Henan Carve Electronics Shares Experience Month of Growth

Shares of Henan Carve Electronics Technology Co., Ltd. (SZSE:301182) have experienced a notable surge, increasing by 27% last month, following a period of instability. This recent performance adds to an impressive 172% increase over the past year.

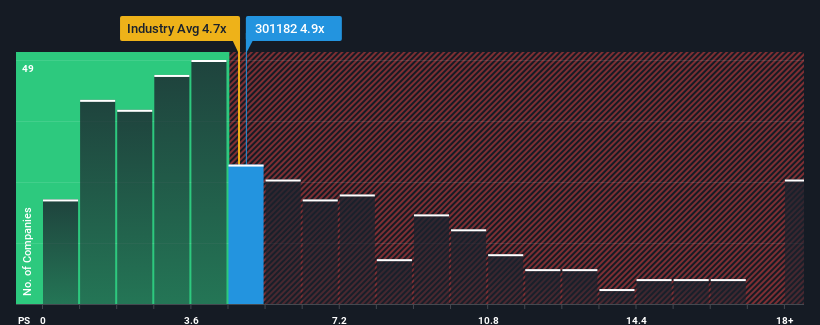

However, despite this significant price increase, some analysts are questioning whether Henan Carve Electronics Technology’s price-to-sales (P/S) ratio of 4.9x is justified. This is because the median P/S ratio within China’s electronic equipment and components industry is approximately 4.7x. While this may appear insignificant at first glance, such a comparison can reveal potential investment opportunities or highlight underlying risks.

Examining Recent Performance

Henan Carve Electronics Technology has demonstrated robust revenue growth in recent times. The market’s reaction may reflect expectations of a slowdown in future revenue performance, which could be keeping the P/S ratio from rising further. Bullish investors are hoping this isn’t the case, as it allows them to acquire the stock at a perceived lower valuation.

Recent trends suggest a promising outlook for the company, and a free report with more in-depth information on Henan Carve Electronics Technology’s earnings, revenue, and cash flow is available to any interested investors. We find it interesting that Henan Carve Electronics Technology is trading at a fairly similar P/S compared to the industry.

Industry Comparison

For a company’s P/S ratio to be considered reasonable, it’s typically expected to align with the industry average; however, recent data shows Henan Carve’s P/S slightly higher than the average. Over the past year, the company’s top line has seen an exceptional increase of 57%. Additionally, the past three years have shown excellent revenue growth, with a 31% overall rise. Shareholders have certainly welcomed these medium-term revenue growth rates.

When comparing these recent revenue trends against the industry’s one-year growth forecast of 26%, it’s apparent that the company’s performance is noticeably more attractive at the moment which is why the stock is still at an equivalent P/S. Therefore, investors seem less bearish and are unwilling to let go of their stock.

P/S Implications for Investors

In conclusion, Henan Carve Electronics Technology seems to be back in favor due to a strong price increase that has brought its P/S back in line with other companies in the industry, despite its recent three-year growth being lower than the wider industry forecast. When this is observed, it is likely that the share price is at risk of declining, which will bring the P/S back in line with expectations if the company doesn’t improve its medium-term performance.

This article is for informational purposes only and does not constitute financial advice. A free report on Henan Carve Electronics Technology’s earnings, revenue and cash flow can be found at Simply Wall St.