A has increased by 50% in 2024 compared to prior years, and is longer in health tech than in any other sector.

This makes it vital for companies seeking their first institutional rounds to grow efficiently, conserve cash, and validate their product-market fit. Given the challenges at the Series A and B stages, we will be releasing a dedicated playbook for $1-10 million ARR businesses in the coming months.

Valuation Dynamics

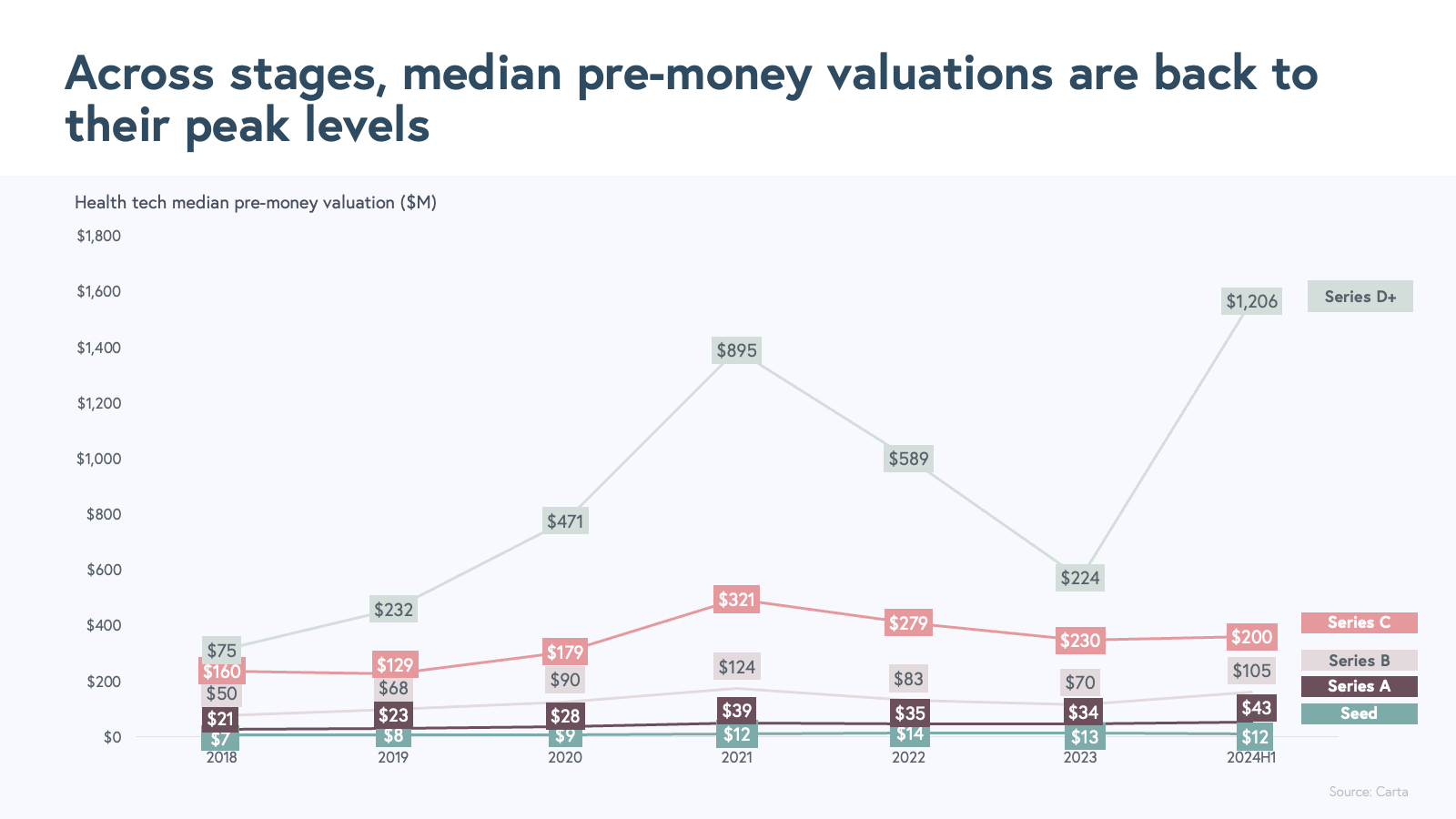

For those able to raise capital, valuations have rebounded. 2024 health tech companies are garnering their highest median pre-money valuations across stages in several years, following a dip from 2022 to 2023.

