{ “title”: “Individual Investors Hold Significant Stake in TRS Information Technology Despite Recent Stock Dip”, “description”: “An analysis of TRS Information Technology (SZSE:300229) reveals that individual investors hold a substantial portion of the company’s shares, influencing key decisions. The stock price decreased last week, affecting these investors.”, “tags”: “TRS Information Technology, SZSE:300229, stock analysis, individual investors, institutional investors”, “rewritten_content”: “TRS Information Technology Co., Ltd. (SZSE:300229) experienced a 7.3% drop in its stock price last week. This decline likely led to disappointment among individual investors, who hold a significant stake in the company.

Understanding the ownership structure of TRS Information Technology is crucial to grasping who truly influences its key decisions. The majority of the company’s shares, approximately 58%, are held by individual investors. This means that the financial performance of the company directly impacts this group, so the recent market dip resulted in notable losses for them, with the market capitalization decreasing by CN¥1.5 billion.

Institutional investors also have a presence in TRS Information Technology, holding about 10% of the company’s shares. This suggests a level of credibility with professional investors. However, it’s essential to remember that even institutions can make poor investment choices.

The largest shareholder is Xinke Interactive Technology Development Co., Ltd., with 25% ownership. The second-largest shareholder holds about 5.1% of the outstanding shares, followed by a 2.1% stake held by the third-largest shareholder. A total of 25 top shareholders collectively own less than 50% of the share register, indicating that no single entity has a controlling interest.

Notably, hedge funds do not have a meaningful investment in TRS Information Technology at this time.

Researching institutional ownership can be an efficient way to gauge a stock’s projected trajectory. The same can be achieved by studying analyst sentiment.

Insiders, including board members, also possess shares in TRS Information Technology. Insider ownership often indicates alignment between the board and shareholders. In this case, insiders own around CN¥246 million worth of shares.

The general public, including retail investors, owns 58% of TRS Information Technology. With this ownership level, retail investors can influence decisions affecting shareholder returns, such as dividend policies and director appointments. They can also vote on acquisitions or mergers.

Private companies hold 31% of the company’s shares. Further investigation into this ownership may be warranted. Related parties, such as insiders, should disclose their interests in the annual report.

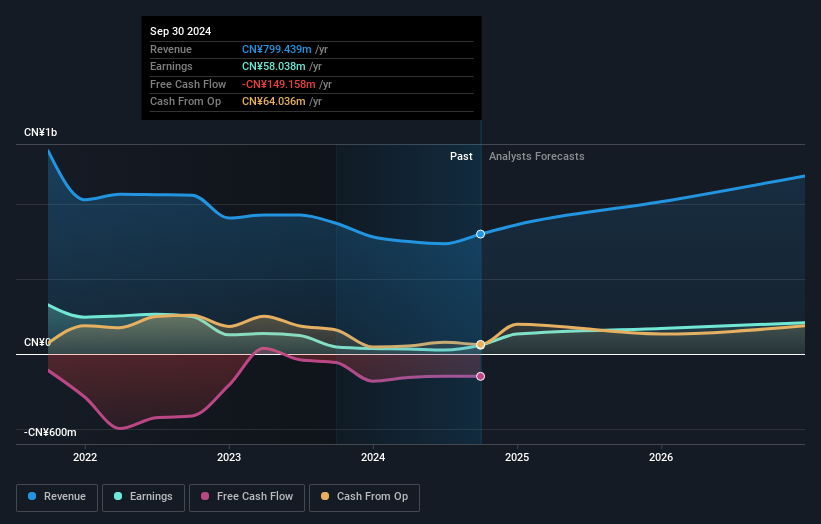

While the ownership structure offers insights, many other factors are equally important. Every company faces risks, and potential investors should be aware of them. Investors interested in future growth predictions can consult analyst forecasts for further information.” }