We see some evidence to support the valuation rise:

- Series D+ rounds are seeing a resurgence from ‘Phoenix’ companies that have demonstrated high growth, scale, and strong unit economics. Companies like Grow Therapy, Equip, and Maven are examples of companies that have risen from the market correction.

- At the Seed through Series C stages, investments in AI-focused startups are driving early-stage valuation increases.

The AI Factor

The influence of artificial intelligence on health tech investments cannot be overstated. The share of health tech dollars invested in AI-focused companies has increased by nine percentage points in just two years, reaching 38% in 2024.

These valuations can range 2-5x higher than their non-AI counterparts, as we see EV/ARR multiples of 30-50x. These high valuation multiples showcase the private market excitement for new business models, market, and technology category creation.

We’re seeing multiple “mega rounds” of >$50 million invested capital in exciting categories like AI-scribes, revenue cycle management (RCM), and back-office admin automation. Many of these companies have seen strong commercial market pull as providers, payers and pharma stakeholders are focused on developing AI strategies and are more willing to experiment with products that drive measurable ROI.

Scaling in the Age of AI: Benchmarks for a New Business Model

Over the past year, a group of Series A and B companies has rapidly gained scale with a new business model we call “AI Services-as-Software.” We are excited to publish a new set of benchmarks for these companies in the $1-10 million ARR range.

Let’s first revisit the Health Tech business models:

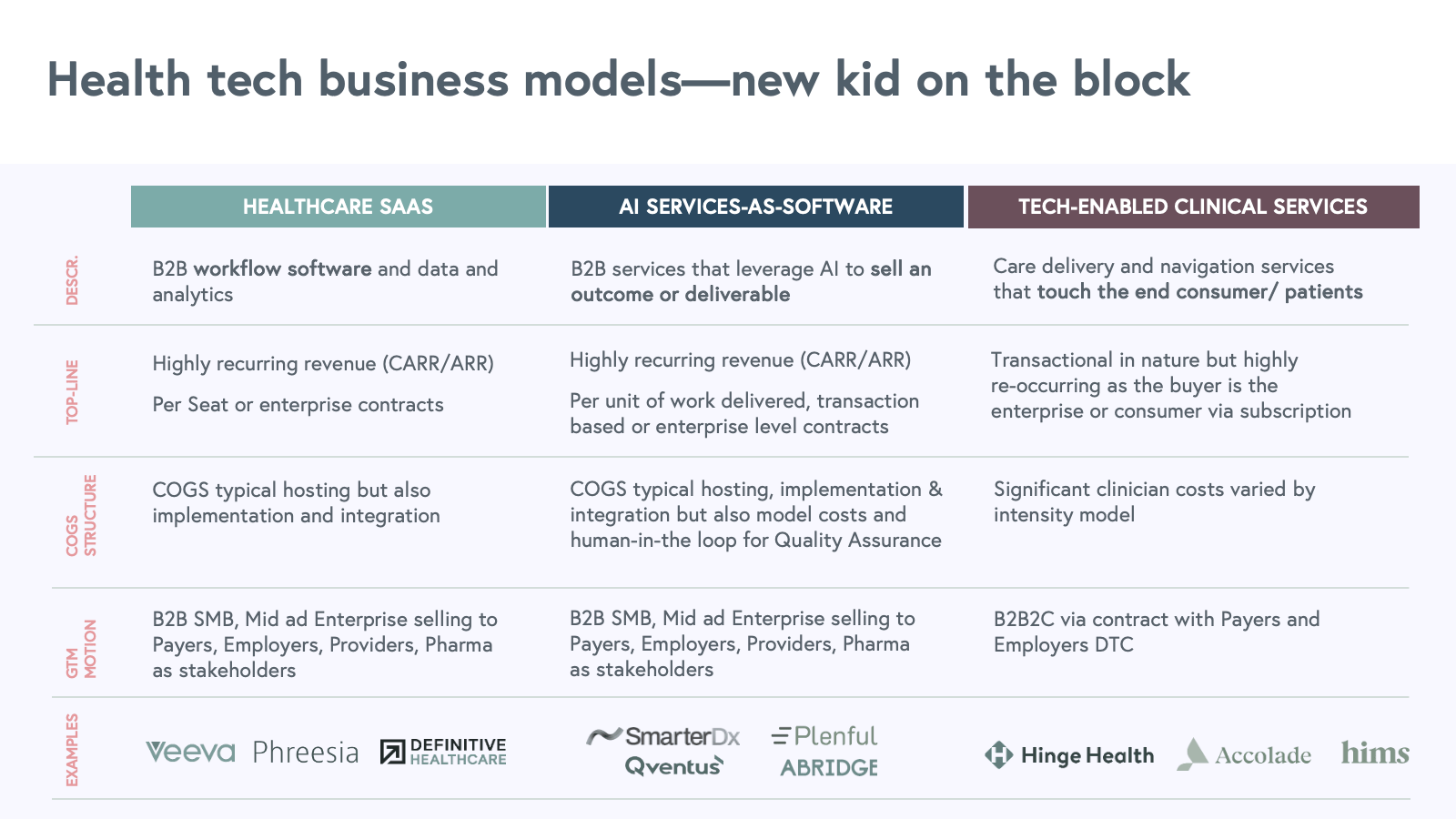

- Healthcare SaaS: Traditional B2B workflow software, data, and analytics businesses. These businesses sell to SMB, mid, and enterprise customers at payer, provider, and pharma stakeholders.

- Tech-enabled clinical services: Care delivery and navigation services that touch the end consumer or patient. This category leverages technology to deliver care more efficiently and effectively, often incorporating elements of value-based care.

- AI Services-as-Software: B2B services that leverage AI to sell an outcome or deliverable for SMB, mid, and enterprise customers at payer, provider, and pharma stakeholders. These businesses use AI workflows to autonomously perform tasks that have typically required human intervention.

AI Services-as-Software: A New Paradigm

We predicted the rise of AI-powered “Services-as-Software” in our 2023 report. That prediction is materializing rapidly. These companies use AI to autonomously perform tasks that required human involvement. By leveraging AI such as large language models (LLMs), OCR, and agentic workflow automation, they streamline processes for B2B customers in providers, payers, and pharma.

Examples include:

- Abridge: Automates medical documentation and clinical note generation. Provides a scribe in the pocket of every physician.

- SmarterDx: AI-powered clinical review and quality audits of complex medical claims. Provides a highly trained auditor to review every claim.

- Qventus: Automated surgery scheduling and surgical operations. Conducts routine pre-surgical workup with patients on behalf of nurses.

- Plenful: Back-office automation and data management for specialty pharmacies.

These companies seek to alleviate routine, time-consuming tasks, and improve how work is done, such as cutting administrative costs. Their AI Services-as-Software approach allows organizations to better allocate their workforce.

It’s important to differentiate companies actually leveraging AI. These technologies are no longer optional but a fundamental part of any successful toolkit.

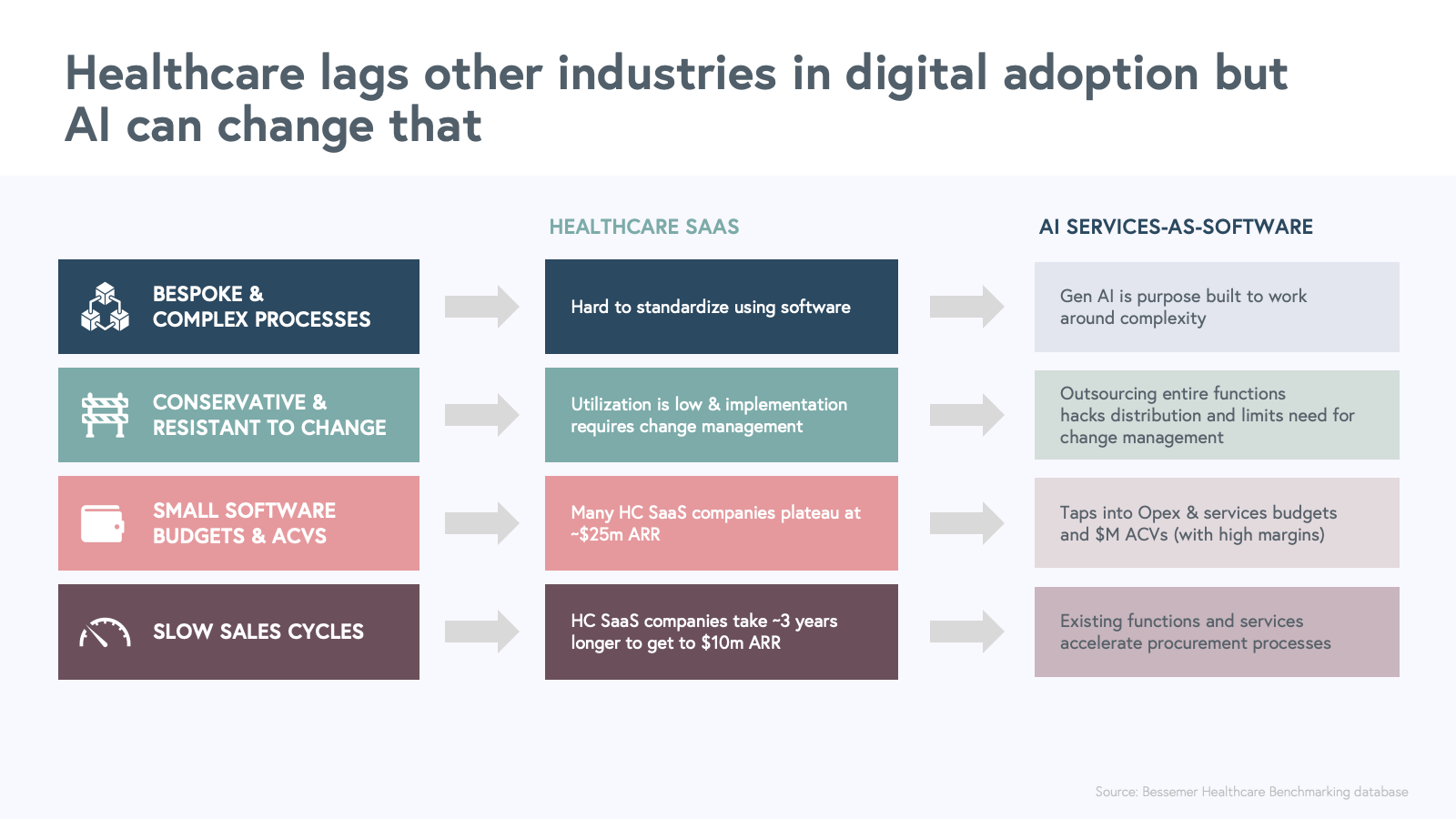

Healthcare has lagged other industries in digital adoption. However, AI Services-as-Software companies are well-positioned to change that. These companies can build around complexity by taking on larger portions of these complex processes themselves.

By selling the end outcome these companies gain access to procurement processes with large operating expenses and services budgets.

Investors are assessing new AI solutions based on their business value. We are early in adopting AI and the ways entrepreneurs are building durability and defensibility is evolving.

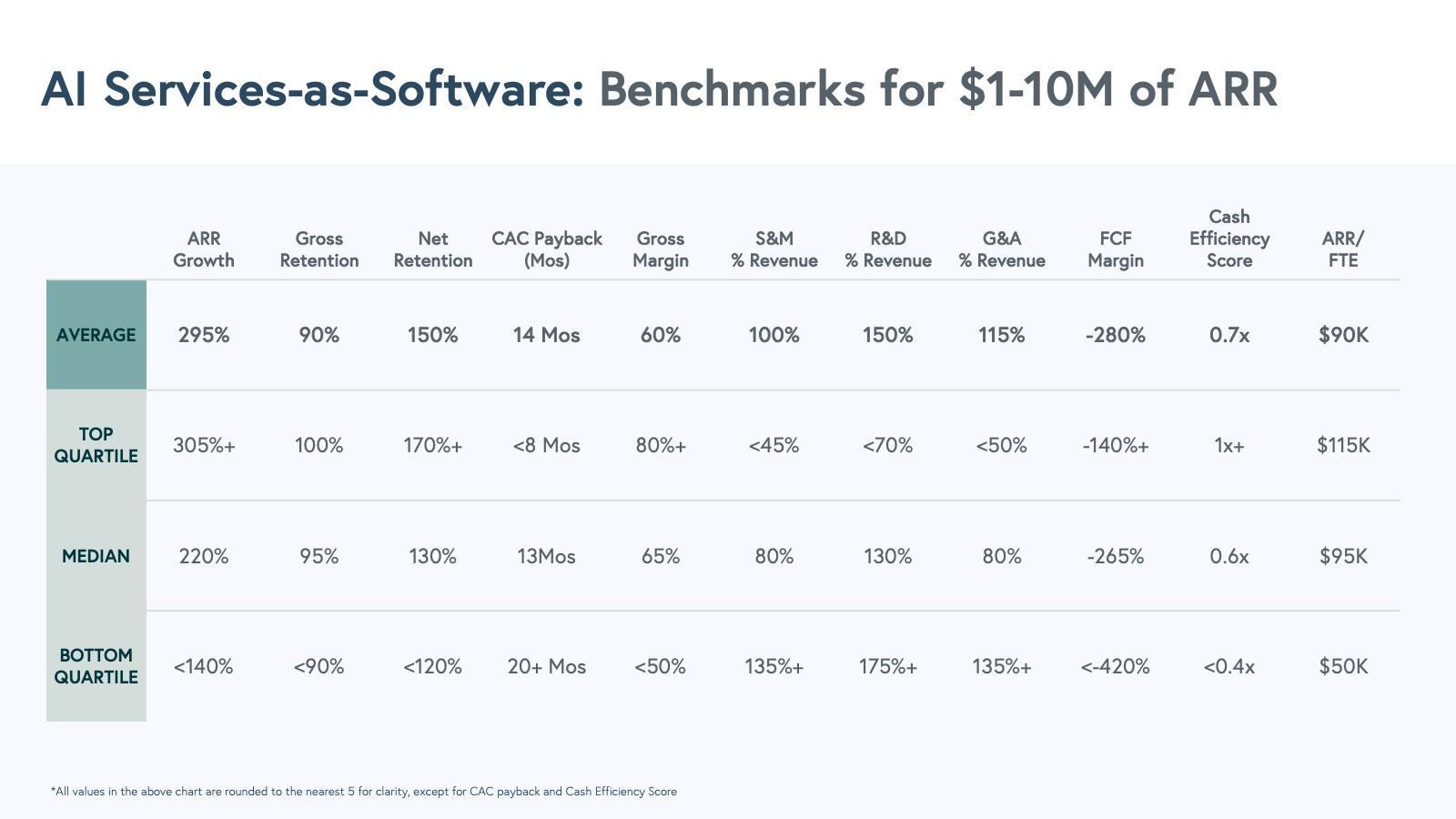

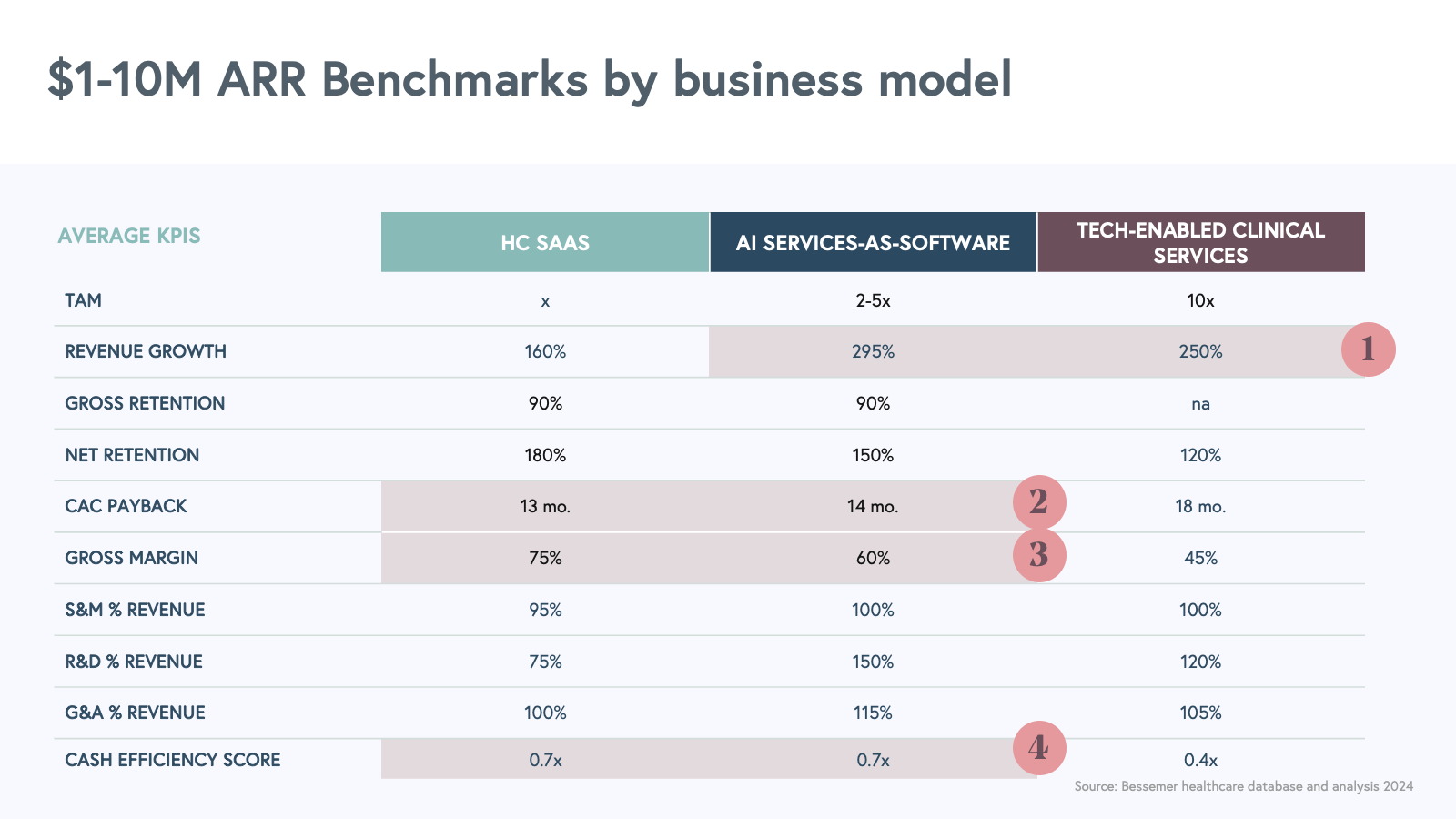

Early benchmarks from ~20 companies show an accelerated go-to-market trajectory compared to traditional SaaS models.

Here are the benchmarks for AI Services-as-Software companies compared to prior business models:

Key Performance Indicators (KPIs)

AI Services-as-Software average KPIs borrow from the best metrics across Healthcare SaaS and Clinical Services. We want to highlight four learnings:

- AI Services-as-Software companies are hitting $10M ARR with unprecedented speed, and are growing as fast, or faster, than tech-enabled clinical services. We hypothesize that the faster sales cycles are driven by urgency from buyers to test and buy AI-enabled solutions.

- It is crucial for these companies to demonstrate clear ROI and time-to-value. We are aware these companies may not get paid per seat or by “recurring” software license but instead for the unit of value provided. This presents an opportunity for startups as incumbents may be limited in how they capture the value of AI given their existing seat-based business model.

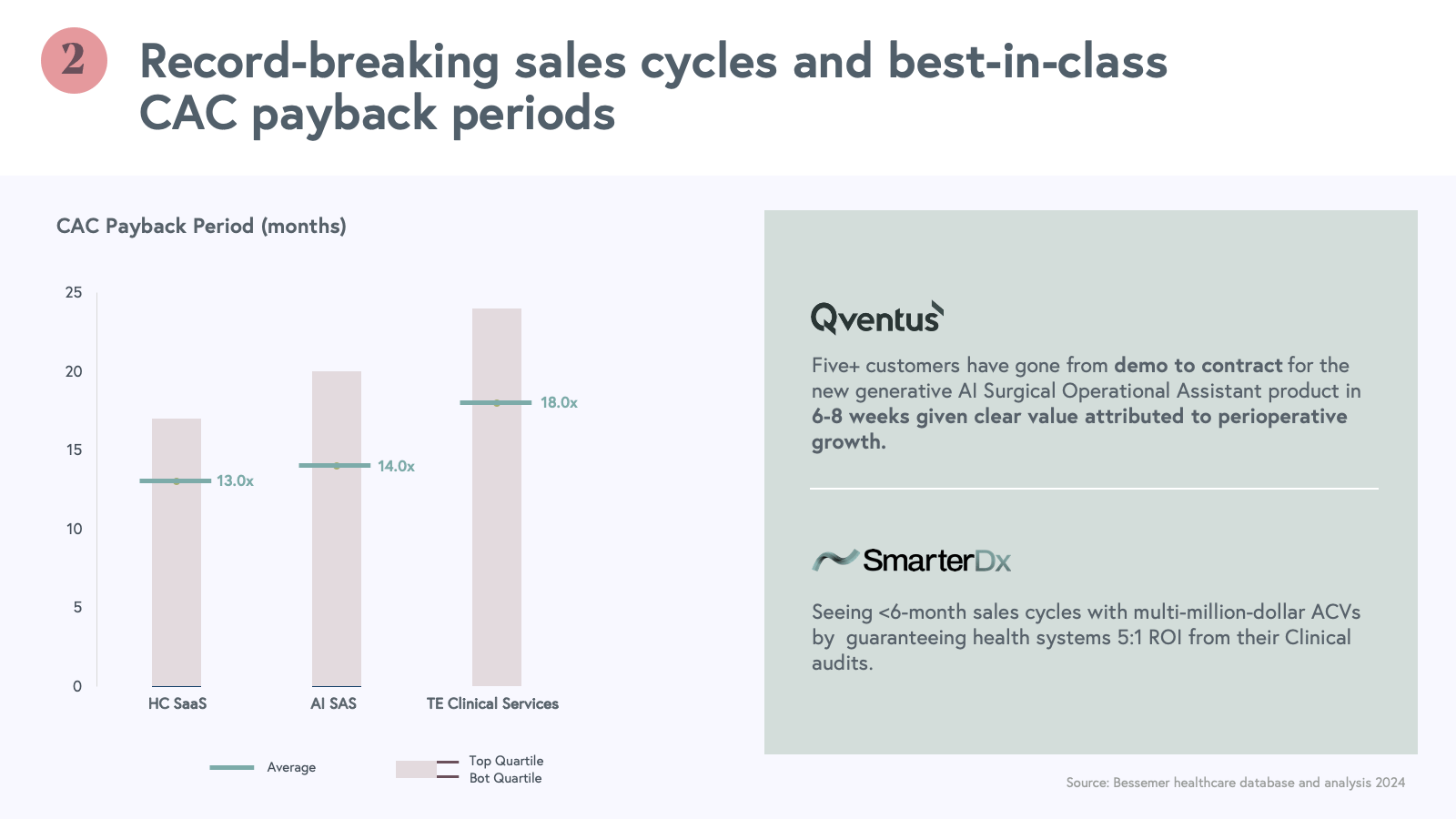

- AI Services-as-Software companies are experiencing record-breaking sales cycles due to high industry demand and seeing CAC payback similar to those of SaaS. Several of our portfolio companies have seen <6 month sales cycles, much faster than traditional Healthcare sales cycles of 12-18 months.

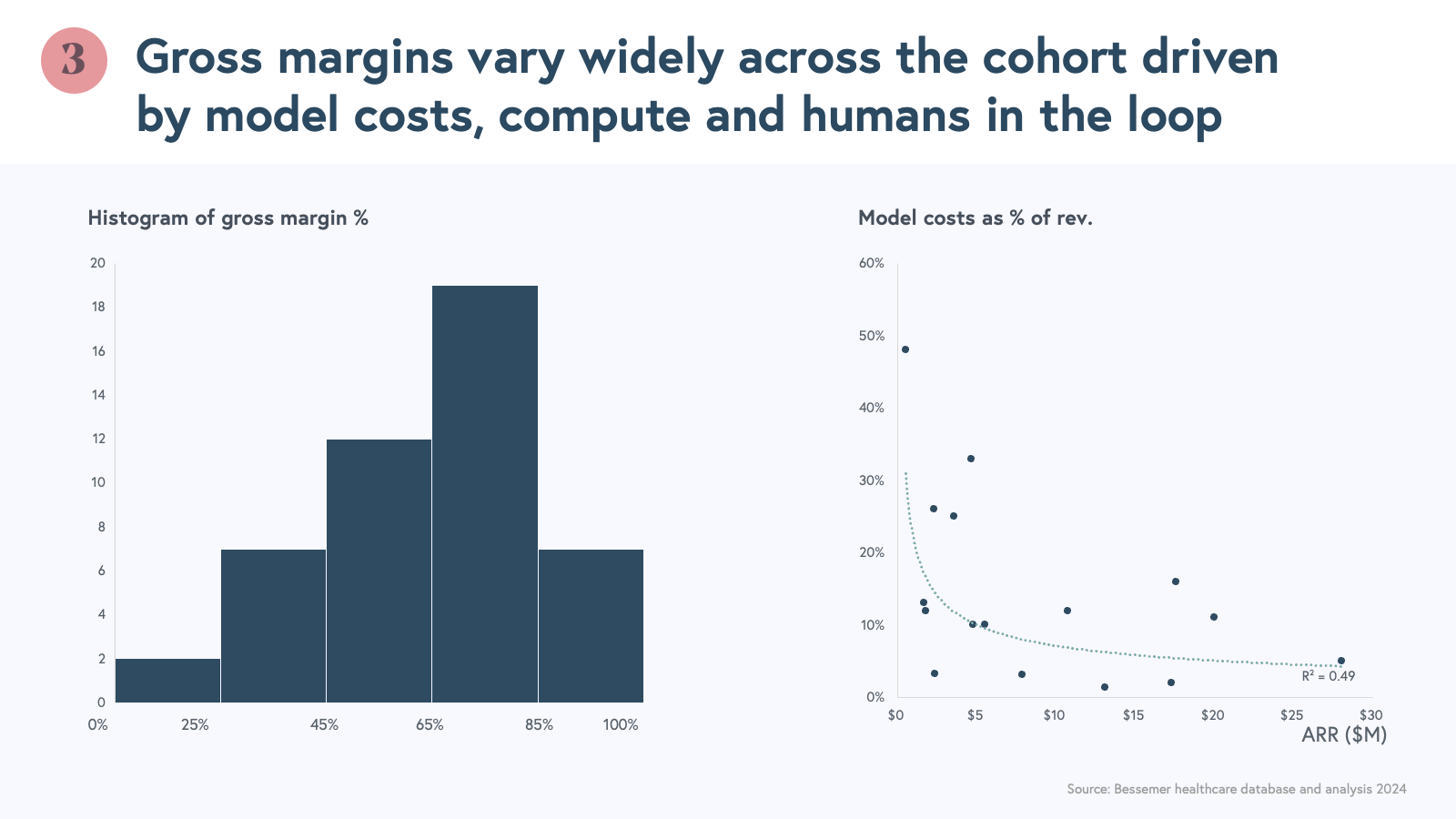

- Gross margins vary in subcategories of AI Services-as-Software companies.

- Copilots: AI tools that supercharge workers by automating tasks and workflows.

- AI-first services: AI native services that automate and enable a service to be fully outsourced to the company. Most likely involves a human in the loop who is typically employed by the startup that checks output of models to ensure accuracy and provides feedback for reinforcement learning.

- Agents: AI tools that replace workers by automating end-to-end workstreams. While most AI agents don’t yet operate reliably enough to function autonomously in complex use cases, progress on agentic workflows is moving quickly.

There are three major drivers of cost of goods sold for these AI companies: model costs, compute, and humans in the loop for quality assurance and reinforcement learning. Despite this, the average and median are 60% and 65% respectively across all sub-types. While it’s early, we see the companies with strong product-market-fit and growing scale able to get some economies of scale for model costs.

- AI Services-as-Software businesses have similar efficiency scores as traditional software despite the variety of gross margins. We are encouraged by this profitable growth.

These early benchmarks are encouraging for a new way of digitizing administration of healthcare. We are closely tracking companies as they scale beyond the first $10M and move towards $100M and beyond.

Emerging Trends and Predictions for 2025

As we look ahead, here are key trends and opportunity areas:

- Payer administration insourcing: Services-as-Software adoption accelerates.

We expect new companies to arise focused on other stakeholders, such as payers and third-party administrators (TPAs). We see an appetite to leverage AI and technology to reduce costs, improve quality and maintain greater control with new AI-first services – an insourcing wave of sorts. For example, we’re seeing increased adoption of AI-powered solutions for utilization management, contact-center benefit navigation and streamlined direct contracting with providers.

- Transparency tooling in pharmacy: Navigating the evolving landscape.

The rising costs and complexity of prescription drugs have become a central focus. We see significant opportunities for companies that can:

- Provide tools for rebate transparency and management.

- Offer solutions for implementing new pricing policies.

- Develop analytics tools to navigate the pharmaceutical landscape.

- AI-Assisted clinical services: Empowering independent providers.

We see AI as giving providers “superpowers,” to deliver more efficient and effective care. Key areas include:

- Risk stratification, triage, and navigation.

- Symptom tracking and analysis.

- More tech-first Managed Services Organizations

- Value-based care system of record: Enabling the shift to risk-based models.

The Centers for Medicare & Medicaid Services (CMS) has set an ambitious goal to move all Medicare and most Medicaid lives into risk-based programs by 2030. Opportunities include:

- Risk stratification and patient management.

- Platforms for contracts.

- Data capture to measure impact and attribution.

Embracing the Future

As we move forward, let’s embrace the lessons learned to build a healthier, more equitable future for all.

The health tech sector is well-positioned to drive meaningful improvements in healthcare delivery, outcomes, and cost-effectiveness.